Get the free CT - 1041EXT , 1999 Application for Extension of Time ... - CT . gov Home - ct

Show details

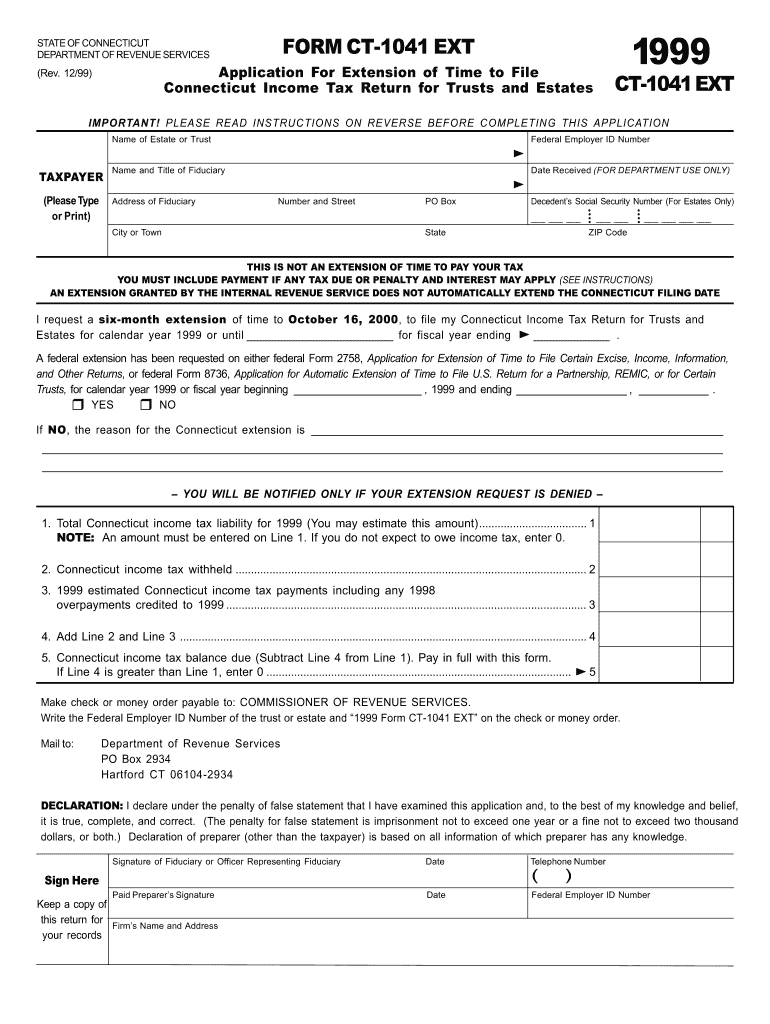

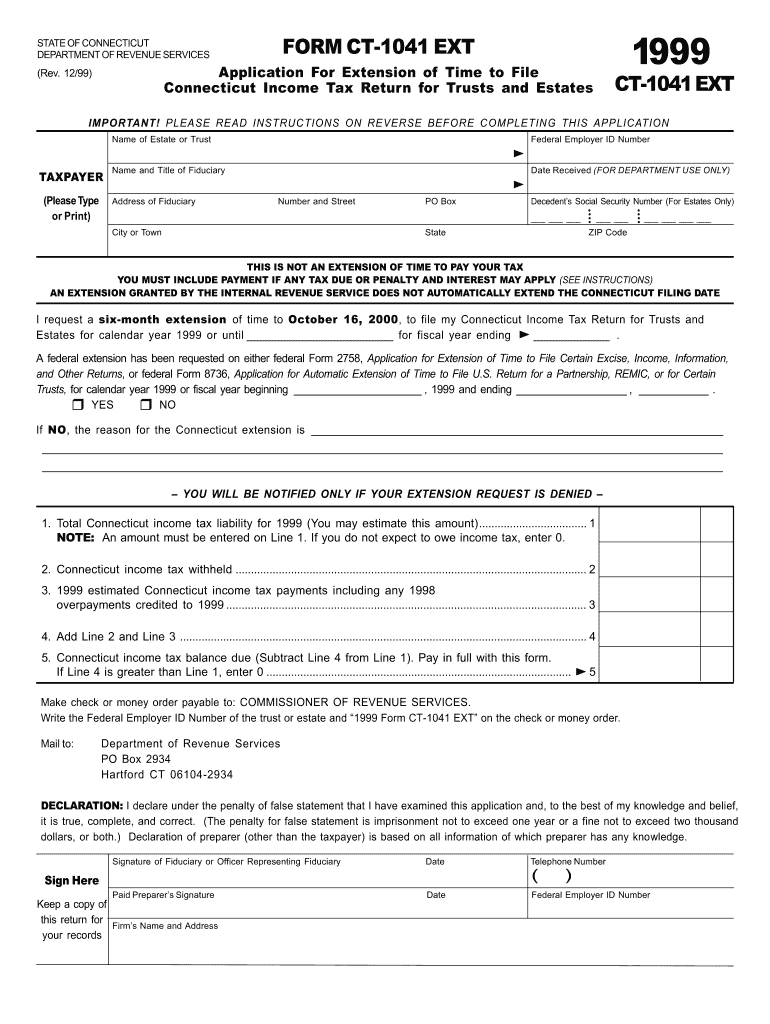

STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES (Rev. 12/99) FORM CT-1041 EXT Application For Extension of Time to File Connecticut Income Tax Return for Trusts and Estates CT-1041 EXT 1999 IMPORTANT!

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct - 1041ext 1999 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct - 1041ext 1999 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct - 1041ext 1999 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ct - 1041ext 1999. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

How to fill out ct - 1041ext 1999

How to fill out ct - 1041ext 1999:

01

Gather all necessary information and documentation related to the trust or estate.

02

Fill out the basic information section of Form CT-1041EXT, including the name, address, and identification number of the trust or estate.

03

Provide details about the tax year for which the extension is being requested.

04

Calculate the tentative total tax liability for the trust or estate and enter it in the appropriate section.

05

Determine the total payments and credits made towards the tax liability and include them on the form.

06

Calculate the balance due or overpayment, if any, and enter it in the appropriate section.

07

Sign and date the form, and provide any additional required information or attachments as specified in the instructions.

Who needs ct - 1041ext 1999:

01

Trusts or estates that need additional time to file their tax returns and want to request an extension to avoid penalties.

02

Individuals who are responsible for handling the tax affairs of a trust or estate.

03

Anyone who is required to file Form CT-1041 for tax year 1999 and meets the eligibility criteria for an extension.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct - 1041ext application?

The ct - 1041ext application is a form used for filing an extension for the Connecticut fiduciary income tax return (Form CT-1041) for trusts and estates.

Who is required to file ct - 1041ext application?

Anyone who needs more time to complete and file their Connecticut fiduciary income tax return (Form CT-1041) for trusts and estates is required to file the ct - 1041ext application.

How to fill out ct - 1041ext application?

To fill out the ct - 1041ext application, you need to provide your personal and contact information, along with the requested information about the trust or estate for which you are filing the extension. The application can be completed online or by mail.

What is the purpose of ct - 1041ext application?

The purpose of the ct - 1041ext application is to request an extension of time to file the Connecticut fiduciary income tax return (Form CT-1041) for trusts and estates. It allows taxpayers to have additional time to gather the necessary information and complete their tax return accurately.

What information must be reported on ct - 1041ext application?

On the ct - 1041ext application, you need to report your name, address, Social Security Number or Employer Identification Number, the tax year you are requesting the extension for, and any estimated tax payments made. Additionally, you need to provide information about the trust or estate, including its name, address, and federal employer identification number.

When is the deadline to file ct - 1041ext application in 2023?

The deadline to file the ct - 1041ext application in 2023 for the tax year 2022 is April 17, 2023. However, please note that this deadline may be subject to change, and it is always recommended to check with the Connecticut Department of Revenue Services for the most up-to-date information.

What is the penalty for the late filing of ct - 1041ext application?

The penalty for the late filing of the ct - 1041ext application can vary depending on the circumstances. Generally, if the application is filed after the deadline without reasonable cause, a penalty of 10% of the tax due or $50, whichever is greater, may be imposed. It is important to note that this penalty is in addition to any penalties and interest that may apply to the late payment of taxes.

How can I send ct - 1041ext 1999 to be eSigned by others?

When you're ready to share your ct - 1041ext 1999, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get ct - 1041ext 1999?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the ct - 1041ext 1999 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the ct - 1041ext 1999 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your ct - 1041ext 1999 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your ct - 1041ext 1999 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.