Get the free Form 8858, PAGE 1 of 2 - irs ustreas

Show details

6 TLS, have you transmitted all R text files for this cycle update? Date I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING INSTRUCTIONS TO PRINTERS Form 8858, PAGE 1 of 2 MARGINS: TOP 13 mm (1 2),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8858 page 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8858 page 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8858 page 1 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 8858 page 1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

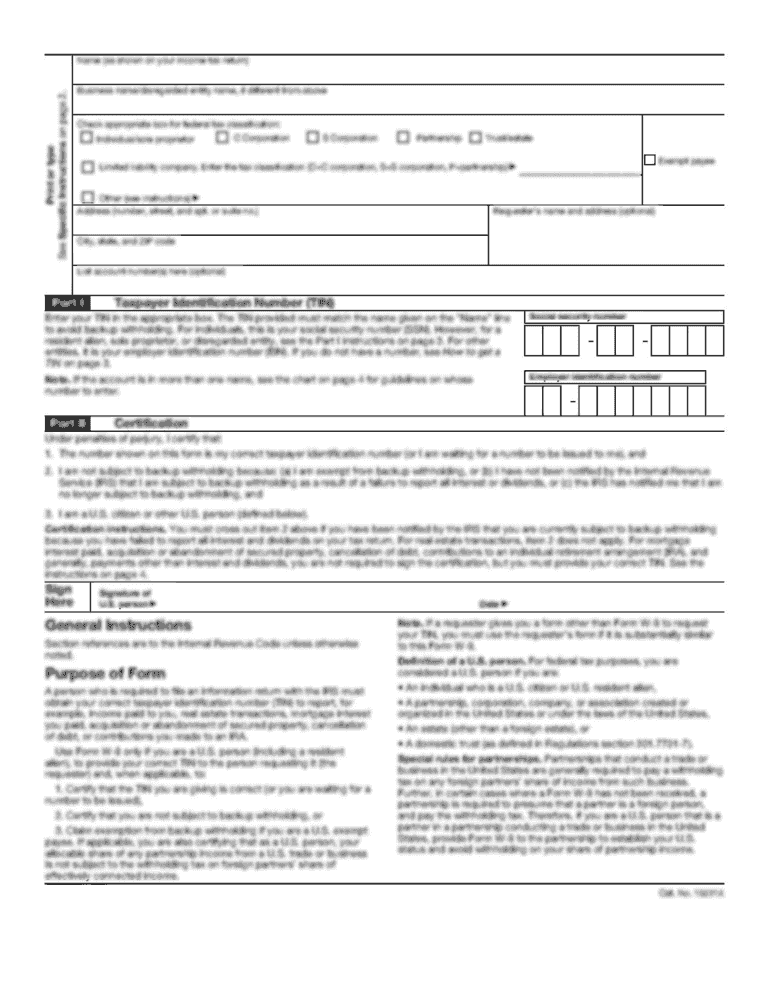

How to fill out form 8858 page 1

How to fill out form 8858 page 1:

01

Start by entering the legal name and address of the foreign disregarded entity or foreign corporation at the top of the form.

02

Provide the Employer Identification Number (EIN) of the foreign entity in the designated section.

03

Indicate the tax year or period that the form is being filed for.

04

Check the appropriate box to identify if the form is being filed for a foreign disregarded entity or a foreign corporation.

05

If the form is being filed for a foreign disregarded entity, provide the name and address of the owner of the entity.

06

Fill in the applicable information regarding the entity's principal business activities.

07

Provide details about any changes that have occurred in the entity's ownership during the tax year.

08

Complete the sections related to the entity's financial information, including income, assets, and liabilities.

09

Attach any necessary schedules or supporting documentation as required.

10

Review the completed form for accuracy and sign and date it before submitting it to the appropriate tax authority.

Who needs form 8858 page 1:

01

U.S. persons who have an ownership interest in a foreign disregarded entity or a foreign corporation are generally required to file form 8858 page 1.

02

This form is used to report information about the foreign entity's activities, income, and ownership details for tax purposes.

03

It is important for individuals who meet the filing requirements to ensure they accurately complete and submit this form to comply with U.S. tax laws.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

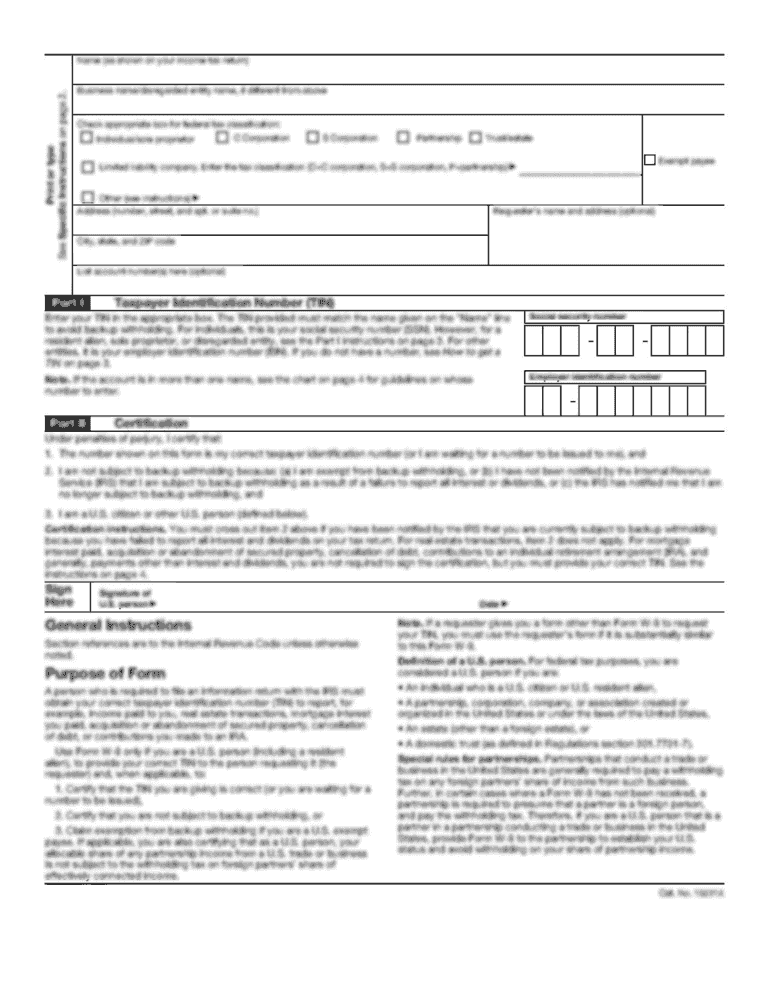

What is form 8858 page 1?

Form 8858 page 1 is a document used for reporting information about foreign disregarded entities (FDE) owned by U.S. persons.

Who is required to file form 8858 page 1?

U.S. persons who own or have control over a foreign disregarded entity are required to file form 8858 page 1.

How to fill out form 8858 page 1?

Form 8858 page 1 requires individuals to provide detailed information about the foreign disregarded entity, including its ownership, income, and expenses. It is recommended to consult the instructions provided by the Internal Revenue Service (IRS) for step-by-step guidance on filling out the form.

What is the purpose of form 8858 page 1?

The purpose of form 8858 page 1 is to report information about foreign disregarded entities owned by U.S. persons, allowing the IRS to track and tax any income generated by these entities.

What information must be reported on form 8858 page 1?

Form 8858 page 1 requires reporting various details about the foreign disregarded entity, such as its name, address, EIN or taxpayer identification number, organizational structure, financial information, and activities.

When is the deadline to file form 8858 page 1 in 2023?

The deadline to file form 8858 page 1 in 2023 is typically April 15th, unless an extension has been requested.

What is the penalty for the late filing of form 8858 page 1?

The penalty for late filing of form 8858 page 1 can vary depending on the circumstances, but it is generally $10,000 per year for each foreign disregarded entity owned by the taxpayer. Additional penalties may apply for intentional or fraudulent non-compliance.

How can I send form 8858 page 1 for eSignature?

When you're ready to share your form 8858 page 1, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit form 8858 page 1 online?

The editing procedure is simple with pdfFiller. Open your form 8858 page 1 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out form 8858 page 1 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 8858 page 1 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your form 8858 page 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.