Get the free Parent Expense and Income Worksheet 2010-11 - The University of ... - utoledo

Show details

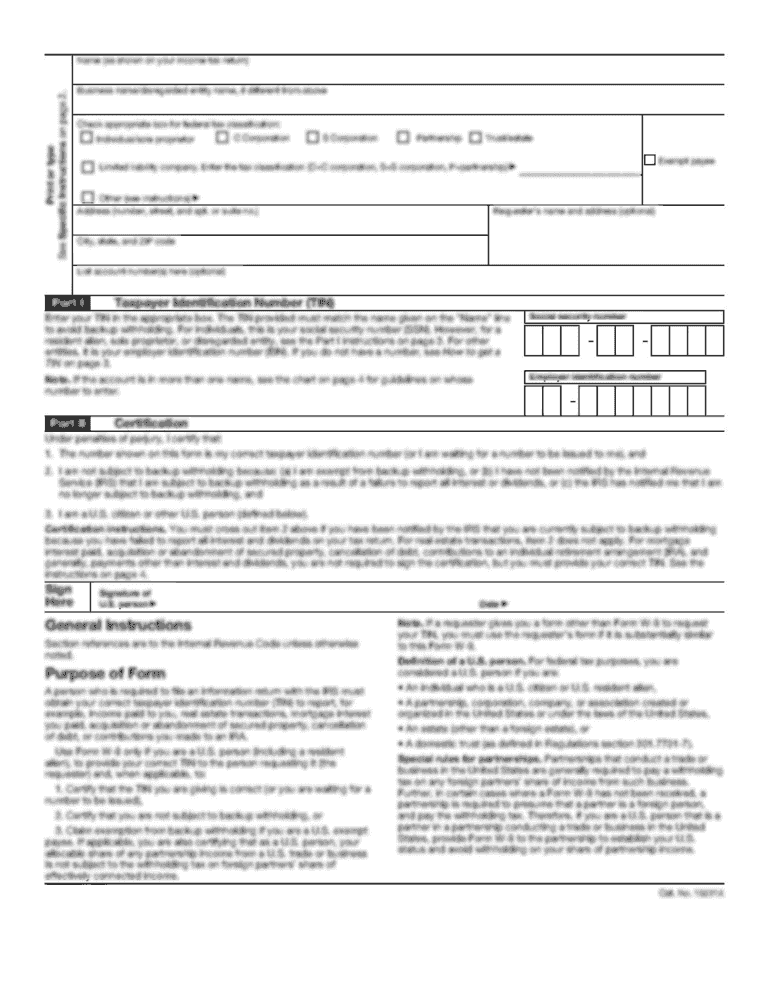

Student Rocket Number Student Last Name () Preferred Phone Number Student First Name The income reported on your 2010-2011 Free Application for Federal Student Aid (FAFSA) does not appear sufficient

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your parent expense and income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your parent expense and income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit parent expense and income online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit parent expense and income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out parent expense and income

How to fill out parent expense and income?

01

Gather all relevant financial documents, such as bank statements, paycheck stubs, and receipts for expenses related to the child.

02

Calculate the total income earned by both parents, including wages, bonuses, and any other sources of income.

03

Deduct any pre-tax deductions, such as health insurance or retirement contributions, from the total income to obtain the adjusted gross income.

04

Determine the child-related expenses incurred by both parents, including costs for education, healthcare, childcare, and extracurricular activities.

05

Allocate the expenses between the parents based on their income percentage. For example, if one parent earns 60% of the total income, they would be responsible for 60% of the child-related expenses.

06

Fill out the appropriate sections of the parent expense and income form, providing accurate information about each parent's income, expenses, and the allocation of these expenses.

07

Double-check all the figures and ensure that the form is completed correctly, as any mistakes or inaccuracies can impact the calculation of child support or other financial obligations.

Who needs parent expense and income?

01

Divorced or separated couples with dependent children may need to fill out the parent expense and income form.

02

Unmarried parents who are sharing custody or have a formal custody agreement may also be required to provide this information.

03

The form is typically used to calculate child support payments or determine the financial responsibilities of each parent towards the child's upbringing.

04

It helps ensure that the financial burden is shared fairly between both parents, taking into account their respective incomes and the costs associated with raising the child.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is parent expense and income?

Parent expense and income refers to the financial information and expenses incurred by a parent or guardian. It includes details of their income, expenses, and any deductions related to supporting their children.

Who is required to file parent expense and income?

Parents or guardians who are financially responsible for their children and meet certain income thresholds are required to file parent expense and income. The specific requirements may vary depending on the jurisdiction.

How to fill out parent expense and income?

To fill out parent expense and income, you need to gather all relevant financial documents such as income statements, expense receipts, and proof of child support payments. Then, you can use the provided forms or online platforms to report your income, expenses, and deductions accurately.

What is the purpose of parent expense and income?

The purpose of parent expense and income is to ensure that parents or guardians accurately report their financial information related to supporting their children. It helps authorities determine child support obligations, tax deductions, and financial responsibilities.

What information must be reported on parent expense and income?

The specific information that must be reported on parent expense and income includes details of the parent's income, expenses related to supporting the children, and any relevant deductions such as child care expenses or medical costs.

When is the deadline to file parent expense and income in 2023?

The deadline to file parent expense and income in 2023 may vary depending on the jurisdiction. It is advisable to check the specific deadlines set by the relevant authorities or consult with a tax professional for accurate information.

What is the penalty for the late filing of parent expense and income?

The penalty for the late filing of parent expense and income varies depending on the jurisdiction and the specific circumstances. It may include financial penalties, interest charges, or other consequences imposed by the authorities. It is important to file the required documents on time to avoid any penalties.

How can I send parent expense and income for eSignature?

When your parent expense and income is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in parent expense and income without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your parent expense and income, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out parent expense and income on an Android device?

On an Android device, use the pdfFiller mobile app to finish your parent expense and income. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your parent expense and income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.