OK BT-175 2012 free printable template

Show details

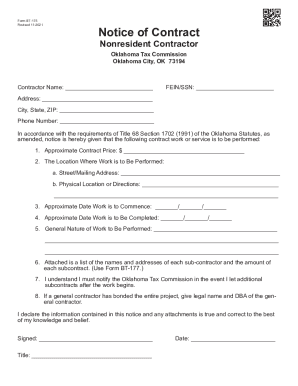

Form BT-175 Revised 5-2012 Notice of Contract Nonresident Contractor Oklahoma Tax Commission Taxpayer Assistance Division Post Office Box 26920 Oklahoma City OK 73126-0920 Contractor Name FEIN/SSN Address City State ZIP Phone Number In accordance with the requirements of Title 68 O.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your oklahoma form bt 175 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma form bt 175 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma form bt 175 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oklahoma form bt 175. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

OK BT-175 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma form bt 175

How to fill out Oklahoma form BT 175:

01

Obtain the form: The Oklahoma form BT 175 can be obtained from the Oklahoma Tax Commission's website or by visiting their local office. It is also available in print at various tax preparation centers.

02

Provide personal information: Begin by filling out the personal information section of the form. This includes your name, address, Social Security number, and other relevant details.

03

Fill out the business information: If you are filing the form on behalf of a business, provide the necessary information such as the name, address, and employer identification number (EIN) of the company.

04

Report sales and use tax information: The BT 175 form is used for reporting sales and use tax. Provide the required information regarding sales made during the reporting period, including gross sales amounts and any exemptions.

05

Calculate tax owed: Use the instructions provided with the form to calculate the tax owed based on the sales made. Take into account any exemptions and credits that may apply.

06

Complete the payment information: If there is tax owed, provide the payment information such as your bank account details or credit card information. Alternatively, you can also choose to mail a check or money order with the form.

07

Review and submit: Carefully review all the information you have entered on the form to ensure accuracy. Once you are satisfied, sign and date the form. Submit the completed form and payment (if applicable) to the Oklahoma Tax Commission.

Who needs Oklahoma form BT 175:

01

Individuals conducting business in Oklahoma: Individuals who conduct business in Oklahoma and have made sales subject to sales and use tax during the reporting period will need to fill out the Oklahoma form BT 175.

02

Businesses operating in Oklahoma: Businesses operating in Oklahoma, including corporations, partnerships, and LLCs, are required to report their sales and use tax information using the form BT 175.

03

Out-of-state sellers: Out-of-state sellers who have sales tax nexus in Oklahoma, meaning they have a sufficient connection to the state that requires them to collect and remit sales tax, will also need to file the form BT 175.

Note: The exact requirements for filing the form may vary based on specific circumstances. It is recommended to consult the Oklahoma Tax Commission's guidelines or seek professional advice for accurate and up-to-date information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oklahoma form bt 175?

Oklahoma form BT 175 is a tax form used for reporting business and occupation taxes in the state of Oklahoma.

Who is required to file oklahoma form bt 175?

Businesses engaged in certain activities, such as manufacturing, mining, transportation, and telecommunications, are required to file Oklahoma form BT 175.

How to fill out oklahoma form bt 175?

To fill out Oklahoma form BT 175, you need to provide information about your business activities, gross receipts, and other relevant details. The form must be completed accurately and submitted with the required payment.

What is the purpose of oklahoma form bt 175?

The purpose of Oklahoma form BT 175 is to calculate and report business and occupation taxes due in the state of Oklahoma.

What information must be reported on oklahoma form bt 175?

On Oklahoma form BT 175, you need to report details such as the nature of your business activities, gross receipts, and any applicable deductions or exemptions.

When is the deadline to file oklahoma form bt 175 in 2023?

The deadline to file Oklahoma form BT should be updated with current year's information.

What is the penalty for the late filing of oklahoma form bt 175?

The specific penalty for the late filing of Oklahoma form BT 175 can vary depending on the circumstances. It is advisable to consult the Oklahoma Tax Commission or a tax professional for accurate and up-to-date penalty information.

How can I manage my oklahoma form bt 175 directly from Gmail?

oklahoma form bt 175 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send oklahoma form bt 175 to be eSigned by others?

Once your oklahoma form bt 175 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my oklahoma form bt 175 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your oklahoma form bt 175 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your oklahoma form bt 175 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.