In this newsletter, we discuss what retirement planning is, and its effects on the financial security of retirement. We also offer some practical ideas for the planning process. To get started, you will need to understand: what retirement planning is, and its effects on the financial security of retirement.

What retirement planning involves when you begin

Who should do it and what is the cost

The financial security issue to realize. If you already have retirement savings (be it bank accounts, checking or savings accounts, or some combination thereof), you can make the initial planning phase easy by choosing retirement accounts or retirement packages that will benefit your retirement and enable you to transition at a later time. This newsletter begins by discussing what retirement planning is. It then discusses what retirement planning involves when you begin. After that, the newsletter details some things an individual can do to help make their retirement plans a success. You can also receive weekly newsletters about important developments in charitable giving including the Giving Back, Planning Ahead initiative. The Giving Back initiative offers organizations a chance to join together for the purposes of promoting the benefits of giving. Once you join a Giving Back organization, you will be alerted about important developments in the areas of donation frequency, gift volume, and donation frequency, which should be a positive incentive for those who are looking to increase their gifts. The Giving Back program offers more than 500 companies a chance to participate in this initiative. As part of the program, Giving Back organizations provide information and guidance to organizations considering joining their Giving Back coalition. The following is a summary of the most important aspects of the Giving Back initiative. Giving Back will be the major program and initiative of both the Giving Back Coalition and the Giving Back Council.

Giving Back Coalition

To enable more people to participate in giving, the Giving Back Coalition will provide guidance and support to organizations that are looking for ways to help improve their giving efforts. Giving Back is defined as the giving for which a charity should receive a government reimbursement;

to enable more people to participate in giving, the Giving Back Coalition will provide guidance and support to organizations that are looking for ways to help improve their giving efforts.

Get the free The planned giving report - George Washington University - gwu

Show details

Theplannedgivingreport Spring 2007 Vol.2 No.2 Planning Before and After Retirement William Alive, MS '71 Giving Back, Planning Ahead Planning for retirement is a crucial undertaking for everyone,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form planned giving report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form planned giving report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form planned giving report online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form planned giving report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form planned giving report?

The form planned giving report is a document that organizations use to report planned gifts they receive, such as bequests, charitable gift annuities, and trusts. It provides information about these gifts and helps track and manage planned giving programs.

Who is required to file form planned giving report?

Organizations that receive planned gifts and meet certain criteria, such as being tax-exempt under section 501(c)(3) of the Internal Revenue Code, are required to file form planned giving report.

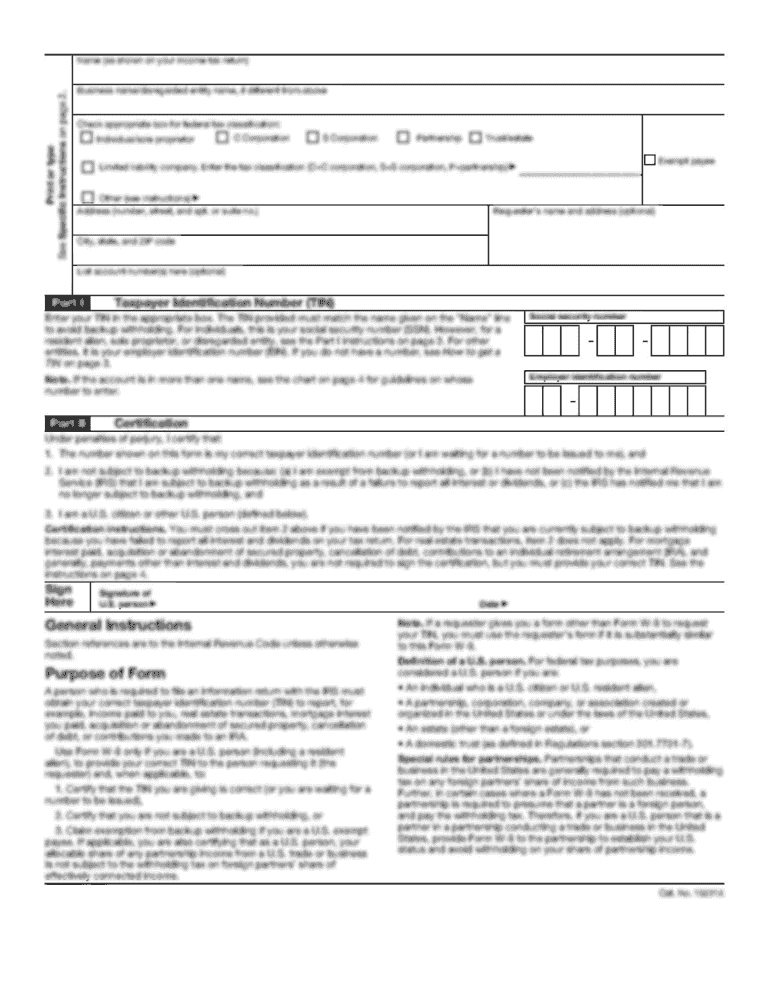

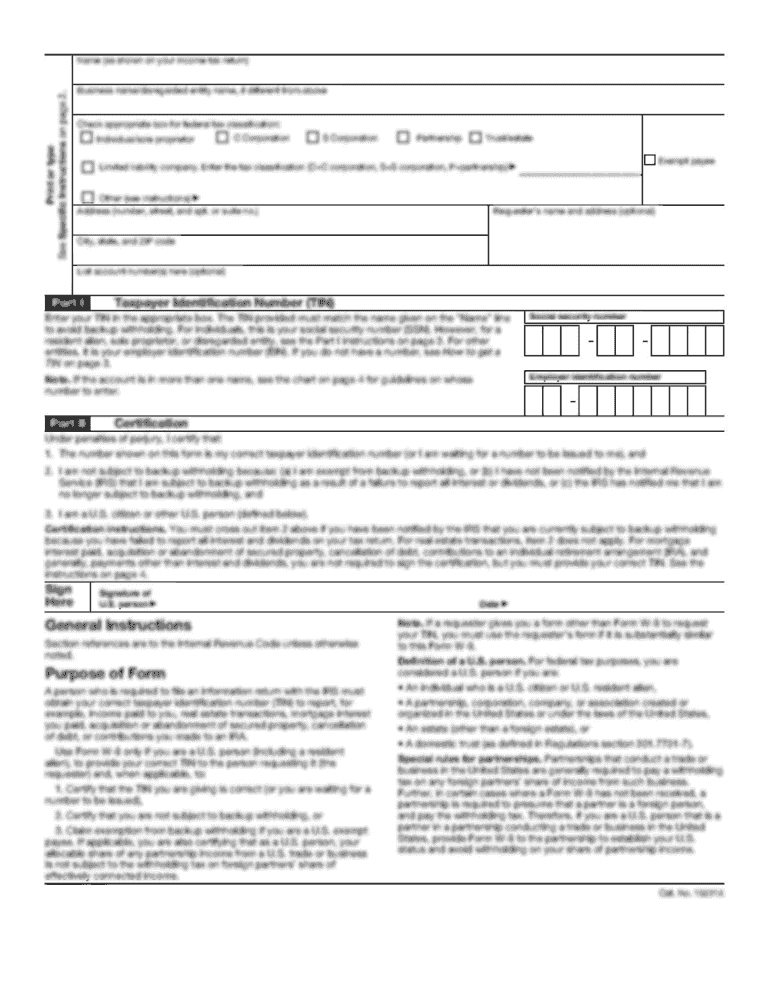

How to fill out form planned giving report?

To fill out a form planned giving report, organizations need to gather information about the planned gifts they have received, such as the donor's information, gift description, and fair market value. This information is then entered into the designated fields of the form.

What is the purpose of form planned giving report?

The purpose of the form planned giving report is to provide transparency and accountability regarding planned gifts received by organizations. It allows the IRS and other interested parties to monitor and ensure proper management of these gifts.

What information must be reported on form planned giving report?

The form planned giving report requires organizations to report information about the donor, including their name, address, and tax identification number. It also requires details about the planned gift, such as the type of gift, fair market value, and any relevant dates.

When is the deadline to file form planned giving report in 2023?

The deadline to file form planned giving report in 2023 is typically May 15th for most tax-exempt organizations. However, it's always recommended to check the official IRS website or consult a tax professional for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of form planned giving report?

The penalty for the late filing of the form planned giving report can vary depending on the organization's size and circumstances. It's important to consult the official IRS guidelines or seek professional tax advice to understand the specific penalty amounts and potential consequences for late filing.

How can I edit form planned giving report from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like form planned giving report, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the form planned giving report electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your form planned giving report in minutes.

Can I edit form planned giving report on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share form planned giving report from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your form planned giving report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.