Get the free irsw8eci form

Show details

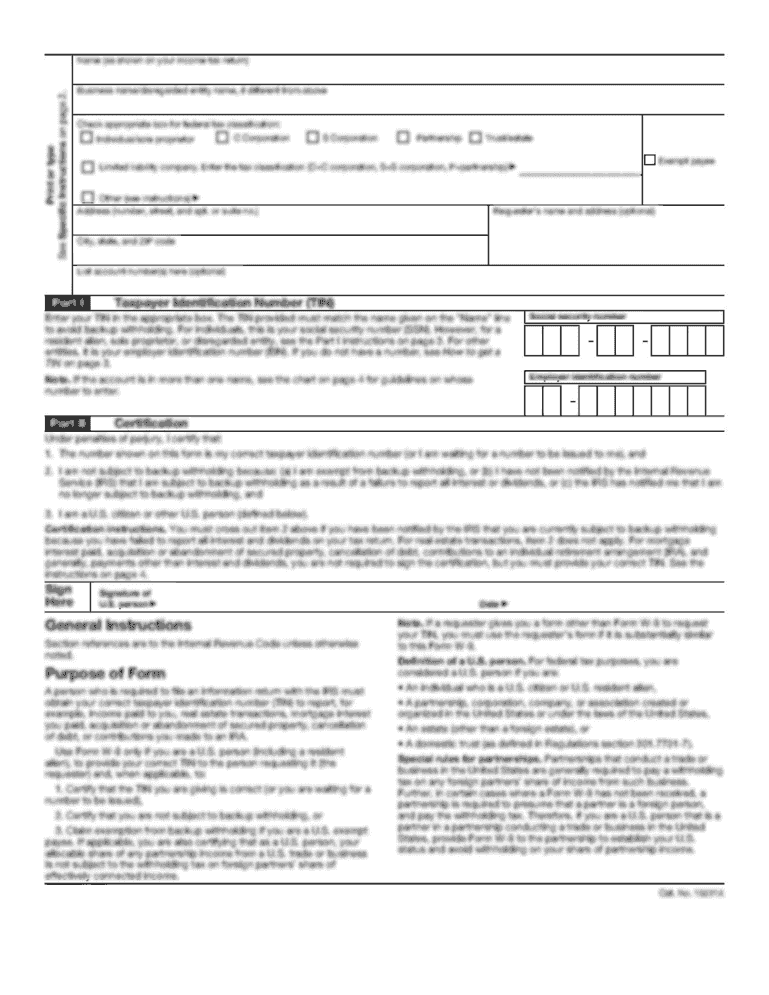

U.S. TREAS Form treas-irs-w-8eci-2000 Form W-8ECI (Rev. December 2000) Department of the Treasury Internal Revenue Service Certificate of Foreign Person's Claim for Exemption From Withholding on Income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irsw8eci form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irsw8eci form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irsw8eci form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irsw8eci form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out irsw8eci form

How to fill out irsw8eci form?

01

Start by downloading the irsw8eci form from the official website of the Internal Revenue Service (IRS).

02

Carefully read the instructions provided with the form to understand the requirements and guidelines for filling it out.

03

Begin by providing your personal information, including your name, address, and social security number.

04

Indicate your tax status and include any supporting documents if necessary.

05

Report your earnings and specify the type of income you are receiving from the U.S. sources.

06

Fill out the treaty information section if you are claiming tax benefits under a specific tax treaty.

07

Complete the certification and signature section, confirming that the information provided is accurate and true.

08

Review the completed form for any errors or omissions before submitting it to the appropriate authority.

Who needs irsw8eci form?

01

Individuals who are non-U.S. residents but receive income from U.S. sources are typically required to fill out irsw8eci form.

02

This form is specifically designed for individuals who claim tax treaty benefits to reduce or eliminate their tax liability on income earned in the United States.

03

It is necessary for individuals to accurately complete and submit irsw8eci form in order to comply with U.S. tax regulations and avoid any potential penalties or legal consequences.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irsw8eci form?

The irsw8eci form is a form used by taxpayers who are not U.S. citizens or residents to report their income that is effectively connected with a trade or business in the United States.

Who is required to file irsw8eci form?

Non-U.S. citizens or residents who have income that is effectively connected with a trade or business in the United States are required to file the irsw8eci form.

How to fill out irsw8eci form?

To fill out the irsw8eci form, you will need to provide your personal information, details about your income, and any applicable tax treaty information. It is recommended to consult with a tax professional or refer to the IRS instructions for specific guidance on filling out the form.

What is the purpose of irsw8eci form?

The purpose of the irsw8eci form is to report income that is effectively connected with a trade or business in the United States by non-U.S. citizens or residents. This form helps the IRS track and tax income generated within the United States by foreign taxpayers.

What information must be reported on irsw8eci form?

The irsw8eci form requires taxpayers to report their personal information, details about their income that is effectively connected with a trade or business in the United States, and any applicable tax treaty information.

When is the deadline to file irsw8eci form in 2023?

The deadline to file the irsw8eci form in 2023 may vary depending on individual circumstances and extensions. It is recommended to consult the IRS or a tax professional for specific information regarding the filing deadline.

What is the penalty for the late filing of irsw8eci form?

The penalty for the late filing of the irsw8eci form may vary depending on individual circumstances and the amount of tax owed. It is recommended to consult the IRS or a tax professional for specific information regarding penalties and consequences of late filing.

How can I edit irsw8eci form from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including irsw8eci form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get irsw8eci form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific irsw8eci form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete irsw8eci form on an Android device?

Complete irsw8eci form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your irsw8eci form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.