Get the free Your contribution is tax-deductible FOR MORE ... - Palmetto Health - palmettohealth

Show details

Yes, I/we want to make Palmetto Health Children's Hospital the best Place to Care for and treat Children In a famIlY-Centered, state-of-tHe-art Healthcare facility. Enclosed is my/our contribution

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your your contribution is tax-deductible form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your contribution is tax-deductible form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your contribution is tax-deductible online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit your contribution is tax-deductible. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

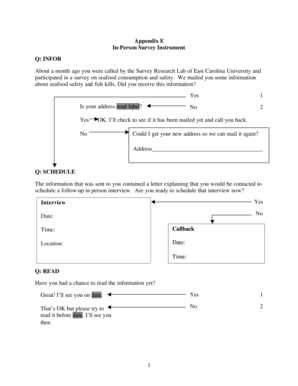

How to fill out your contribution is tax-deductible

Point by point guide on how to fill out your contribution is tax-deductible:

01

Ensure the organization is eligible: Confirm that the organization you are contributing to is recognized as a tax-exempt charitable organization by the IRS.

02

Keep records of your donation: Maintain proper documentation for your contribution, including receipts, invoices, and any written acknowledgments received from the charitable organization.

03

Understand the tax rules: Familiarize yourself with the tax laws and regulations related to charitable contributions, which may vary depending on your country or jurisdiction.

04

Determine the deductibility limits: Check the maximum amount you can deduct for your charitable contributions based on your income level and the type of contribution made.

05

Itemize deductions on your tax return: If you want to claim a tax deduction for your charitable contribution, you usually need to itemize your deductions instead of taking the standard deduction on your tax return.

06

Complete the appropriate tax forms: Use the relevant tax forms, such as Form 1040 or Schedule A, to report your charitable contributions accurately and claim the tax deduction.

Who needs your contribution to be tax-deductible?

01

Individuals: If you are an individual taxpayer looking to reduce your taxable income, you can benefit from making tax-deductible contributions to eligible charitable organizations.

02

Businesses: Businesses can also make tax-deductible contributions to qualified charitable organizations, which can help lower their taxable income and demonstrate corporate social responsibility.

03

Non-profit organizations: Non-profit organizations or charities rely on tax-deductible contributions to fund their operations and fulfill their mission. These organizations must meet specific criteria to be eligible for tax-deductible donations.

It is important to consult with a tax professional or refer to the official tax guidelines in your country or jurisdiction for accurate and up-to-date information regarding the deductibility of your contributions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is your contribution is tax-deductible?

Tax-deductible contributions are usually made to qualified charitable organizations and certain other eligible entities. These contributions can reduce your taxable income and potentially lower your tax liability.

Who is required to file your contribution is tax-deductible?

Individual taxpayers who make tax-deductible contributions and wish to claim a deduction on their tax return are required to file the necessary documentation.

How to fill out your contribution is tax-deductible?

To fill out your contribution as tax-deductible, you will need to gather the necessary documentation such as donation receipts or acknowledgment letters from the receiving organizations. You can then report the appropriate contribution amounts on your tax return using the relevant forms or worksheets provided by the tax authorities.

What is the purpose of your contribution is tax-deductible?

The purpose of tax-deductible contributions is to incentivize individuals and businesses to support charitable causes and qualified organizations by providing them with a tax benefit. By allowing deductions for these contributions, the government aims to promote philanthropy and support societal needs.

What information must be reported on your contribution is tax-deductible?

When reporting your tax-deductible contributions, you typically need to include information such as the name and address of the organization receiving the contribution, the contribution amount, and any supporting documentation. The specific requirements may vary depending on your jurisdiction's tax laws.

When is the deadline to file your contribution is tax-deductible in 2023?

The deadline to file your tax-deductible contributions for the year 2023 may depend on your jurisdiction. It is recommended to consult with your local tax authority or a tax professional to determine the specific filing deadlines.

What is the penalty for the late filing of your contribution is tax-deductible?

The penalties for late filing of tax-deductible contributions vary depending on the tax regulations of your jurisdiction. In some cases, you may incur late filing fees or penalties that can result in an increased tax liability. It is advisable to review the specific penalty provisions outlined by your local tax authority to understand the consequences of late filing.

How can I get your contribution is tax-deductible?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific your contribution is tax-deductible and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in your contribution is tax-deductible?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your your contribution is tax-deductible to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit your contribution is tax-deductible on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign your contribution is tax-deductible on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your your contribution is tax-deductible online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.