Get the free Small Business Administration Information Technology Strategic ... - sba

Show details

(OHIO) and IT leaders from program offices throughout SBA. .... ensuring evolving SBA program goals. .... contribution to execution of all 3 SBA Goals) ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your small business administration information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business administration information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business administration information online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit small business administration information. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out small business administration information

How to fill out small business administration information:

01

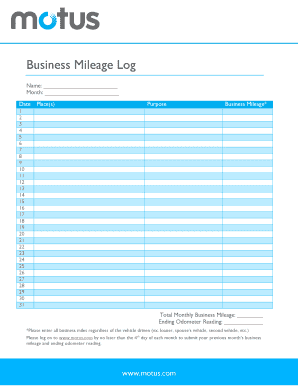

Gather all necessary documents, such as financial statements, tax records, and legal documents related to your business.

02

Visit the Small Business Administration (SBA) website and navigate to the appropriate section for filling out the required information.

03

Create an account on the SBA website if you don't have one already.

04

Provide the requested details about your business, including its name, address, contact information, and legal structure.

05

Fill out financial information, including revenue, expenses, and any outstanding debts.

06

Upload the required documents, ensuring they meet the specified file format and size requirements.

07

Review the information you have entered to ensure accuracy and completeness.

08

Submit the completed small business administration information form electronically.

09

Wait for confirmation that your submission has been received and processed.

Who needs small business administration information:

01

Entrepreneurs and small business owners who are seeking assistance and support from the Small Business Administration.

02

Individuals who are applying for loans, grants, or other financial programs offered by the SBA.

03

Businesses that are looking for guidance and resources on topics like business planning, marketing, and expanding their operations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

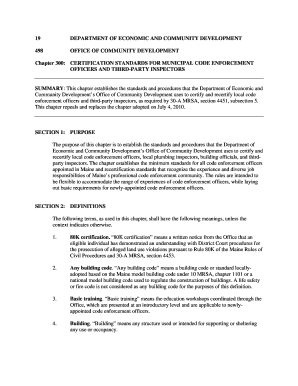

What is small business administration information?

Small Business Administration (SBA) information refers to the data and documentation required by the Small Business Administration to assess and support small business endeavors, such as loan applications, certifications, and federal contract eligibility.

Who is required to file small business administration information?

Small businesses seeking assistance or benefits from the Small Business Administration are typically required to file relevant information. This includes businesses applying for loans, certifications, or contracts that fall under SBA oversight.

How to fill out small business administration information?

To fill out Small Business Administration (SBA) information, you need to gather the necessary documentation based on the specific requirements. This may include financial statements, tax returns, business plans, certifications, and other relevant information. The exact process and forms will depend on the particular SBA program or application you are pursuing.

What is the purpose of small business administration information?

The purpose of small business administration information is to evaluate and support small business initiatives. It helps the Small Business Administration assess the eligibility, credibility, and financial stability of small businesses applying for assistance, loans, certifications, or federal contracts.

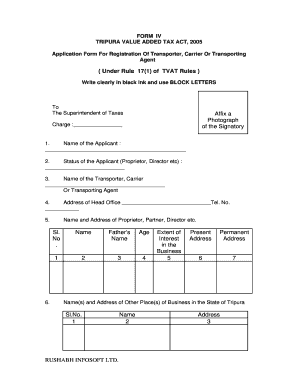

What information must be reported on small business administration information?

The specific information required on small business administration forms varies depending on the type of application or program. Generally, it includes details on the business structure, ownership, financials, tax returns, assets, liabilities, business plans, certifications, and other relevant information as specified by the particular SBA program.

When is the deadline to file small business administration information in 2023?

The deadline to file small business administration information in 2023 will depend on the specific program or application you are dealing with. It is advisable to refer to the guidelines and instructions provided by the Small Business Administration or the relevant SBA program for accurate and up-to-date deadlines.

What is the penalty for the late filing of small business administration information?

The penalties for late filing of small business administration information vary depending on the specific program or requirement. The Small Business Administration may impose fines, restrict eligibility for certain benefits, or delay processing of applications for those who fail to meet deadlines. It is recommended to consult the guidelines and regulations pertaining to the particular SBA program to understand the penalties associated with late filing.

How do I execute small business administration information online?

pdfFiller makes it easy to finish and sign small business administration information online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my small business administration information in Gmail?

Create your eSignature using pdfFiller and then eSign your small business administration information immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit small business administration information on an Android device?

You can make any changes to PDF files, such as small business administration information, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your small business administration information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.