Get the free IN THE UNITED STATES DISTRICT COURT FOR THE WESTERN DISTRICT OF TENNESSEE EASTERN DI...

Show details

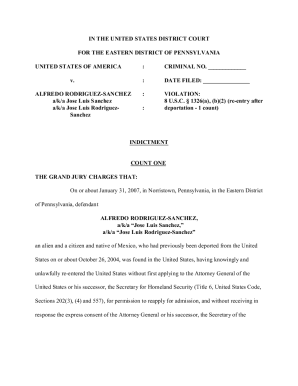

IN THE UNITED STATES DISTRICT COURT FOR THE WESTERN DISTRICT OF TENNESSEE EASTERN DIVISION BARBARA L. SORREL, Plaintiff, VS. HOM E DE POT U.S.A., INC., Defend ant. ))))))))) No. 00-1188 ORDER GRANTING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your in form united states form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in form united states form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in form united states online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit in form united states. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

How to fill out in form united states

Point by point instructions on how to fill out a form in the United States:

01

Start by carefully reading and understanding the instructions provided on the form. Make sure you comprehend the purpose and requirements of the form.

02

Gather all the necessary information and documents that you will need to complete the form accurately. This may include personal identification, legal documents, or financial records.

03

Begin by filling out the basic information section of the form, which usually includes your name, address, contact details, and social security number.

04

Follow the form's instructions regarding specific sections or questions. Be sure to provide all requested information, and if any question does not apply to you, indicate it as "N/A" or "not applicable."

05

Pay careful attention to any required signatures. Some forms may require your signature as well as those of witnesses or authorized individuals.

06

Double-check all the information you have entered before submitting the form. Ensure that it is accurate, complete, and legible.

07

If there are any supporting documents required, make sure to attach them securely to the form. It is recommended to make copies of all documents for your records.

08

Once you have completed the form, follow the submission instructions provided. This may include mailing the form, submitting it online, or delivering it in person to the appropriate office or agency.

Who needs a form in the United States:

01

Individuals applying for various types of visas or immigration benefits.

02

U.S. citizens or permanent residents sponsoring family members for immigration status.

03

Employers who need to file employee-related forms for tax purposes or work authorization.

04

Students applying for financial aid, scholarships, or college admissions.

05

Individuals filing income tax returns or claiming tax credits.

06

People applying for government assistance programs, such as Medicaid or Social Security benefits.

07

Businesses filing corporate or partnership tax returns, or forms related to employment taxes.

08

Organizations or individuals seeking permits, licenses, or certifications from government agencies.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is in form united states?

Form United States refers to the various forms required to be filed with the United States government by individuals, businesses, and organizations for reporting purposes.

Who is required to file in form united states?

The requirement to file Form United States varies depending on the specific form and the individual's or entity's circumstances. Generally, individuals, businesses, and organizations that meet certain income or activity thresholds are required to file.

How to fill out in form united states?

The process of filling out Form United States varies depending on the specific form. Generally, individuals and businesses are required to provide accurate and complete information regarding their income, expenses, assets, liabilities, and other relevant financial information.

What is the purpose of in form united states?

The purpose of Form United States is to gather information from individuals, businesses, and organizations for regulatory, taxation, and reporting purposes. The information collected helps the United States government monitor compliance, assess tax liabilities, and enforce applicable laws and regulations.

What information must be reported on in form united states?

The information required to be reported on Form United States varies depending on the specific form. Generally, individuals and businesses must report their income, deductions, credits, assets, liabilities, and other relevant financial information.

When is the deadline to file in form united states in 2023?

The deadline to file Form United States in 2023 will depend on the specific form being filed. The deadlines are often set by the Internal Revenue Service (IRS) and can vary for different entities and individuals. It is recommended to check the IRS website or consult with a tax professional for the specific deadline for the form you need to file.

What is the penalty for the late filing of in form united states?

The penalties for late filing of Form United States vary depending on the specific form and the individual's or entity's circumstances. Generally, penalties may include monetary fines, interest on unpaid taxes, and potentially in some cases, criminal charges. It is advisable to consult with a tax professional or refer to the specific form instructions for information on the penalties associated with late filing.

How do I modify my in form united states in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your in form united states along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit in form united states from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like in form united states, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out the in form united states form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign in form united states and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your in form united states online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.