You may make changes to an existing return by email to the address below, using the following information:

Name:

TINNIC-O-Meter Account Number:

Account Expiration Month and Year:

Type:

Account Code:

File Number:

Date of Change:

Email address:

Account Name:

Account Number:

Tax Year:

The tax period to have your return modified during the year is the tax period which includes the month and year for which the return is submitted. You may file one return for the entire tax period, and you may use the same form and checkbox for both returns. You do not have to wait until the tax period ends to have your return modified, although this may allow you to file your return earlier. Your tax return must be completed and filed by the 10th day of the fourth month after the end of the tax period for which your return is being filed at the following address:

Pursuant to Section 8-0-15 of the Delaware Revised Code, for Tax Year:

Filing Address and PO Box:

Address: 1 and 2 Delaware Avenue, Suite 901

Wilmington DE 19801

Filing Address Line 2: 9001 Washington Boulevard

Tallahassee, FL 32399

PO Box Number:

Address Line 4: 200 South Main Street, Suite 450

Wilmington DE 19801

(Please Note: DO NOT SUBMIT YOUR TAX RETURN TO US DURING THE TAX PERIOD FOR WHICH YOU ARE MAKING A CHANGE, BECAUSE WE WILL NO LONGER BE MAILING THIS FORM TO YOU.)

The return must be submitted to us by mail using the above address, and must be accompanied by a completed and signed change form. Failure to mail with these documents may result in a delay in processing the return. Please complete the form on a separate page from the return, and mark the envelope “A Change of Address Form”. Your change form must include all the following information:

Your name, street address, state and city (if different and applicable), and telephone number;

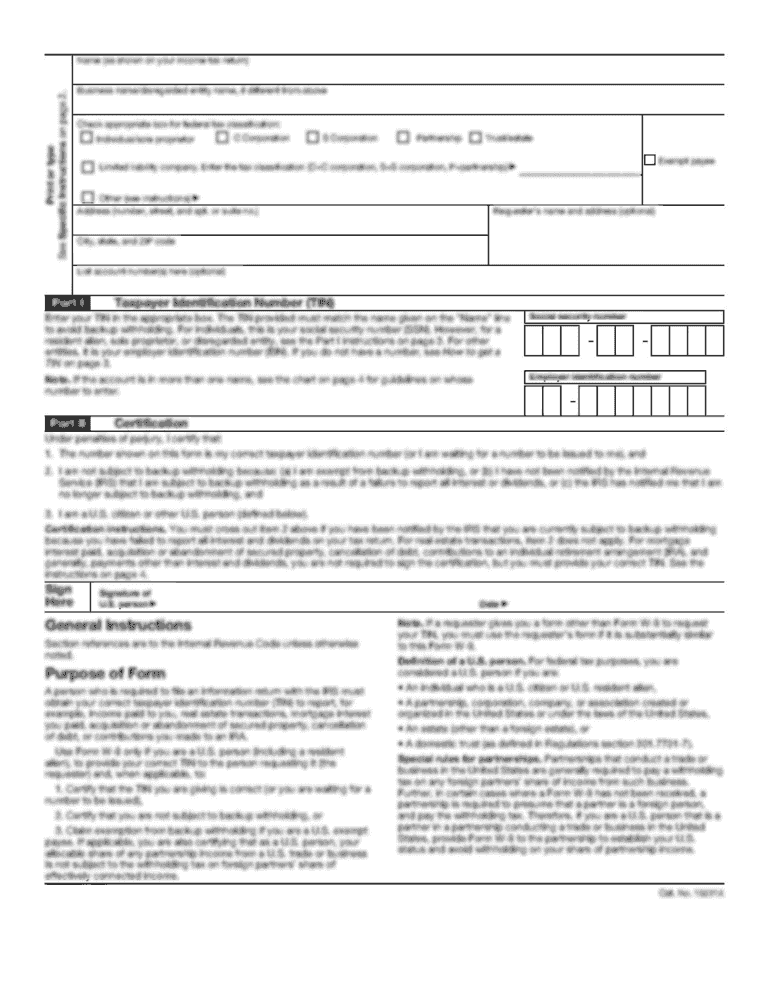

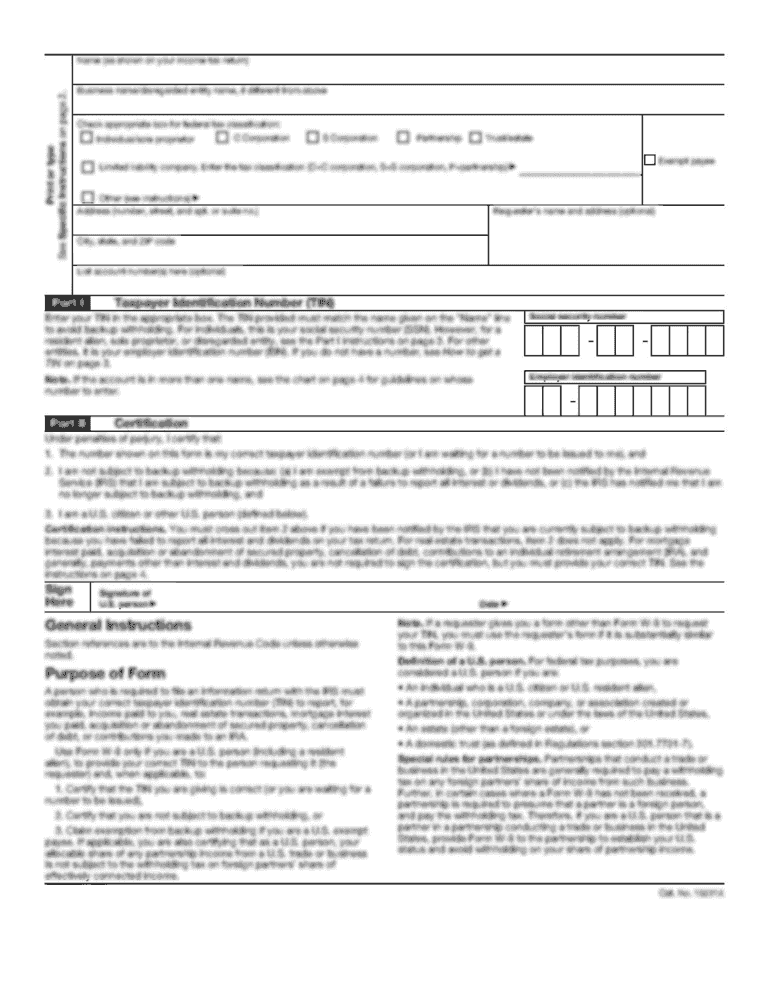

Your Social Security Number;

Your Taxpayer Identification Number (TIN); and

The Taxpayer Identification Number (TIN) of the person designated in the order you make your change.

Get the free required to deduct and withhold during this past year s " - revenue delaware

Show details

DELAWARE DIVISION OF REVENUE WITHHOLDING TAX RETURN FORM W1A 9301 ACCOUNT NUMBER TAX PERIOD ENDING DUE ON OR BE FORE W8 0-000000000-000 09-03-08 09-08-08 SEP 2008 Reset 0089-06 Print Form 00890608000000000000009030809080800000000000000000000

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your required to deduct and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your required to deduct and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit required to deduct and online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit required to deduct and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is required to deduct and?

To deduct and, you need to have the necessary information about the deductions you are eligible for and you must meet the requirements set by the tax authorities.

Who is required to file required to deduct and?

Any individual or entity that is eligible for deductions and meets the requirements set by the tax authorities is required to file required to deduct and.

How to fill out required to deduct and?

To fill out required to deduct and, you need to gather all the necessary information about your deductions, including supporting documentation, and complete the relevant forms or electronic filings as per the instructions provided by the tax authorities.

What is the purpose of required to deduct and?

The purpose of required to deduct and is to allow eligible individuals or entities to claim deductions and reduce their taxable income, thereby lowering their overall tax liability.

What information must be reported on required to deduct and?

The specific information that must be reported on required to deduct and may vary depending on the type of deductions being claimed. Generally, it may include details about the nature of the deduction, supporting documentation, and any other relevant information requested by the tax authorities.

When is the deadline to file required to deduct and in 2023?

The deadline to file required to deduct and in 2023 may vary based on the tax jurisdiction and the specific tax year. It is important to refer to the instructions provided by the tax authorities or consult with a tax professional to determine the exact deadline.

What is the penalty for the late filing of required to deduct and?

The penalty for the late filing of required to deduct and may vary depending on the tax jurisdiction and the specific tax laws. It is advisable to refer to the guidelines provided by the tax authorities or consult with a tax professional to understand the potential penalties for late filing.

How can I send required to deduct and for eSignature?

When you're ready to share your required to deduct and, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit required to deduct and online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your required to deduct and to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit required to deduct and on an iOS device?

Create, edit, and share required to deduct and from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your required to deduct and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.