Get the free cta hawaii form

Show details

B) Background Check form for DHS form 1507 (APS). Mail to Insights To Success c) DHS form 1645 (Criminal History/Fingerprint). Call Insights To Success to ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cta hawaii form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cta hawaii form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cta hawaii online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cta hawaii forms. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

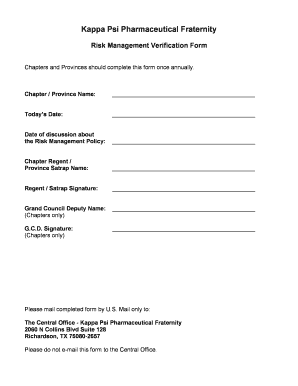

How to fill out cta hawaii form

How to fill out cta hawaii?

01

Start by obtaining the necessary application form from the official CTA Hawaii website or by visiting the nearest CTA office.

02

Carefully read through the instructions provided on the application form to ensure you understand the requirements and have all the necessary documents and information ready.

03

Fill out the application form accurately and completely, providing all requested personal details, contact information, and any other relevant information required.

04

Double-check your completed application form for any errors or omissions before submitting it.

05

Gather and include all supporting documents as specified on the application form, such as identification documents, proof of residency, and any other required documentation.

06

If applicable, pay the required application fee either online or at the designated payment location specified in the instructions.

07

Submit your completed application form along with the supporting documents to the designated CTA office or through the provided online submission process.

08

Keep a copy of the submitted application form and any receipts or confirmations for future reference.

Who needs cta hawaii?

01

Individuals who are planning to travel to Hawaii and want to use the public transportation system efficiently and conveniently.

02

Residents of Hawaii who require a valid transportation card for their daily commuting needs.

03

Visitors to Hawaii who prefer using public transportation instead of renting a car or relying on other forms of transportation during their stay.

Fill communities of america : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

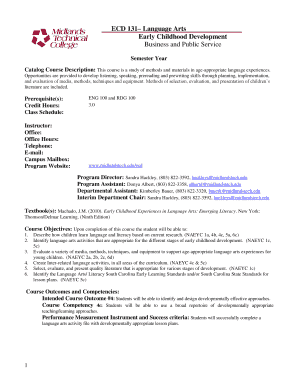

What is cta hawaii?

CTA Hawaii is a community transportation association located in the state of Hawaii.

Who is required to file cta hawaii?

In Hawaii, any person engaging in the business of soliciting or conducting tours or activities for compensation, and who meets certain criteria, is required to file a Commercial Use Authorization (CUA) application with the Hawaii Department of Land and Natural Resources (DLNR) Division of State Parks. This includes tour operators, guides, or individuals conducting tours or activities on state park lands. However, the specific requirements may vary, and it is advised to consult with the DLNR or a legal professional for more accurate information.

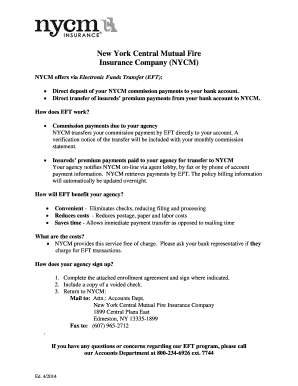

How to fill out cta hawaii?

To fill out the CTA (Certificate of Tax Clearance) for Hawaii, follow these steps:

1. Visit the Hawaii Department of Taxation website at tax.hawaii.gov.

2. Search for the "Forms" section on the website.

3. Look for the specific form titled "CTA - Certificate of Tax Clearance."

4. Download the CTA form and save it to your computer.

5. Open the downloaded form using a PDF reader software.

6. Read the instructions provided on the form carefully to ensure you understand the requirements and obligations.

7. Begin filling out the form by entering your business or personal information as requested. This may include your name, address, phone number, Social Security number, or Federal Employer Identification Number (FEIN), depending on the type of taxpayer.

8. Provide accurate details regarding the type of taxes you owe or have owed to the state of Hawaii. This may include general excise tax, transient accommodations tax, income tax, or other relevant taxes.

9. Indicate the tax periods for which you are requesting the certificate of tax clearance.

10. Calculate and enter any outstanding amounts or balances owed to the state, if applicable.

11. If you have any attachments or documents necessary to support your CTA application, ensure they are properly referenced and attached to the form.

12. Review your completed form to check for any errors or missing information. Make corrections or additions as required.

13. Sign and date the form in the designated section.

14. Submit the completed CTA form to the Hawaii Department of Taxation as per their specific instructions. This may include mailing the form or submitting it through an online portal, depending on the options provided.

15. Keep a copy of the filled-out form for your records.

Please note that the process may vary slightly depending on individual circumstances, so it's always advisable to review the specific instructions provided on the official Hawaii Department of Taxation website or consult with a tax professional for guidance.

What is the purpose of cta hawaii?

CTA Hawaii is an abbreviation for the Community Transportation Association of Hawaii. The purpose of CTA Hawaii is to promote and improve transportation options for individuals and communities in the state of Hawaii. It aims to enhance access to transportation services and ensure equal mobility for all citizens, particularly those with disabilities, older adults, and people with low incomes. CTA Hawaii works towards connecting people to essential services, employment opportunities, education, healthcare, and recreational activities through advocacy, education, and collaboration with various stakeholders in the transportation sector.

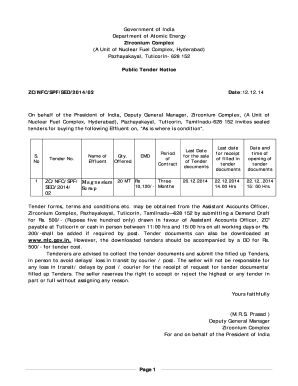

What information must be reported on cta hawaii?

CTA (Certificate to Advertise) Hawaii is a requirement for businesses that advertise timeshare interests or vacation ownership plans in the state of Hawaii. The following information must be reported on CTA Hawaii:

1. Business Information: The name, address, principal place of business, and contact information of the advertiser/commercial provider.

2. Product Information: Details about the timeshare interest or vacation ownership plan being advertised, including its name or description, location, duration, features, and any limitations or restrictions.

3. Ownership and Control: Information about the ownership and control of the advertiser, including the names, addresses, and ownership percentages of persons or entities with an interest in the business.

4. Financial Information: Information about the financial condition of the advertiser, including financial statements, statements of assets, liabilities, and net worth, and any other relevant financial information.

5. Legal Disclosures: Disclosure of any pending or prior legal actions, judgments, or regulatory actions against the advertiser, related to timeshare interests or vacation ownership plans.

6. Sales and Marketing Information: Details about the sales or marketing techniques and practices used by the advertiser, including any statements or representations made to consumers regarding the product being advertised.

7. License Information: Proof of appropriate licenses, permits, or registrations required to advertise or offer timeshare interests or vacation ownership plans in Hawaii.

8. Other supporting documents may be required, depending on the specific regulations of the Hawaii Department of Commerce and Consumer Affairs regarding timeshare advertising.

It is important to note that this information may vary, and it is recommended to consult the specific requirements and guidelines provided by the Hawaii Department of Commerce and Consumer Affairs for accurate and up-to-date details.

What is the penalty for the late filing of cta hawaii?

The penalty for late filing of CTA (Corporation Tax Return) in Hawaii is 5% of the unpaid tax liability for each month or fraction thereof that the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax liability at the rate of 2/3% per month or fraction thereof.

How do I execute cta hawaii online?

Filling out and eSigning cta hawaii forms is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in communities of america without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing comties and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my community ties of america forms in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your community ties of america form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your cta hawaii form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Communities Of America is not the form you're looking for?Search for another form here.

Keywords relevant to cta hawaii form

Related to community ties of america

If you believe that this page should be taken down, please follow our DMCA take down process

here

.