Get the free 1120ME Corporate income tax form - Maine.gov - maine

Show details

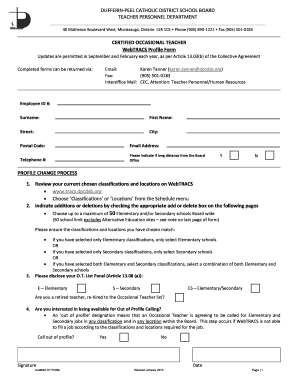

FORM 1120ME MAINE CORPORATE INCOME TAX RETURN MM DD For calendar year 2005 or tax year 2005 0BYYY to MM DD BY *0500100* Check if you filed federal Form 990-T Federal Business code 00 Names of Corporation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1120me corporate income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1120me corporate income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1120me corporate income tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1120me corporate income tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out 1120me corporate income tax

How to fill out 1120me corporate income tax:

01

Gather all the necessary financial documents, such as income statements, balance sheets, and receipts.

02

Obtain the 1120me form from the IRS website or any authorized source.

03

Carefully read the instructions provided with the form to ensure accurate completion.

04

Fill in the required information, including the business name, address, and employer identification number.

05

Report the company's income and deductions accurately, following the guidelines provided in the form instructions.

06

Calculate the taxable income by subtracting the deductions from the total income.

07

Determine the tax liability by applying the corporate tax rate to the taxable income.

08

Fill in any additional required schedules or forms that are applicable to your business.

09

Double-check all the entered information for accuracy before submitting the form.

10

Sign and date the completed form.

11

Mail the completed 1120me form to the designated IRS address by the due date.

Who needs 1120me corporate income tax:

01

Companies that are organized as corporations and are required to pay federal income tax.

02

Small businesses, especially those operating in Maine or deriving income from activities within the state.

03

Corporations that meet the specific filing requirements outlined by the IRS and have income exceeding the threshold set for filing corporate tax returns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1120me corporate income tax?

The 1120me corporate income tax is a tax imposed on corporations in the state of Maine. It is based on the corporation's taxable income and is calculated using the tax rates specified by the Maine Revenue Services.

Who is required to file 1120me corporate income tax?

Any corporation that conducts business or generates income in the state of Maine is required to file the 1120me corporate income tax return. This includes both domestic and foreign corporations.

How to fill out 1120me corporate income tax?

To fill out the 1120me corporate income tax, you will need to gather information about your corporation's income, deductions, and credits. This includes details about the corporation's revenue, expenses, assets, and liabilities. The completed form can be filed electronically or by mail to the Maine Revenue Services.

What is the purpose of 1120me corporate income tax?

The purpose of the 1120me corporate income tax is to collect revenue from corporations operating in Maine. It helps fund various state programs and services, including infrastructure, education, healthcare, and public safety.

What information must be reported on 1120me corporate income tax?

The 1120me corporate income tax requires corporations to report their total income, deductions, and credits. This includes details about the corporation's revenue, expenses, assets, liabilities, and any applicable tax credits or deductions.

When is the deadline to file 1120me corporate income tax in 2023?

The deadline to file the 1120me corporate income tax in 2023 is April 17th. Please note that this deadline may be subject to change, and it is always advisable to check with the Maine Revenue Services for the most accurate and up-to-date information.

What is the penalty for the late filing of 1120me corporate income tax?

The penalty for the late filing of 1120me corporate income tax is based on a percentage of the unpaid tax. The exact penalty rate varies depending on the length of the delay and the amount of tax owed. It is important to file the return and pay any outstanding tax as soon as possible to minimize penalties and interest.

How can I send 1120me corporate income tax for eSignature?

When you're ready to share your 1120me corporate income tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I fill out 1120me corporate income tax on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 1120me corporate income tax, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit 1120me corporate income tax on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share 1120me corporate income tax on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your 1120me corporate income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.