Get the free Charitable Gifts from IRAs and Other Pension Plan Assets - amherst

Show details

This document explains how individuals can make charitable gifts using assets from IRAs and other pension plans, detailing tax implications and strategies for charitable giving.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable gifts from iras

Edit your charitable gifts from iras form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable gifts from iras form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable gifts from iras online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit charitable gifts from iras. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable gifts from iras

How to fill out Charitable Gifts from IRAs and Other Pension Plan Assets

01

Confirm your eligibility to make a charitable gift from your IRA or pension plan.

02

Choose a qualified charity that meets IRS guidelines.

03

Determine the amount you wish to donate, keeping in mind any annual limits.

04

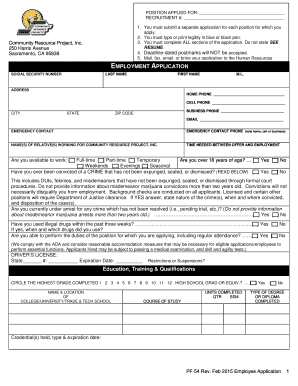

Obtain the necessary forms from your IRA or pension plan administrator.

05

Complete the forms with the charity's information and your personal details.

06

Specify that the donation is to be made directly to the charity.

07

Submit the completed forms to your administrator for processing.

08

Keep a copy of the donation form and any correspondence for your records.

09

Ensure the charity provides you with a written acknowledgment of your gift for tax purposes.

Who needs Charitable Gifts from IRAs and Other Pension Plan Assets?

01

Individuals over the age of 70½ who have IRAs or pension plan assets.

02

Those looking for tax-efficient ways to support charitable organizations.

03

People who wish to reduce their taxable income while benefiting a charity.

04

Individuals wanting to make a significant charitable contribution without impacting their cash flow.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for QCD from IRA?

An individual donor can contribute up to $108,000 per year in QCDs, as long as that individual is 70½ years old or older. For married couples, each spouse can make QCDs up to the $108,000 limit for a potential total of $216,000. The $108,000 per person limit applies to the sum of all QCDs taken from all IRAs in a year.

What are the new rules for QCD?

What are the QCD limits? For tax year 2024, you can donate up to $105,000 ($108,000 for 2025), and you can also use up to $53,000 ($54,000 in 2025) of a QCD to make a one-time donation to a charitable remainder trust (CRT) or charitable gift annuity (CGA).

Why is a QCD better than a charitable deduction?

What are the QCD limits? For tax year 2024, you can donate up to $105,000 ($108,000 for 2025), and you can also use up to $53,000 ($54,000 in 2025) of a QCD to make a one-time donation to a charitable remainder trust (CRT) or charitable gift annuity (CGA).

Is it better to take QCD or charitable deduction?

A QCD would probably be more beneficial because it reduces AGI as well as taxable income. Itemizing reduces taxable income but not AGI. Higher AGI can in many cases expose more SS income to taxation, reduce any itemized medical deduction, and increase NIIT.

What are the rules for QCD from IRAs?

An individual donor can contribute up to $108,000 per year in QCDs, as long as that individual is 70½ years old or older. For married couples, each spouse can make QCDs up to the $108,000 limit for a potential total of $216,000. The $108,000 per person limit applies to the sum of all QCDs taken from all IRAs in a year.

How does the IRS know you made a QCD?

What tax reporting does Fidelity provide for a QCD? A QCD is reported as a normal distribution on IRS Form 1099-R for any non-inherited IRAs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Charitable Gifts from IRAs and Other Pension Plan Assets?

Charitable Gifts from IRAs and Other Pension Plan Assets refers to the act of donating funds directly from an Individual Retirement Account (IRA) or other pension plan to a qualified charitable organization, often allowing for tax benefits and helping individuals satisfy required minimum distributions (RMDs).

Who is required to file Charitable Gifts from IRAs and Other Pension Plan Assets?

Individuals who make charitable contributions from their IRAs or pension plans may be required to file relevant tax documents to report these transactions, particularly if they are looking to claim the contributions as a deduction or to satisfy RMD requirements.

How to fill out Charitable Gifts from IRAs and Other Pension Plan Assets?

To fill out Charitable Gifts from IRAs and Other Pension Plan Assets, individuals need to complete the appropriate tax forms (such as Form 1099-R for distributions) detailing the amount donated and ensure that the charity is eligible. It’s advisable to consult a tax professional for guidance.

What is the purpose of Charitable Gifts from IRAs and Other Pension Plan Assets?

The purpose of Charitable Gifts from IRAs and Other Pension Plan Assets is to allow individuals to make tax-efficient contributions to charity, support nonprofit organizations, and fulfill required withdrawals from retirement accounts without incurring additional tax liabilities.

What information must be reported on Charitable Gifts from IRAs and Other Pension Plan Assets?

Information that must be reported includes the total amount donated, the name and tax identification number of the charitable organization, and any relevant transaction details to ensure compliance with IRS regulations regarding the donation.

Fill out your charitable gifts from iras online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Gifts From Iras is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.