Get the free connecticut form 2011 ct709

Show details

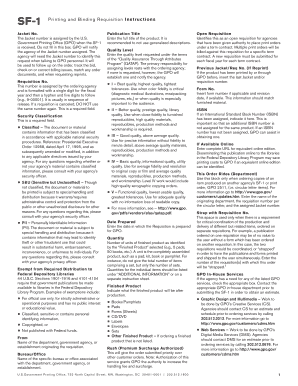

Department of Revenue Services

PO Box 2978

Hartford CT 061042978Schedule CT709 FarmlandCalendar Year2011(Rev. 05/11)Complete this schedule in blue or black ink only.

Purpose: Use Schedule CT709 Farmland

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your connecticut form 2011 ct709 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your connecticut form 2011 ct709 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit connecticut form 2011 ct709 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit connecticut form 2011 ct709. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out connecticut form 2011 ct709

01

To fill out Connecticut form 2011 ct709, first gather all the necessary information and documentation. This may include your personal details, such as your name, address, and Social Security number, as well as any additional tax-related information.

02

Next, carefully read the instructions provided with the form to ensure you understand the requirements and procedures for filling it out correctly. The instructions will guide you through the various sections and fields of the form.

03

Begin filling out the form by entering your personal information in the designated fields. Double-check the accuracy of your information to avoid any errors.

04

Proceed to the next sections of the form and provide the requested information accordingly. This may include details about your income, deductions, credits, and taxes paid.

05

Take your time to accurately calculate and provide the required figures and amounts. In some cases, you may need to attach additional schedules or forms to provide supporting documentation for certain entries.

06

If you have any questions or are unsure about certain sections of the form, seek assistance from a tax professional or refer to the official IRS website for guidance.

Now, who needs Connecticut form 2011 ct709?

01

Individuals who were residents of Connecticut during the tax year 2011 may need to file form 2011 ct709. This form is used to report Connecticut state income tax and determine the amount owed or the refund due.

02

Non-residents may also be required to file Connecticut form 2011 ct709 if they earned income within Connecticut that is subject to state taxation.

03

It is important to check the Connecticut Department of Revenue Services (DRS) website or consult with a tax professional to understand the specific circumstances under which you may need to file form 2011 ct709. Each taxpayer's situation can vary based on factors such as income, residency, and type of income earned.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is connecticut form ct709?

Connecticut form ct709 is a tax form used to report information related to Connecticut gift and estate taxes.

Who is required to file connecticut form ct709?

Anyone who is required to file a federal gift tax return (Form 709) may also be required to file connecticut form ct709 if they made gifts subject to Connecticut gift tax or have a Connecticut taxable estate.

How to fill out connecticut form ct709?

Connecticut form ct709 must be filled out with accurate and complete information about the gifts made and any taxable estate. The form requires details such as the value of gifts made, exemptions claimed, and calculations of Connecticut gift and estate tax liabilities.

What is the purpose of connecticut form ct709?

The purpose of connecticut form ct709 is to report and calculate Connecticut gift and estate taxes owed based on gifts made and the value of the taxable estate.

What information must be reported on connecticut form ct709?

Connecticut form ct709 requires reporting of various information including the value of gifts made during the tax year, exemptions claimed, and calculations of Connecticut gift and estate tax liabilities.

When is the deadline to file connecticut form ct709 in 2023?

The deadline to file connecticut form ct709 in 2023 is typically April 15th, unless the taxpayer requests an extension. It is recommended to consult the latest official instructions or the Connecticut Department of Revenue Services for the most accurate deadline.

What is the penalty for the late filing of connecticut form ct709?

The penalty for the late filing of connecticut form ct709 may vary depending on the specific circumstances. It is advisable to consult the latest official instructions or the Connecticut Department of Revenue Services for detailed information on penalties and late filing fees.

How can I get connecticut form 2011 ct709?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the connecticut form 2011 ct709 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the connecticut form 2011 ct709 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your connecticut form 2011 ct709 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out connecticut form 2011 ct709 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign connecticut form 2011 ct709 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your connecticut form 2011 ct709 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.