Get the free Alaska 2012 Payment Information - Park National Bank

Show details

June 17 29, 2012 Alaska 2012 Payment Information Passenger Name (1): Passenger Name (2): Address: City: Zip: Phone: Stateroom Selection (All Pricing is Per Person) Category 9 (Inside Stateroom-170

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your alaska 2012 payment information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alaska 2012 payment information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alaska 2012 payment information online

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit alaska 2012 payment information. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out alaska 2012 payment information

How to fill out alaska 2012 payment information?

01

Gather all necessary documents, such as pay stubs, tax forms, and bank statements.

02

Access the Alaska 2012 payment information form online or obtain a physical copy.

03

Fill in personal information, including your name, address, and social security number.

04

Provide employment details, including your employer's name and contact information.

05

Enter your income information accurately, including wages, tips, and any other sources of income.

06

Specify any deductions or credits that apply to your situation, such as dependents or tax credits.

07

Double-check all entries for accuracy and completeness before submitting the form.

Who needs Alaska 2012 payment information?

01

Individuals who earned income in Alaska during the year 2012.

02

Individuals who are required to file taxes in the state of Alaska for the year 2012.

03

Individuals who need to report their income and relevant deductions/credits accurately to the Alaska tax authorities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is alaska payment information?

Alaska payment information refers to the financial details that need to be reported to the state of Alaska regarding payments made by businesses or individuals.

Who is required to file alaska payment information?

Any business or individual who makes payments to vendors or contractors exceeding a certain threshold in Alaska is required to file Alaska payment information.

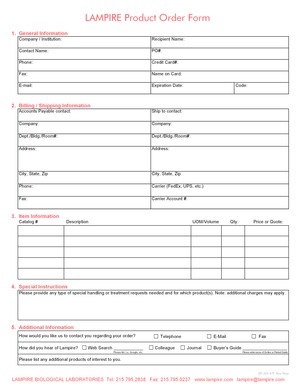

How to fill out alaska payment information?

Alaska payment information can be filled out using the official forms provided by the Alaska Department of Revenue. The forms require the payer to provide details of the payments made, including the recipient's information and payment amounts.

What is the purpose of alaska payment information?

The purpose of Alaska payment information is to track payments made within the state for tax and reporting purposes. It helps the state monitor financial transactions and ensure compliance with tax regulations.

What information must be reported on alaska payment information?

Alaska payment information typically requires reporting of the recipient's name, address, taxpayer identification number, payment amount, and the nature of the payment.

When is the deadline to file alaska payment information in 2023?

The deadline to file Alaska payment information in 2023 is usually determined by the Alaska Department of Revenue. It is recommended to refer to their official guidelines or website for specific deadline information.

What is the penalty for the late filing of alaska payment information?

The penalty for the late filing of Alaska payment information can vary depending on the specific circumstances. It is advisable to consult the Alaska Department of Revenue or a tax professional for accurate penalty information.

How do I modify my alaska 2012 payment information in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your alaska 2012 payment information and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send alaska 2012 payment information for eSignature?

When you're ready to share your alaska 2012 payment information, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the alaska 2012 payment information in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your alaska 2012 payment information and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your alaska 2012 payment information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.