Get the free 2001 Minesota Property Tax Refund Forms and Instructions. 2001 Minesota Property Tax...

Show details

2001 Minnesota Property Tax Refund Forms and Instructions Inside this booklet Form M1PR Minnesota property tax refund return Need help completing your return? We're ready to answer your questions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

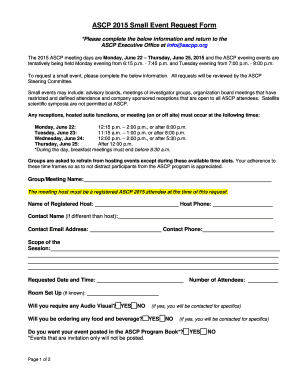

Edit your 2001 minesota property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2001 minesota property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2001 minesota property tax online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2001 minesota property tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out 2001 minesota property tax

How to fill out 2001 Minnesota property tax:

01

Gather all necessary documents such as property deed, mortgage information, and previous year's property tax statement.

02

Enter your property information accurately, including the address and legal description of the property.

03

Determine the property's value by consulting the county assessor's office or using online resources provided by the county.

04

Calculate the property tax amount based on the assessed value and applicable tax rates for the specific jurisdiction.

05

Fill out all required sections of the property tax form, including personal information, exemptions, and any additional information requested.

06

Double-check all information provided to ensure accuracy and completeness of the form.

07

Submit the filled-out property tax form and any required supporting documents to the appropriate county office or online portal.

08

Pay the property tax amount by the specified due date.

Who needs 2001 Minnesota property tax:

01

Property owners in the state of Minnesota are required to pay property taxes.

02

Individuals who own real estate, residential or commercial properties in Minnesota.

03

Anyone who leased or rented out properties in Minnesota during the 2001 tax year.

04

Entities that own properties in Minnesota, such as corporations, partnerships, or trusts.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is minesota property tax refund?

The Minnesota Property Tax Refund is a program that provides financial assistance to homeowners and renters who meet certain eligibility requirements.

Who is required to file minesota property tax refund?

Homeowners and renters who meet the income and residency requirements are required to file for the Minnesota Property Tax Refund.

How to fill out minesota property tax refund?

To fill out the Minnesota Property Tax Refund, you will need to complete the appropriate application form, provide the necessary documentation, and submit it to the Minnesota Department of Revenue.

What is the purpose of minesota property tax refund?

The purpose of the Minnesota Property Tax Refund is to provide financial assistance to eligible homeowners and renters to help offset their property tax burden.

What information must be reported on minesota property tax refund?

The information that must be reported on the Minnesota Property Tax Refund includes your income, property tax payment information, residency status, and other relevant details.

When is the deadline to file minesota property tax refund in 2023?

The deadline to file the Minnesota Property Tax Refund in 2023 is typically August 15th, but it is recommended to check with the Minnesota Department of Revenue for any changes or updates to the deadline.

What is the penalty for the late filing of minesota property tax refund?

The penalty for the late filing of the Minnesota Property Tax Refund may vary depending on the specific circumstances. It is advisable to refer to the guidelines provided by the Minnesota Department of Revenue for more information on late filing penalties.

How do I modify my 2001 minesota property tax in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your 2001 minesota property tax and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete 2001 minesota property tax online?

With pdfFiller, you may easily complete and sign 2001 minesota property tax online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete 2001 minesota property tax on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 2001 minesota property tax by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your 2001 minesota property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.