Get the free Loans for Disadvantaged Students (LDS) - utmb

Show details

Loans for Disadvantaged Students(LDS)

Repayment Provisions Is there any penalty for prepaying or paying my loan off early? How long is the initial grace period? Does interest accrue during my grace

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loans for disadvantaged students form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loans for disadvantaged students form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loans for disadvantaged students online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loans for disadvantaged students. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

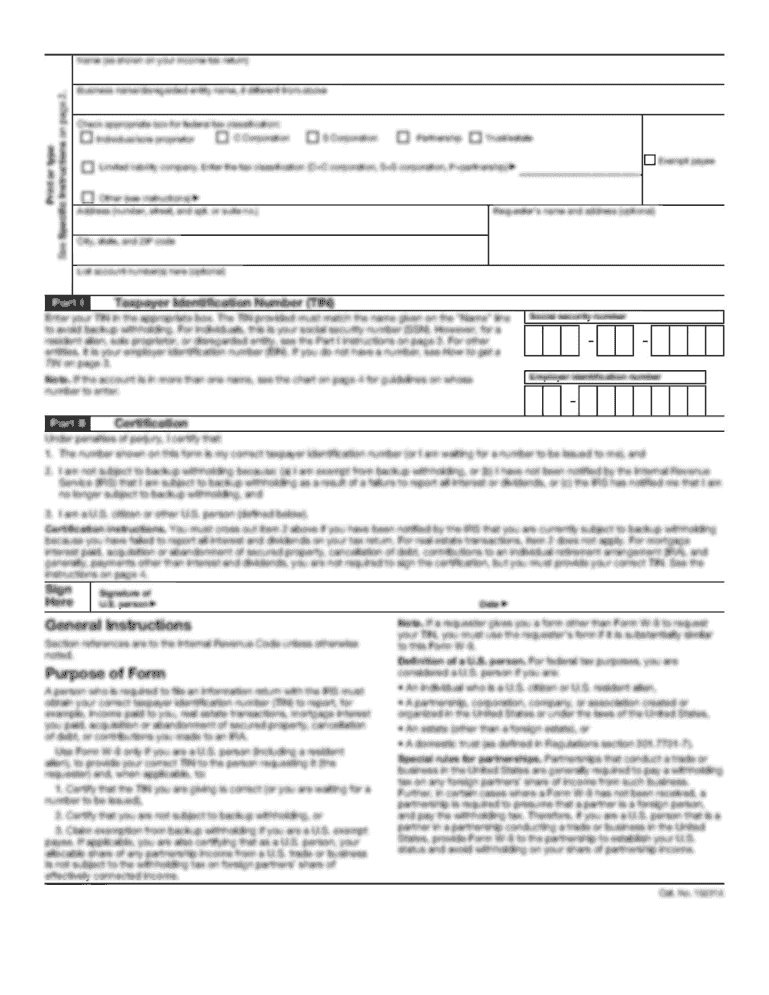

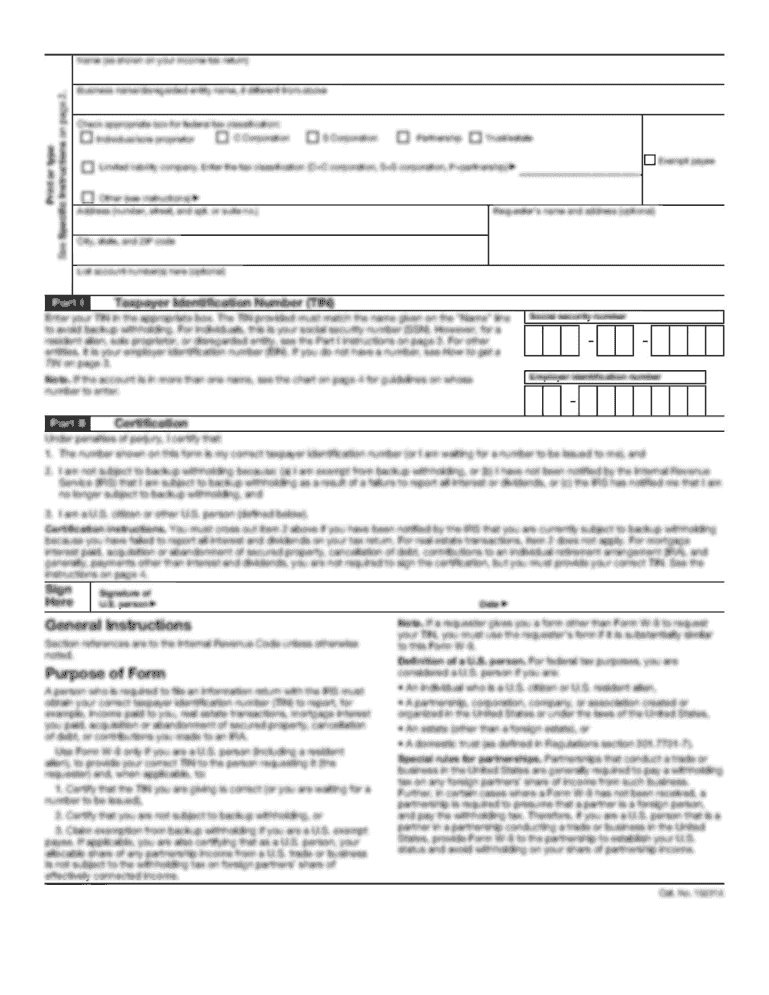

How to fill out loans for disadvantaged students

01

To fill out loans for disadvantaged students, start by researching the available loan options specifically designed for disadvantaged students. There are various federal and state programs that provide financial assistance to students from low-income backgrounds.

02

Once you have identified the appropriate loan program, gather the necessary documents and information required to apply for the loan. This may include your personal identification, financial documents, proof of income, and academic records.

03

Carefully review the eligibility criteria and ensure that you meet all the requirements before proceeding with the application. Some loan programs may have specific criteria regarding income levels, academic performance, or other factors.

04

Complete the loan application form accurately and honestly. Ensure that you provide all the requested information and double-check for any errors or missing details. It may be helpful to seek assistance from a financial aid counselor or advisor if you have any doubts or questions.

05

Submit the completed loan application along with all the required supporting documents. Follow the application instructions provided by the loan program and ensure that you meet any specified deadlines.

06

After submitting the application, wait for a response from the loan program. This may take some time, so be patient. In the meantime, you can continue exploring other financial aid options such as scholarships, grants, or work-study programs.

07

If your loan application is approved, carefully review the terms and conditions of the loan agreement. Understand the repayment terms, interest rates, and any other obligations you will have as a borrower. If you have any concerns or questions, seek clarification from the loan program or a financial aid counselor.

Who needs loans for disadvantaged students?

01

Students from low-income backgrounds who are unable to fully cover their educational expenses through personal savings or other means may need loans for disadvantaged students.

02

Disadvantaged students who come from families with limited financial resources and face significant barriers, such as being the first in their family to attend college, may require loans to bridge the financial gap and pursue their education.

03

These loans are designed to provide financial assistance to individuals who otherwise may not have access to higher education due to financial constraints. They aim to promote equity and equal opportunities for students from disadvantaged backgrounds.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loans for disadvantaged students?

Loans for disadvantaged students are financial aid programs designed to provide educational loans to students from economically disadvantaged backgrounds who may face difficulties in affording higher education expenses.

Who is required to file loans for disadvantaged students?

Students from economically disadvantaged backgrounds who wish to avail educational loans are required to file loans for disadvantaged students.

How to fill out loans for disadvantaged students?

To fill out loans for disadvantaged students, students need to complete the application form provided by the financial aid office or online portal. The form typically requires personal information, financial details, academic records, and any supporting documents as required.

What is the purpose of loans for disadvantaged students?

The purpose of loans for disadvantaged students is to help students who may not have sufficient financial resources to afford higher education expenses. It aims to provide them with the necessary funds to pursue their academic goals.

What information must be reported on loans for disadvantaged students?

On loans for disadvantaged students, students are typically required to report personal information such as name, address, contact details, social security number, as well as financial information including income, assets, and expenses. Academic records and supporting documents may also be required.

When is the deadline to file loans for disadvantaged students in 2023?

The deadline to file loans for disadvantaged students in 2023 may vary depending on the institution or program. It is recommended to check with the financial aid office or the specific loan program for the exact deadline.

What is the penalty for the late filing of loans for disadvantaged students?

The penalty for the late filing of loans for disadvantaged students may vary depending on the institution or program. It can result in a loss of eligibility or a delay in receiving the loan funds. It is important to adhere to the specified deadlines to avoid any penalties.

How can I send loans for disadvantaged students for eSignature?

loans for disadvantaged students is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in loans for disadvantaged students?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your loans for disadvantaged students to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit loans for disadvantaged students in Chrome?

Install the pdfFiller Google Chrome Extension to edit loans for disadvantaged students and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your loans for disadvantaged students online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.