Phone Number Telephone Number Email Address (Optional) Fiduciary Address Attach a Letter from an Attorney/Lawyer Attach a Letter from a Trustee Attach a Letter from a Judge Attach a Certificate of Trust Attach a Certificate of Probate Attach a Certificate of Probate (Must be original letter with date and seal) If your estate will include a dependent, attach a certified copy of an order of dependency and support showing the current status of the dependent. If the dependent is over 18 years of age and not in the employ of the decedent at the time of death, attach a certified copy of a court order that the dependent is not an employee and that the dependent is not subject to state taxes. If the dependent is not a dependent, it should be stated in the letter whether the dependent is an employee or an independent contractor, and whether the dependent has made a financial contribution to the decedent at any time in the last 12 months. DO NOT include an itemized statement of your estate/trust assets, except for property received by probate. Attach a Certificate of Appraisal if the value shown on the certified tax return is more than the fair market value. Taxpayers should include a copy of their tax return, if any, on an attached form, such as Form 1041-X. The tax return should reflect the correct estimated tax amount under the federal instructions, if there were any. The tax return should include any personal tax returns filed by the decedent, as required by state law. DO not include any information on your tax return relating to the decedent's insurance policies or annuity agreements, unless your tax return also reflects those policies and annuity agreements. You should attach a certified copy of the insurance policy/annuity agreement, if any. It is the responsibility of you, if you are the beneficiary, to report the total income and deductions for the account under the Social Security Administration code (P.O. Boxes must be left blank). For Trusts and Estates of 2,499.00 or more, the trust mayor must: Provide evidence of the number of beneficiaries on the Statement of Trust/Estate. If the number of beneficiaries exceeds 6 beneficiaries, attach a document that shows the actual number of beneficiaries on the Statement of Trust/Estate, including copies of death certificates and other evidence of beneficiaries.

Get the free CT-1041EXT, 2001 Application for Extension of Time to File Connecticut Income Tax Re...

Show details

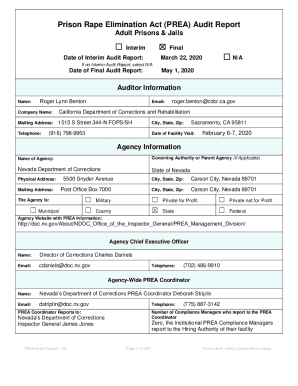

STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES (Rev. 12/01) FORM CT-1041 EXT Application for Extension of Time to File Connecticut Income Tax Return for Trusts and Estates CT-1041 EXT 2001 IMPORTANT!

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct-1041ext 2001 application for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-1041ext 2001 application for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct-1041ext 2001 application for online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ct-1041ext 2001 application for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct-1041ext application for extension?

The ct-1041ext application for extension is a form used to request an extension of time to file the Connecticut Estate or Trust Tax Return (Form CT-1041).

Who is required to file ct-1041ext application for extension?

Any person or fiduciary required to file the Connecticut Estate or Trust Tax Return (Form CT-1041) can file the ct-1041ext application for extension if they need additional time to file the tax return.

How to fill out ct-1041ext application for extension?

To fill out the ct-1041ext application for extension, you need to provide information such as the taxpayer or fiduciary's name, address, identification number, estimated tax liability, and the requested extension period.

What is the purpose of ct-1041ext application for extension?

The purpose of the ct-1041ext application for extension is to request additional time to file the Connecticut Estate or Trust Tax Return (Form CT-1041).

What information must be reported on ct-1041ext application for extension?

The ct-1041ext application for extension requires information such as the taxpayer or fiduciary's name, address, identification number, estimated tax liability, and the requested extension period.

When is the deadline to file ct-1041ext application for extension in 2023?

The specific deadline to file the ct-1041ext application for extension in 2023 will be determined by the Connecticut Department of Revenue Services. It is recommended to check their official website or contact them directly for the most accurate and up-to-date information.

What is the penalty for the late filing of ct-1041ext application for extension?

The penalty for the late filing of the ct-1041ext application for extension may vary depending on the specific circumstances and tax regulations. It is advisable to consult the Connecticut Department of Revenue Services or a tax professional for accurate penalty information.

How do I modify my ct-1041ext 2001 application for in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your ct-1041ext 2001 application for and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in ct-1041ext 2001 application for?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your ct-1041ext 2001 application for and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the ct-1041ext 2001 application for form on my smartphone?

Use the pdfFiller mobile app to complete and sign ct-1041ext 2001 application for on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your ct-1041ext 2001 application for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.