Get the free Frostburg State University Payroll & Employee Services Graduate ... - frostburg

Show details

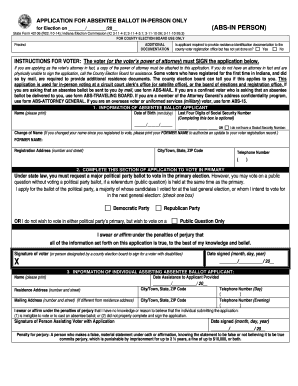

Frost burg State University Payroll & Employee Services Graduate Assistant Time Report PAY PERIOD NAME: DEPARTMENT: BEGIN: EMIL ID: END: 1. Complete this bi-weekly positive time report accounting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your frostburg state university payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your frostburg state university payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing frostburg state university payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit frostburg state university payroll. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out frostburg state university payroll

How to fill out the Frostburg State University payroll:

01

Gather all necessary information such as employee names, job titles, and pay rates.

02

Access the Frostburg State University payroll system using the provided login credentials.

03

Navigate to the payroll section and select "Create New Payroll."

04

Enter the relevant employee information, including hours worked, overtime hours (if applicable), and any other necessary details.

05

Review the entered data for accuracy and make any necessary adjustments.

06

Verify that the total payroll amount aligns with the budgetary constraints and available funds.

07

Once satisfied with the information entered, click "Submit Payroll" to finalize the process.

08

Generate payroll reports and records for future reference or auditing purposes.

Who needs Frostburg State University payroll?

01

Employees of Frostburg State University who are entitled to receive payment for their services require the payroll system.

02

The payroll department and administrators of the university need access to the payroll system to manage and oversee the payment process.

03

Human Resources may also use the payroll system to ensure accurate employee compensation and legal compliance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is frostburg state university payroll?

Frostburg State University payroll refers to the system used by the university to manage and process the payment of salaries and wages to its employees.

Who is required to file frostburg state university payroll?

All employees of Frostburg State University, including faculty, staff, and administrators, are required to file the payroll information.

How to fill out frostburg state university payroll?

To fill out the Frostburg State University payroll, employees need to provide their personal information, such as name, address, Social Security number, and bank account details. They also need to provide details of their earnings, deductions, and other relevant information.

What is the purpose of frostburg state university payroll?

The purpose of Frostburg State University payroll is to ensure timely and accurate payment of salaries and wages to the university employees. It also helps in maintaining proper records for taxation purposes and compliance with employment regulations.

What information must be reported on frostburg state university payroll?

The information that needs to be reported on Frostburg State University payroll includes employee details, such as name, address, Social Security number, wages earned, deductions, taxes withheld, and other relevant information required for payroll processing and reporting.

When is the deadline to file frostburg state university payroll in 2023?

The deadline to file Frostburg State University payroll in 2023 is usually determined by the university and may vary. It is recommended to consult the university's payroll department or the official guidelines for the specific deadline.

What is the penalty for the late filing of frostburg state university payroll?

The penalty for late filing of Frostburg State University payroll may vary and is typically determined by the university's policies and governing regulations. It is advisable to check the specific penalty provisions outlined by the university's payroll department or consult with them for accurate information.

How can I send frostburg state university payroll to be eSigned by others?

When you're ready to share your frostburg state university payroll, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in frostburg state university payroll without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing frostburg state university payroll and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out frostburg state university payroll using my mobile device?

Use the pdfFiller mobile app to complete and sign frostburg state university payroll on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your frostburg state university payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.