Get the free it 540 2d form

Show details

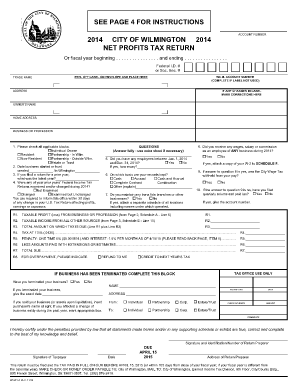

6291 IT-540B-2D Nonresident and Part-Year Resident NPR Worksheet. 6295 IT-540B-2D Schedule F-NR and H-NR. The numbers must be printed in a bold 12-point Courier font. The following are the numbers assigned to Form IT-540B-2D 2011 Return / Schedule / Worksheet Doc ID No. IT-540B-2D Return Page 1. The test samples of Form IT-540B-2D must use the scenarios that are found on Pages 29 through 40 of this document. R-6235 11/08/11 final Specifications a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it 540 2d form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 540 2d form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it 540 2d online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit it 540b 2d form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out it 540 2d form

How to fill out Form 540 2D:

01

Start by gathering all the necessary information such as your personal details, income sources, deductions, and credits.

02

Carefully read the instructions provided with Form 540 2D to understand the specific requirements and guidelines.

03

Begin with section 1 of the form, which requires your personal information such as your name, address, and social security number.

04

Move on to section 2, where you will report your income from various sources such as wages, self-employment, interest, dividends, and retirement plans.

05

If you have any deductions or credits, fill out the appropriate sections, such as section 3 for deductions and section 4 for credits.

06

Double-check all the information you have entered to ensure accuracy and minimize errors.

07

Sign and date the form in the designated area to certify that the information provided is true and accurate.

08

Keep a copy of the filled-out Form 540 2D for your records.

Who needs Form 540 2D?

01

Individuals who are residents of California for tax purposes and have income from sources inside or outside of California need to fill out Form 540 2D.

02

It is required to be filled out by taxpayers who do not qualify to use the simpler Form 540 2EZ.

03

Form 540 2D is necessary for reporting taxable income, deductions, and credits to calculate the amount of California state income tax owed or the refund to be received.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is it 540 2d?

The 540 2d is a specific tax form used to report capital gains and losses for individual taxpayers in California.

Who is required to file it 540 2d?

California taxpayers who have capital gains or losses from the sale of assets are required to file the 540 2d form.

How to fill out it 540 2d?

To fill out the 540 2d form, taxpayers must provide information about their capital gains and losses, including the sale dates, sale prices, cost basis, and other relevant details.

What is the purpose of it 540 2d?

The purpose of the 540 2d form is to accurately report and calculate the capital gains or losses of an individual taxpayer in California.

What information must be reported on it 540 2d?

The 540 2d form requires taxpayers to report details about their capital gains or losses, including the type of asset sold, sale date, sale price, cost basis, and other relevant information.

When is the deadline to file it 540 2d in 2023?

The specific deadline to file the 540 2d form for the year 2023 will be announced by the California Franchise Tax Board. It is usually around April 15th.

What is the penalty for the late filing of it 540 2d?

The penalty for the late filing of the 540 2d form in California is typically a percentage of the unpaid tax amount, depending on the duration of the delay. The exact penalty rates can be found on the official website of the California Franchise Tax Board.

How do I complete it 540 2d online?

pdfFiller has made it easy to fill out and sign it 540b 2d form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in it 540b without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit it 540 2d and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit it 540b 2d form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like it 540b. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your it 540 2d form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It 540b is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.