PA HS 1780 2002 free printable template

Show details

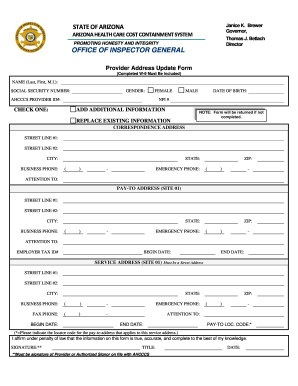

STATEMENT OF CLAIM REQUEST FORM DECEDENT'S NAME: DECEDENT'S LAST KNOWN ADDRESS: (Prior to entering nursing home) (CITY, STATE, ZIP CODE) DECEDENT'S SOCIAL SECURITY NUMBER: / / DECEDENT'S DATE OF BIRTH:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your pa estate recovery statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa estate recovery statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pa estate recovery statement of claim request form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pa statement of claim request form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

PA HS 1780 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pa estate recovery statement

How to fill out a PA estate recovery statement:

01

Gather all necessary information: Before starting to fill out the PA estate recovery statement, gather all the required information such as the deceased person's personal details, including their name, date of birth, and social security number. Also, collect any relevant financial information, including details about their assets and debts.

02

Obtain a copy of the estate recovery statement form: You can obtain the PA estate recovery statement form from the Pennsylvania Department of Human Services website or by contacting the appropriate department.

03

Fill out the personal information section: Start by providing the deceased person's personal information in the designated section of the form. This includes their full name, date of birth, and social security number.

04

Provide details about the deceased person's assets and debts: In the next section, itemize and disclose all the assets and debts of the deceased person. List any real estate properties, bank accounts, investments, vehicles, or any other valuable assets they owned. Additionally, detail any outstanding debts or liabilities they may have had.

05

Include information about estate administration: If someone is currently handling the estate administration process, provide their contact information and any relevant details about their role.

06

Attach supporting documentation: To support the information provided in the estate recovery statement, include relevant documents such as bank statements, property deeds, or any other proof of assets and debts.

07

Review and sign the form: Ensure that all the information provided is accurate and complete. Carefully review the estate recovery statement before signing and dating it.

Who needs a PA estate recovery statement?

01

Executors or administrators of a decedent's estate: If you are responsible for managing the estate of a deceased person in Pennsylvania, you may need to fill out a PA estate recovery statement. This form is typically required as part of the estate administration process.

02

Individuals designated to handle estate recovery matters: In some situations, individuals may be appointed specifically to handle estate recovery matters by the Pennsylvania Department of Human Services. These individuals would likely need to complete the PA estate recovery statement.

03

Individuals with legal authority over the deceased person's estate: Anyone with legal authority over the deceased person's estate, such as beneficiaries or trustees, may also be required to fill out a PA estate recovery statement when necessary.

Please note that it is always advisable to consult with an attorney or legal professional specializing in estate planning and administration to ensure compliance with all relevant laws and regulations.

Fill pa dpw statement of claim request form : Try Risk Free

People Also Ask about pa estate recovery statement of claim request form

What is the Pennsylvania estate recovery Statute?

How do I make a claim against an estate in Pennsylvania?

What is PA estate recovery statute?

How do I avoid Medicaid Estate Recovery in PA?

What assets are subject to estate recovery in Pennsylvania?

What is a notice of claim against estate in Pennsylvania?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pa estate recovery statement?

A PA (Pennsylvania) estate recovery statement refers to a document that outlines the state's right to recover funds for Medicaid benefits paid on behalf of a deceased individual from their estate. When someone receives Medicaid benefits, the state may seek repayment of these benefits from their estate after their death. This statement provides details of the amounts owed by the estate to Medicaid for the benefits received.

Who is required to file pa estate recovery statement?

In Pennsylvania, the estate recovery statement is required to be filed by the executor or administrator of a deceased person's estate.

How to fill out pa estate recovery statement?

To properly fill out the Pennsylvania estate recovery statement, follow these steps:

1. Obtain a copy of the estate recovery statement form. You can request the form from the Pennsylvania Department of Human Services or download it from their website.

2. Gather the necessary information. You will need to provide details about the deceased individual, their assets, and their estate. Collect documents such as bank statements, real estate deeds, and insurance policies.

3. Begin filling out the form. Start by entering the decedent's name, date of birth, Social Security number, and date of death. Fill in the applicable sections regarding the decedent's assets, income, and financial resources. Include specific information about any property, bank accounts, vehicles, or other assets they owned.

4. Provide details about any debts or liabilities. Include information about any outstanding mortgages, loans, or other debts that the decedent had at the time of their death.

5. Indicate if the decedent received any medical assistance benefits during their lifetime. Specify the dates of eligibility and the type of benefits received.

6. If the decedent had a surviving spouse, provide their information and specify if any assets were jointly owned between the decedent and their spouse.

7. Sign and date the form. If you are the personal representative or executor of the estate, you will need to sign the form. If you are not, ensure that the person authorized to sign on behalf of the estate fills in their information.

8. Attach any necessary documentation. Include copies of any supporting documents that verify the information provided on the form, such as death certificates, asset valuations, and property titles.

9. Submit the completed form and attachments. Mail the estate recovery statement to the address specified on the form or as directed by the Pennsylvania Department of Human Services. Keep a copy for your records.

10. Wait for a response. The Pennsylvania Department of Human Services will review the form and documentation and determine if the estate is subject to recovery or if further information is needed. They will communicate their decision to you in writing.

It is advisable to seek legal or financial advice if you are unsure about how to accurately complete the estate recovery statement or if you have complex estate matters to address.

What is the purpose of pa estate recovery statement?

The purpose of a PA estate recovery statement is to determine if the Pennsylvania Department of Human Services (DHS) has the right to seek reimbursement from a deceased individual's estate for certain medical assistance benefits received during their lifetime.

The estate recovery program allows the state to recover funds paid out for medical assistance services such as nursing home care, home and community-based services, and prescription drugs. The statement helps identify any assets or resources in the deceased individual's estate that may be subject to recovery by the state.

This process helps ensure that individuals who received medical assistance benefits from the state repay them if they have the means to do so. It allows the state to recoup some of the costs associated with providing these services and helps sustain the program in the long run.

What information must be reported on pa estate recovery statement?

In Pennsylvania, the following information must be reported on an Estate Recovery Statement:

1. Identification of the decedent: The statement must include the full name, date of birth, and date of death of the deceased individual.

2. Estate Information: The statement should provide a detailed inventory of the assets and liabilities of the estate. This may include real estate, bank accounts, investments, personal property, and any other valuable assets.

3. Probate Information: The statement should list the probate case number, the name of the probate court, and the name of the personal representative or executor administering the estate.

4. Medical Assistance Benefits Received: The statement must include the total amount of Medical Assistance benefits received by the decedent during their lifetime. This may include long-term care expenses, nursing home costs, hospital bills, and any other medical expenses covered by the Medical Assistance program.

5. Recoverable Medical Assistance Costs: The statement should calculate and specify the total amount of recoverable Medical Assistance costs, which is the amount the state is entitled to collect from the estate. This may include both the original amount of benefits paid and any interest or administrative costs incurred.

6. Payment Demand: The statement should indicate the specific amount demanded by the Pennsylvania Department of Human Services as the repayment for the Medical Assistance benefits provided.

It is important to note that these requirements may vary, and it is advisable to consult with an attorney or estate professional familiar with Pennsylvania laws and regulations for a more accurate and comprehensive understanding of the reporting requirements.

What is the penalty for the late filing of pa estate recovery statement?

The penalty for the late filing of a PA Estate Recovery Statement may vary depending on the specific circumstances and the policies of the Pennsylvania Department of Human Services (DHS). However, generally, late filers may be subject to interest charges, fines, or other penalties determined by the DHS. It is recommended to consult with the DHS or a legal professional to get accurate and up-to-date information regarding the penalties for late filing.

How can I get pa estate recovery statement of claim request form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific pa statement of claim request form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in pa estate recovery statement of claim request without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing pa department of public welfare statement of claim request form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit statement of claim request form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share pa estate statement of claim request form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your pa estate recovery statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Estate Recovery Statement Of Claim Request is not the form you're looking for?Search for another form here.

Keywords relevant to pa estate recovery statement of claim request fillable form

Related to statement of claim request form pa

If you believe that this page should be taken down, please follow our DMCA take down process

here

.