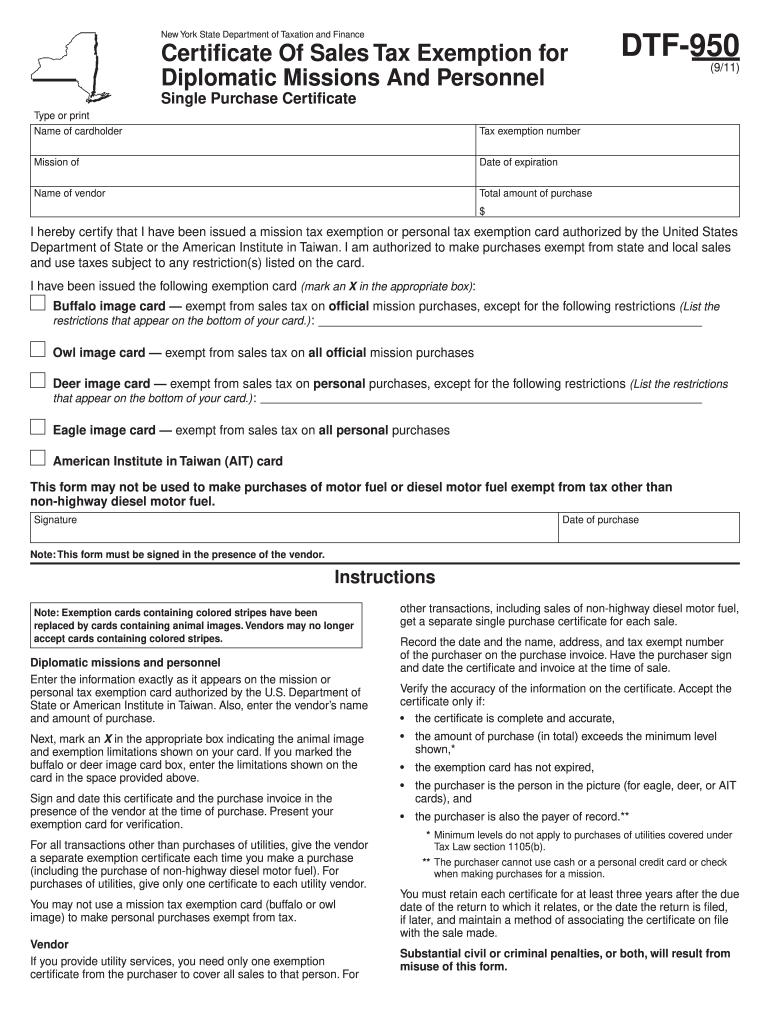

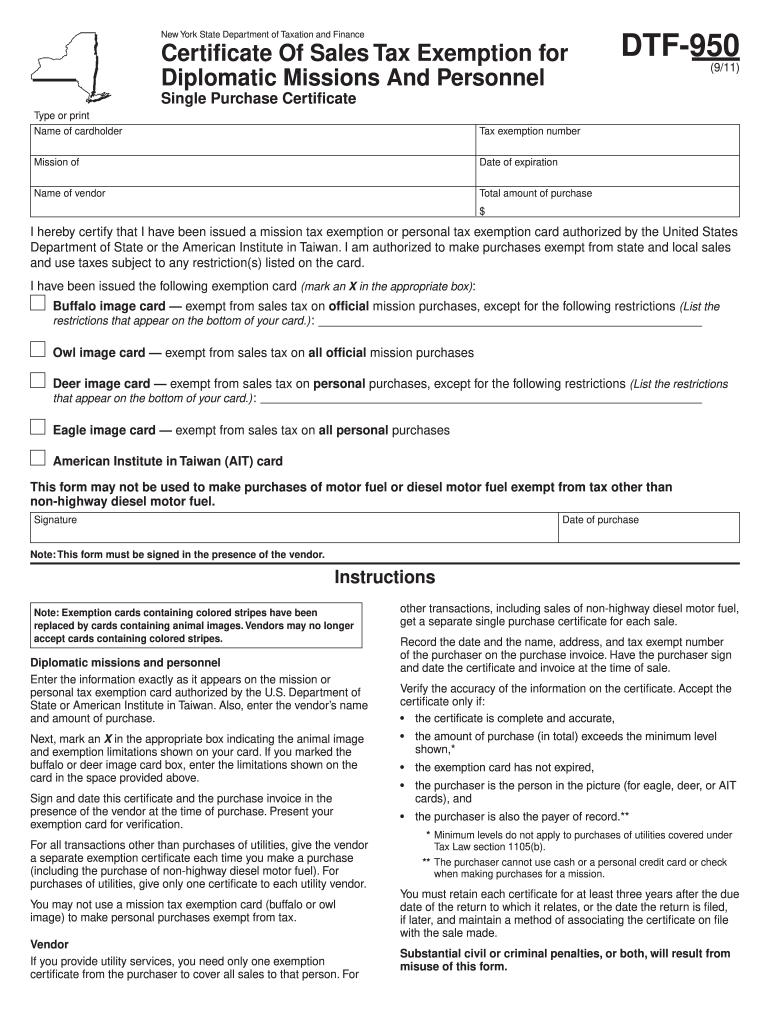

NY DTF-950 2011-2024 free printable template

Get, Create, Make and Sign

How to edit tax exempt form online

How to fill out tax exempt form

How to fill out tax exempt form:

Who needs tax exempt form:

Video instructions and help with filling out and completing tax exempt form

Instructions and Help about tax exemption personnel form

Oh, well again inside red with boomer and×39’m doing stuff here now yeah every no wand then see what those IN×39’ll talk about this right hearth Microsoft Allah Milan Lucia 950xlwindows 10 mobile first and last probably the device as smack sauce Andre now moving on to stop at the Windows10 on our the IOT in the seashell Randall that fun stuff that's one kind of as you all know mostly for sometimes I used to cheap hardware Thought yes it is this is plastic but uh you can take it off replace it for something else take out the battery test the battery if it dies you know it×39’s I think it's kind of more of a long-lasting device really, but you know what you will don't people want more metal phones nowadays I'm done×39;love the same songs and the iPhones and whatnot but yeah the camera on twisting×39’s still probably better than mostphontodayyI got most people with what all what negative people here it is the OS logical done×39’t like Windows 10 mobile Did are we using Windows Phones inspire2012 I am shooting this on a highway mate 9 at that moment kind of those are the will I return the windows will see really curious to see what's going to happen with the tackle though this mode mobile things probably just that what are you having said it should you buy it think you's not really amazing anyone I'm done×39;think isn't if you want to find it×39;probably going to find on like eBay sort of Amazon Marketplace or price list or whatever the hell you have in your region but yeah as a phone and this is perfect see it×39’s its kind of big oh yeah the camera feel good decently sized battery for today standard just as they say 3000 something millions just found like micros support got headphone jack again the feature but keep it modern times you know what again orient you USB type-c continuum all that stuff yeah I mean Windows Phone got pal got get sluggish it because they will access at Gap thing I mean Facebook'their Instagram there what's thatwhat'’s up they're not officiaYouTube butt it×39’s like 52 clones or third-partyofferings some you can say a lot better or more I don't know that no ads for example unlike my tea or to cast to let other kind of bit you know a lot of people use AdBlock anyway, so I don'tknow good that be help me I'm done×39’t know but yeah the Microsoft on the phone theistic got a horrible start never seem to reach IIT×39’s a full potential in my opinion but released as a phone is still pretty good just you know if you care about having Snapchat in Pokémon Go and I can service you might not be all that ideal but are you know there will be some point in the future, but Web Apps just really take off then he only needs apps anyway and although something you can do put out fun now just you know what do you think you have in the somehow you have used it or use a gas through that Apple and phone and Android phones all the way up in Europe where they moorhen you're watching return of tales from my dusty discs as you see again yeah yeah

Fill tax exempt number : Try Risk Free

People Also Ask about tax exempt form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.