Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

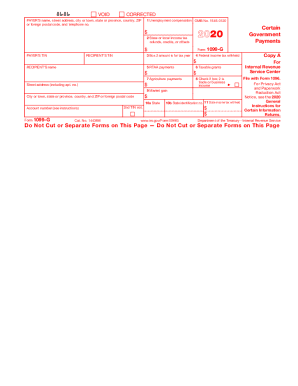

What is 1099 g california form?

Form 1099-G is a tax form used to report certain government payments, including unemployment compensation, state or local income tax refunds, and agricultural payments. In California, Form 1099-G specifically reports state income tax refunds or overpayments received by taxpayers. It shows the total amount of the refund or overpayment received during the tax year and is generally issued by the California Franchise Tax Board (FTB) to taxpayers who have received a state income tax refund. The information provided on Form 1099-G is important for taxpayers to accurately report their income on their federal and state tax returns.

Who is required to file 1099 g california form?

There are several situations where individuals or entities may be required to file Form 1099-G in California.

According to the California Franchise Tax Board, you may be required to file Form 1099-G if:

1. You received a payment from the state of California for unemployment compensation, state disability insurance (SDI) benefits, Paid Family Leave (PFL) benefits, or any other state payments included in federal income taxable income.

2. You made payments as a part of your trade or business and are engaged in transaction(s) for which you are required to file a Form 1099-G.

It is important to note that the filing requirements may vary, and it is advised to consult with a tax professional or refer to the specific instructions provided by the California Franchise Tax Board for accurate and up-to-date information.

How to fill out 1099 g california form?

To fill out the 1099-G California form, follow these steps:

1. Obtain the 1099-G form: The form can be obtained from the California Franchise Tax Board (FTB) website or by contacting them directly.

2. Gather necessary information: Collect all the required information to complete the form. This includes your personal information, such as name, address, and Social Security number (or taxpayer identification number), as well as the information related to the income or refund you received.

3. Identify the recipient: Indicate whether you are the recipient of the income or refund, or if you are acting as a third-party filer.

4. Fill out Box 1: In Box 1, report the total taxable income you received in the tax year, including unemployment benefits, state or local income tax refunds, or any other income reported on the 1099-G.

5. Fill out Box 2: In Box 2, report the amount of state or local income tax that was withheld from your income.

6. Fill out Box 3: In Box 3, report any adjustments made to the taxable income reported in Box 1. This could include items such as repayments of income previously refunded or overpayments credited to the current year.

7. Fill out Box 4: In Box 4, report any federal income tax withheld from the taxable income reported in Box 1.

8. Fill out Box 5: In Box 5, report the amount of the refund or credit you received from the state or local government. This could be the amount of a tax refund or credit received during the tax year.

9. Fill out Box 6: In Box 6, report any income tax withheld by the state or local government from the refund or credit reported in Box 5.

10. Check Box 7: Check Box 7 if the 1099-G form is reporting unemployment compensation.

11. Check Box 8: Check Box 8 if you are completing the form for a deceased beneficiary.

12. Sign and submit the form: Sign the completed form and submit it to the appropriate tax authorities. Keep a copy of the form for your records.

It is recommended to consult with a tax professional or use tax software to ensure accurate completion of the 1099-G California form, as individual circumstances may vary.

What is the purpose of 1099 g california form?

The purpose of the 1099-G form in California is to report certain government payments received throughout the year. It provides information regarding any state or local income tax refunds, unemployment compensation, or other types of government payments that may be taxable.

What information must be reported on 1099 g california form?

The 1099-G form in California is used to report certain government payments made by the state, such as unemployment compensation, state or local income tax refunds, or credits. The following information is typically reported on the 1099-G form:

1. Payer's information (name, address, and taxpayer identification number)

2. Recipient's information (name, address, and taxpayer identification number)

3. Payment amount received

4. Type of payment (e.g., unemployment compensation, tax refund, etc.)

5. State withholding, if any

6. Federal withholding, if any

7. State identification number

8. State income tax refunded, if any

It is important to note that the specific information reported on the form may vary depending on the circumstances and the type of payment being reported. It is advisable to consult the IRS instructions or a tax professional for accurate and specific guidance for your individual situation.

When is the deadline to file 1099 g california form in 2023?

The deadline for filing the 1099-G form in California for the year 2023 is January 31, 2024. It is important to note that this deadline may vary if it falls on a weekend or federal holiday, in which case it would be the next business day.

Where do I find 1099 g california form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 1099 g form and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the 1099 g california in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your form 1099 g california directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out how do i get a copy of my 1099 g california using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign how do i get my 1099 g online california form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.