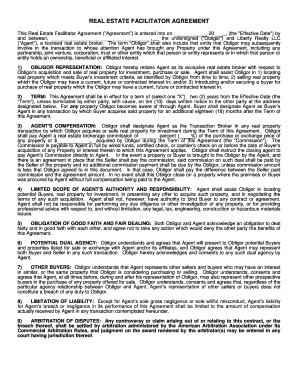

Get the free Form ST-810: November 1998 , New York State and Local Sales and ... - tax ny

Show details

New York State Department of Taxation and Finance New York State and Local Sales and Use Tax Return Quarterly for Part-Quarterly Filers Sales tax vendor identification number Legal name DBA Street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form st-810 november 1998 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form st-810 november 1998 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form st-810 november 1998 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form st-810 november 1998. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out form st-810 november 1998

How to fill out form st-810 november 1998?

01

Begin by carefully reading through the instructions provided with the form. These instructions will guide you through each section of the form and provide important details on how to fill it out correctly.

02

Gather all the necessary information and documents you will need to complete the form. This may include details about your business, sales transactions, and any relevant supporting documents.

03

Start with the first section of the form, usually related to the identification information of the filer. Provide accurate and up-to-date details about your business, such as the legal name, address, and taxpayer identification number.

04

Proceed to the subsequent sections, which may include specific details about the sales transactions made during the reporting period. Fill in the required information accurately, such as the total sales made, any tax exemptions or exclusions, and applicable tax rates.

05

Carefully review all the information you have provided on the form to ensure it is accurate and complete. Double-check the calculations and make sure you haven't missed any required fields.

06

Once you are satisfied with the information provided, sign and date the form as required. Keep a copy for your records and submit the form according to the specified instructions.

Who needs form st-810 november 1998?

01

The form st-810 november 1998 may be required by businesses that are responsible for collecting and remitting sales tax in certain jurisdictions.

02

If your business is engaged in selling tangible personal property or providing taxable services in a jurisdiction where this form is applicable, you may need to file this form to comply with the sales tax regulations.

03

It is important to consult the specific sales tax laws of the jurisdiction where your business operates to determine if form st-810 november 1998 is required for your business. Additionally, you may need to check for any updated versions or revisions of the form that may be applicable.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form st-810 november 1998 to be eSigned by others?

Once your form st-810 november 1998 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get form st-810 november 1998?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific form st-810 november 1998 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit form st-810 november 1998 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing form st-810 november 1998 right away.

Fill out your form st-810 november 1998 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.