Get the free Loan Application - bloomington in

Show details

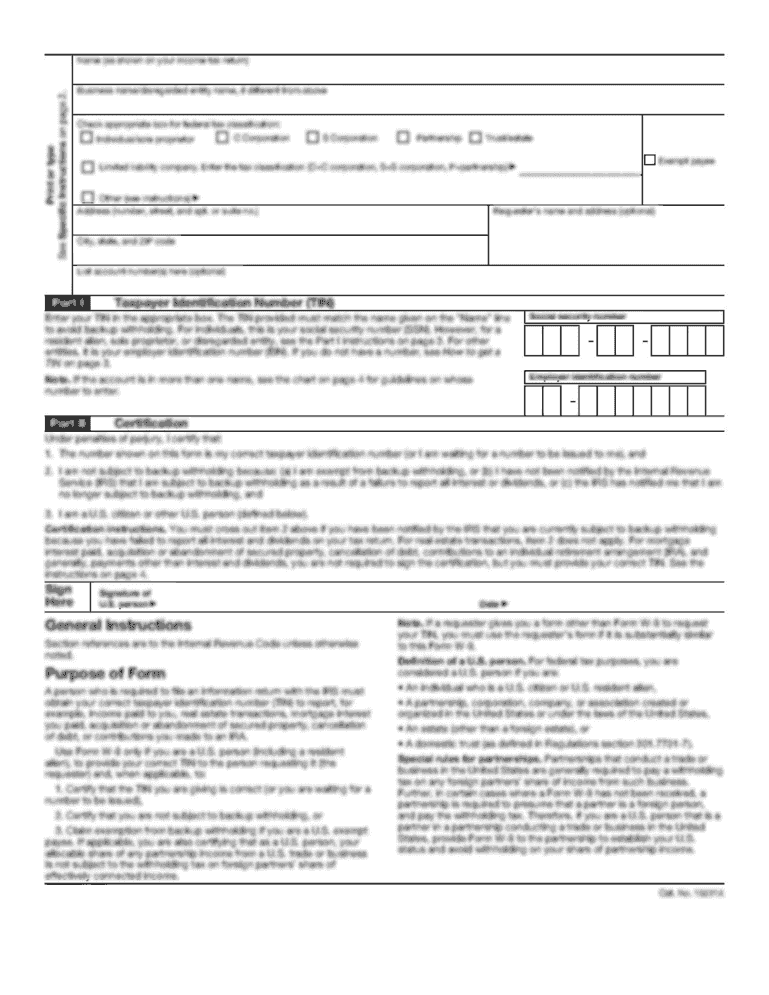

Bloomington Urban Enterprise Association Loan Application Return to: Showers City Hall, Room 130 401 N. Morton P.O. Box 100 Bloomington, IN 47402 (812) 349-3805 Loan Program Application The information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan application - bloomington form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan application - bloomington form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan application - bloomington online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan application - bloomington. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out loan application - bloomington

How to fill out a loan application - Bloomington?

01

Gather all necessary documents and information, including identification, income verification, and collateral details.

02

Visit the nearest branch of the lender in Bloomington or access their online application portal.

03

Follow the instructions provided by the lender to complete each section of the loan application thoroughly and accurately.

04

Provide detailed information about your personal and financial background, employment history, and any existing debts or obligations.

05

Indicate the desired loan amount, repayment terms, and purpose of the loan.

06

Review the completed loan application for any errors or omissions before submitting it to the lender.

07

Wait for the lender to review and process your loan application. They may contact you for additional information or documentation if needed.

08

Once the loan application is approved, carefully review the terms and conditions offered by the lender before accepting the loan.

09

Sign all necessary loan agreements and contracts as required by the lender.

Who needs a loan application - Bloomington?

01

Individuals who require financial assistance to meet various needs such as personal expenses, education, home improvements, or business ventures may need to fill out a loan application in Bloomington.

02

Entrepreneurs or small business owners who need funding for their ventures may utilize a loan application to seek financial support in Bloomington.

03

Students pursuing higher education or seeking educational loans may be required to complete a loan application for financial aid in Bloomington.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan application - bloomington?

Loan application - bloomington is a form used by individuals or organizations in the Bloomington area to request a loan from a financial institution. It contains personal and financial information about the applicant to assess their eligibility for the loan.

Who is required to file loan application - bloomington?

Any individual or organization in the Bloomington area who wishes to apply for a loan from a financial institution is required to file a loan application - bloomington.

How to fill out loan application - bloomington?

To fill out a loan application - bloomington, you need to provide accurate and complete personal and financial information. This includes details such as your name, contact information, income, employment history, assets, liabilities, and the purpose of the loan. It is important to read the instructions carefully and provide all the required documentation and supporting materials.

What is the purpose of loan application - bloomington?

The purpose of loan application - bloomington is to gather all the necessary information about the applicant in order to assess their creditworthiness and determine whether they qualify for a loan. It helps the financial institution in evaluating the risks associated with lending money and making an informed decision on loan approval.

What information must be reported on loan application - bloomington?

On a loan application - bloomington, you are typically required to report personal information such as your name, address, social security number, and contact details. You must also provide financial information, including your income, employment history, assets, liabilities, and any existing debts. Additionally, you may need to specify the purpose of the loan and provide supporting documentation such as bank statements, tax returns, and pay stubs.

When is the deadline to file loan application - bloomington in 2023?

The specific deadline to file a loan application - bloomington in 2023 may vary depending on the financial institution or lending agency. It is recommended to contact the relevant institution directly or refer to their official website or documentation for the exact deadline.

What is the penalty for the late filing of loan application - bloomington?

The penalty for the late filing of a loan application - bloomington can also vary depending on the financial institution or lending agency. It is important to review the terms and conditions provided by the institution to understand any potential penalties, such as additional fees or potential impact on the loan approval process.

How do I complete loan application - bloomington online?

pdfFiller has made it simple to fill out and eSign loan application - bloomington. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in loan application - bloomington?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your loan application - bloomington and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit loan application - bloomington on an iOS device?

You certainly can. You can quickly edit, distribute, and sign loan application - bloomington on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your loan application - bloomington online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.