Get the free iowa special assessment credit form

Show details

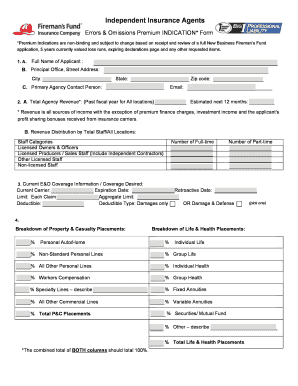

IOWA 2011 Iowa Special Assessment Credit This claim must be filed or mailed to your county treasurer by September 30, 2011. Iowa's treasurers' addresses can be found at the Iowa Treasurers Association

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your iowa special assessment credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iowa special assessment credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing iowa special assessment credit online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit iowa special assessment credit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out iowa special assessment credit

How to fill out Iowa special assessment credit:

01

Gather all necessary documents such as the Iowa special assessment credit form and any other relevant tax documents.

02

Provide your personal information such as name, address, and social security number on the form.

03

Determine if you meet the eligibility requirements for the credit, which include being an Iowa resident and meeting certain income limits.

04

Calculate the amount of the credit by following the instructions provided on the form.

05

Fill in the appropriate boxes or sections on the form with the required information, such as the amount of the credit you are claiming.

06

Double-check all the information you provided to ensure accuracy and completeness.

07

Sign and date the form.

08

Attach any necessary supporting documents, such as proof of payment for the special assessment.

09

File the completed form and supporting documents with the appropriate tax authority, such as the Iowa Department of Revenue.

10

Keep a copy of the completed form and supporting documents for your records.

Who needs Iowa special assessment credit:

01

Iowa residents who have paid special assessments on their property.

02

Individuals who meet the eligibility requirements for the credit, including income limits and residency.

03

Property owners who want to claim the Iowa special assessment credit on their state tax return.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is iowa special assessment credit?

The Iowa Special Assessment Credit is a tax credit available to eligible taxpayers who own or rent residential property in Iowa with a special assessment imposed by a city for public improvements, such as street paving or sewer projects. The credit helps offset the cost of these special assessments for qualifying individuals.

Who is required to file iowa special assessment credit?

Individuals who own or rent residential property in Iowa and have been assessed a special assessment by a city for public improvements may be eligible for the Iowa Special Assessment Credit. Eligibility and filing requirements are determined by the Iowa Department of Revenue.

How to fill out iowa special assessment credit?

To fill out the Iowa Special Assessment Credit, taxpayers need to complete the appropriate form provided by the Iowa Department of Revenue. The form typically requires the taxpayer to provide their personal information, details about the property subject to special assessment, and any supporting documents as requested. It is important to carefully review and follow the instructions provided with the form to ensure accurate and complete filing.

What is the purpose of iowa special assessment credit?

The purpose of the Iowa Special Assessment Credit is to provide financial relief to eligible taxpayers who have been assessed a special assessment by a city for public improvements. This credit helps mitigate the financial burden of these special assessments by reducing the overall tax liability for qualifying individuals.

What information must be reported on iowa special assessment credit?

The specific information required to be reported on the Iowa Special Assessment Credit form may vary depending on the individual's circumstances and the instructions provided by the Iowa Department of Revenue. Generally, taxpayers will need to provide their personal information, details about the special assessment, and any supporting documentation as required. It is important to carefully review the form instructions for the specific requirements.

When is the deadline to file iowa special assessment credit in 2023?

The deadline to file the Iowa Special Assessment Credit in 2023 is typically April 30th. However, it is advisable to check with the Iowa Department of Revenue or refer to the specific instructions provided with the tax form for the most accurate and up-to-date information on the deadline.

What is the penalty for the late filing of iowa special assessment credit?

The penalty for the late filing of the Iowa Special Assessment Credit may vary depending on the specific circumstances and regulations set by the Iowa Department of Revenue. It is advisable to refer to the department's instructions or consult with a tax professional for accurate and up-to-date information on penalties for late filing.

How do I edit iowa special assessment credit online?

The editing procedure is simple with pdfFiller. Open your iowa special assessment credit in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit iowa special assessment credit straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing iowa special assessment credit, you can start right away.

How do I fill out iowa special assessment credit on an Android device?

Use the pdfFiller mobile app and complete your iowa special assessment credit and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your iowa special assessment credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.