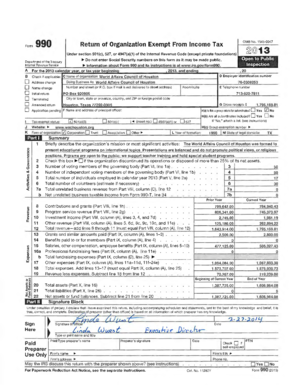

Estimated payroll taxes and estimated tax payments for full-time year-round workers: Street address 1. Estimated tax payment for the year ending MONTH 1.75 5.13 3. Estimated tax payment for the year ending JANUARY / FEBRUARY / MARCH 1.83 3.84 4. Estimated Social Security no. 1 / ANNUAL NO. 3 4,000 4. Estimated Social Security no. 4 Annual pension from employment, or.

annual annuity from a pension plan Annual pension from employment, or

Annual annuity from a pension plan 5. Estimated tax payments for one-half of the year: Street address --

(City, State, ZIP) — Enter Street Address (City, State, ZIP)

--

Street Address (City, State, ZIP) --

--

Street Address (City, State, ZIP) --

-- Name --

-- Home Phone --

-- Work Phone --

-- Mobile Home --

-- Bank Account 1 --

-- Bank Account 2 --

--

The calculation of Social Security no. 1 and no. 4, above, is based on the amounts in this calculator.

Please note that the amounts given in this calculator are subject to change.

Please also note that, in addition to estimated taxes, you must also pay monthly estimated tax payments. These payments are due no later than 15 calendar days from the date of the return.

About Your Personal Financial Information

The information you enter here is used by the state to evaluate your economic or financial status and can be used to determine eligibility for public assistance programs, and for reporting or conducting background checks for other reasons, such as criminal history. If you are receiving public assistance benefits, your income and family resources can be evaluated using our Social Security Income Calculator.

Social Security Number (SSN)

The Social Security number (SSN) is the five-digit number assigned to each individual upon birth in the United States. Social Security numbers are also assigned to U.S. citizens based on proof of U.S. birthplace. For individuals born outside the United States, a U.S.

Get the free 1-ES - Mass.Gov - mass

Show details

1-ES Massachusetts Department of Revenue Estimated Tax Payment -- 2006 Due date Voucher 1 Estimated tax for the year ending MONTH Social Security number Spouse's Social Security no. 1 Last name (print)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1-es - massgov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1-es - massgov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1-es - massgov online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 1-es - massgov. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1-es - massgov?

1-es - massgov refers to a specific form required by the Massachusetts government.

Who is required to file 1-es - massgov?

The specific requirements for filing 1-es - massgov may vary, but typically it is required for certain individuals or entities based on specific criteria set by the Massachusetts government.

How to fill out 1-es - massgov?

To fill out 1-es - massgov, you need to obtain the form from the Massachusetts government, review the instructions provided, and provide the necessary information as requested on the form. It is recommended to consult with a tax professional or refer to the official guidelines for accurate and complete filling of the form.

What is the purpose of 1-es - massgov?

The purpose of 1-es - massgov is to gather specific information from individuals or entities that the Massachusetts government requires for various purposes, such as tax calculations, compliance, or data collection.

What information must be reported on 1-es - massgov?

The specific information that must be reported on 1-es - massgov can vary depending on the purpose and requirements set by the Massachusetts government. It is generally important to provide accurate and up-to-date information as requested on the form.

When is the deadline to file 1-es - massgov in 2023?

The exact deadline for filing 1-es - massgov in 2023 will be determined by the Massachusetts government and may vary depending on the specific form and filing requirements. It is recommended to refer to the official guidelines or consult with the relevant authorities for the most accurate information.

What is the penalty for the late filing of 1-es - massgov?

The penalty for the late filing of 1-es - massgov can vary depending on the specific rules and regulations established by the Massachusetts government. It is advisable to review the official guidelines or consult with the concerned authorities to understand the applicable penalties and consequences for late filing.

How can I edit 1-es - massgov from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 1-es - massgov. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I edit 1-es - massgov on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 1-es - massgov right away.

How do I complete 1-es - massgov on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 1-es - massgov by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your 1-es - massgov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.