MI 3980 2015-2024 free printable template

Show details

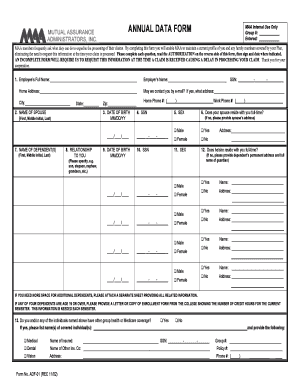

Reset Form Michigan Department of Treasury 3980 (Rev. 9-11) Facsimile Signature Declaration for Real and Personal Property Statements Issued under Public Act 267 of 2002. Filing is voluntary. Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your michigan treasury form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan treasury form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan treasury form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit michigan treasury form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out michigan treasury form

How to fill out michigan treasury form:

01

Begin by carefully reading the instructions provided with the form. These instructions will outline the specific information and documents you will need to complete the form accurately.

02

Gather all the necessary documents, such as your tax returns, income statements, and any other supporting documentation required.

03

Start by entering your personal information on the form, including your name, address, social security number, and any other relevant details.

04

Follow the instructions to report your income and deductions accurately. This may involve calculating and entering various figures related to your earnings and expenses.

05

Provide information about any dependents you may have if applicable.

06

Ensure that all the required fields are filled out correctly and accurately. Double-check your entries for any errors or omissions.

07

Sign and date the form as necessary.

08

Make copies of the completed form and any supporting documentation for your records.

09

Send the completed form to the appropriate address as mentioned in the instructions.

10

Keep a copy of the sent form and any associated documents for your personal records.

Who needs michigan treasury form:

01

Individuals residing in the state of Michigan who are required to file their taxes with the Michigan Department of Treasury need the michigan treasury form.

02

This form is necessary for individuals who have earned income in Michigan and need to report their income, deductions, and pay any applicable taxes.

03

It is also required for individuals who may be eligible for tax credits or deductions specific to the state of Michigan.

04

Business entities operating in Michigan may also need to file the michigan treasury form, depending on their legal structure and tax obligations.

Fill michigan personal property form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is michigan treasury form?

The Michigan Treasury Form is a standardized form used by the Michigan Department of Treasury for various financial transactions and reporting purposes. These forms are used for activities such as tax filing, requesting refunds, reporting income, claiming exemptions, and other financial transactions related to state taxes and revenues. The specific form numbers and purposes may vary depending on the type of transaction or reporting requirement.

Who is required to file michigan treasury form?

There are various forms under the Michigan Treasury that may be required to be filed by different individuals or entities, depending on their specific circumstances. Some common forms that may need to be filed include:

1. Michigan Individual Income Tax Return (MI-1040): All Michigan residents with taxable income, regardless of their filing status, are required to file this form.

2. Michigan Corporate Income Tax Return (Form 4891): Corporations that conduct business in Michigan or have Michigan-based income are required to file this form.

3. Michigan Partnership Return of Income (Form 1065): Partnerships with income derived from or connected to Michigan must file this form.

4. Michigan Fiduciary Income Tax Return (Form 1041): Estates and trusts that have income originating from Michigan are required to file this form.

5. Michigan Sales and Use Tax Return: Businesses engaged in sales or providing taxable services in Michigan are typically required to file this form.

Please note that this is not an exhaustive list, and there may be other forms that are required to be filed based on specific circumstances. It is always recommended to refer to the official Michigan Treasury website or consult with a tax professional to determine which forms are applicable to your situation.

How to fill out michigan treasury form?

To accurately fill out a Michigan Treasury form, you will need to follow specific instructions provided by the Michigan Department of Treasury. The steps below provide a general process to help you get started:

1. Identify the specific Michigan Treasury form you need to fill out. This will typically be indicated on the form itself or in the instructions that accompany it.

2. Gather all the necessary information and supporting documents required to complete the form. This may include personal or business details, tax-related documents, or any other relevant information.

3. Read the form instructions carefully to understand the purpose of the form and any additional guidelines or requirements. These instructions will provide specific details on how to fill out each section of the form.

4. Begin filling out the form by entering your personal or business information as required. This may include your name, address, social security number, employer identification number (EIN), or other relevant details.

5. Follow the instructions for each section of the form, providing accurate and complete information. If you are unsure about any specific section, consult the form instructions or contact the Michigan Department of Treasury for guidance.

6. Double-check your entries for accuracy, especially when providing numerical information such as income, expenses, or deductions.

7. If applicable, attach any supporting documents requested on the form or in the instructions. This may include wage statements, financial statements, receipts, or other relevant documentation.

8. Review the completed form to ensure all required fields are filled out, all necessary documents are attached, and the provided information is accurate.

9. Make a copy of the completed form and supporting documents for your records before submitting it.

10. Submit the form by mail or through the appropriate online system, depending on the instructions provided on the form or by the Michigan Department of Treasury.

Remember, these steps are a general guideline and may vary depending on the specific form and situation. Always carefully review and follow the instructions provided by the Michigan Department of Treasury to ensure accurate completion of the form.

What is the purpose of michigan treasury form?

The purpose of a Michigan treasury form is to provide a means for individuals and businesses to fulfill their tax-related obligations to the state of Michigan. These forms are used for various purposes, such as filing income tax returns, reporting sales and use tax, claiming tax credits, requesting tax exemptions, and making various other tax-related transactions. The Michigan treasury forms facilitate efficient and accurate reporting of financial information to the state treasury department, ensuring compliance with state tax laws and regulations.

What information must be reported on michigan treasury form?

The Michigan Treasury form, also known as the Michigan Department of Treasury Revenue and Taxation Division form, requires the reporting of various types of information depending on the specific form being filed. Some common types of information that may need to be reported on Michigan Treasury forms include:

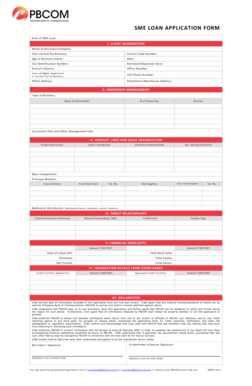

1. Personal identification information: This includes the taxpayer's name, address, Social Security number (or employer identification number for businesses), and contact details.

2. Income information: Information related to various sources of income should be included, such as wages, salaries, interest, dividends, partnership/LLC earnings, rental income, retirement income, and other miscellaneous income.

3. Deductions and exemptions: Taxpayers are required to report any deductions or exemptions they are eligible for. This may include deductions for mortgage interest, property taxes, medical expenses, charitable contributions, and student loan interest, among others.

4. Tax credits and refunds: Individuals may need to report any eligible tax credits they wish to claim or any expected refunds from overpaid taxes.

5. Business information (if applicable): Business taxpayers are typically required to provide information such as gross receipts, expenses, losses, and other relevant financial data.

6. Sales and use tax information (if applicable): Businesses engaged in retail sales may need to report information regarding their sales and use tax collections.

7. Estimated tax payments: Taxpayers who make estimated tax payments throughout the year must report the amounts and dates of those payments.

It is important to consult the specific Michigan Treasury form instructions and guidelines for accurate and comprehensive reporting, as the information required may vary based on the form being filed.

What is the penalty for the late filing of michigan treasury form?

The penalties for late filing of Michigan Treasury forms vary depending on the specific form. However, common penalties may include a late-filing fee or penalties based on a percentage of the amount due. It is recommended to check the specific form's instructions or consult with the Michigan Department of Treasury for accurate and up-to-date information regarding penalties for late filing.

How can I get michigan treasury form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the michigan treasury form. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in michigan treasury online?

The editing procedure is simple with pdfFiller. Open your mi treasury in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out declaration statement form on an Android device?

On Android, use the pdfFiller mobile app to finish your michigan real form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your michigan treasury form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Treasury Online is not the form you're looking for?Search for another form here.

Keywords relevant to michigan treasury fillable form

Related to mi statement form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.