NY DTF POA-1 2010 free printable template

Show details

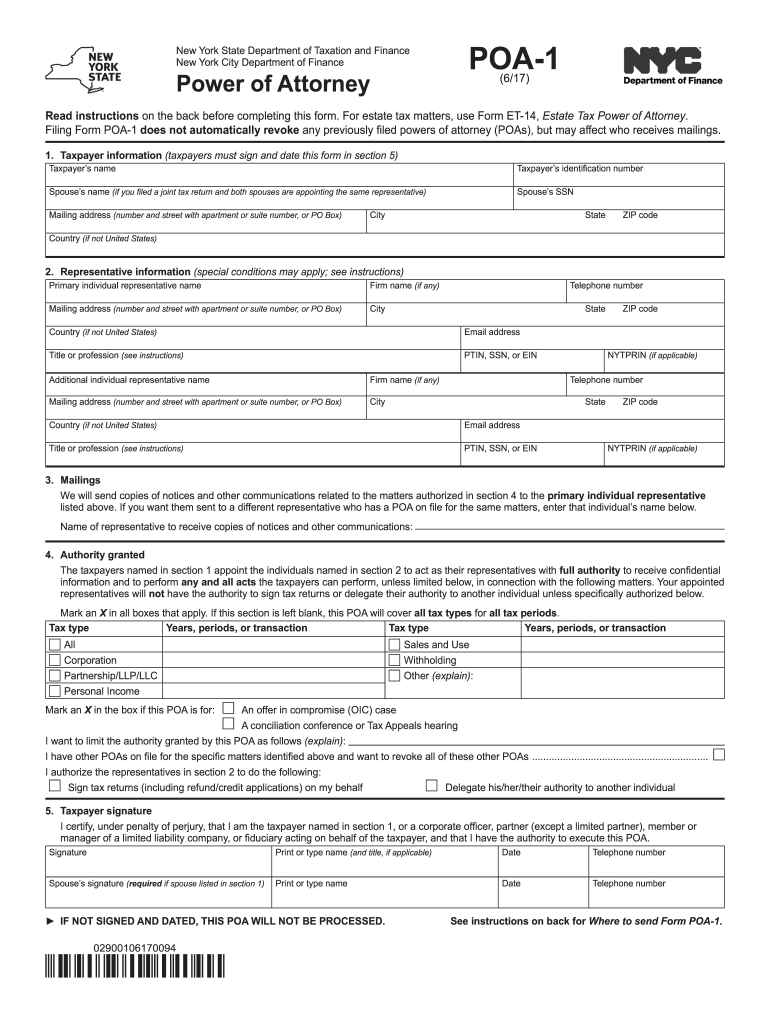

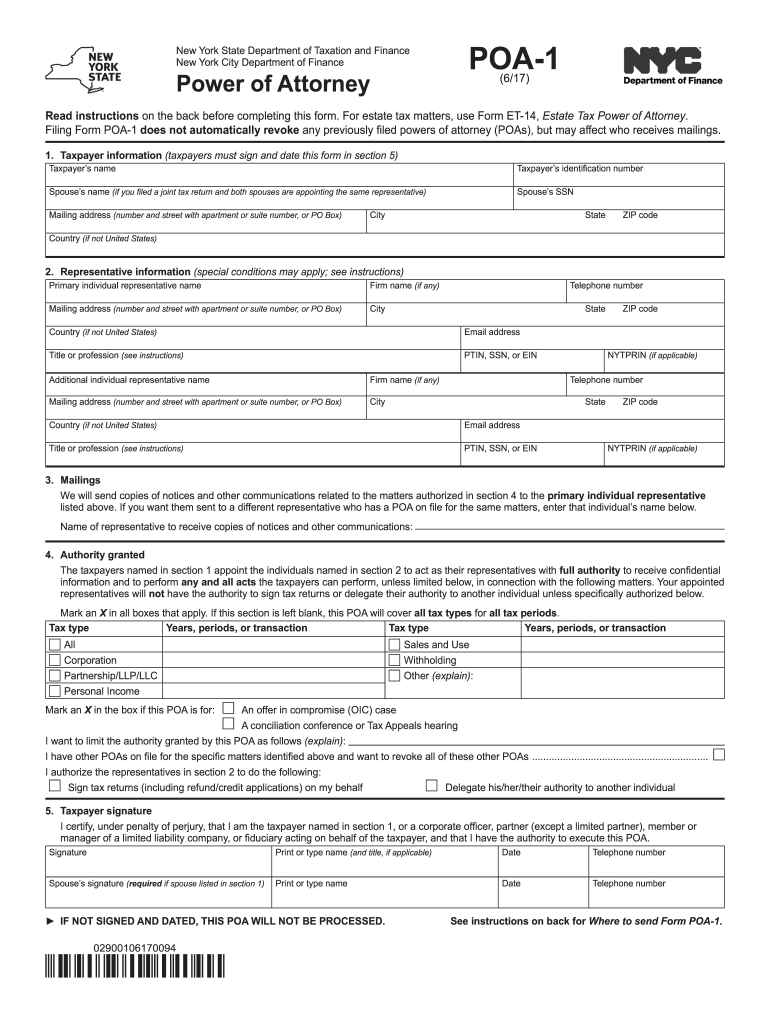

Filing Form POA 1 File the original Form POA 1 with the office of the agency in which a matter is pending. New York State Department of Taxation and Finance New York City Department of Finance Power of Attorney Read Form POA-1-I Instructions for Form POA-1 before completing. 0291100094 POA-1 9/10 Page 1 of 4 Page 2 of 4 POA-1 9/10 I / We authorize the above representative s to sign tax returns for the tax matter s indicated above. A photocopy or facsimile transmission fax is also...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF POA-1

Edit your NY DTF POA-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF POA-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF POA-1 online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF POA-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF POA-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF POA-1

How to fill out NY DTF POA-1

01

Obtain the NY DTF POA-1 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your name, address, and taxpayer identification number in the designated fields at the top of the form.

03

Specify the type of tax for which you are granting power of attorney (e.g., income tax, sales tax).

04

Indicate the name and address of the person you are granting power of attorney to in the appropriate area.

05

Sign and date the form to validate the power of attorney.

06

Submit the completed form either by mailing it to the address provided on the form or by the method indicated by the New York State Department of Taxation and Finance.

Who needs NY DTF POA-1?

01

Individuals or entities who wish to authorize someone else to act on their behalf in tax matters.

02

Taxpayers who need assistance in dealing with the New York State Department of Taxation and Finance.

03

Accountants, tax preparers, or legal representatives acting on behalf of a taxpayer.

Instructions and Help about NY DTF POA-1

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a NY POA?

Here are the basic steps to make your New York power of attorney: Decide which type of power of attorney to make. Decide who you want to be your agent. Decide what authority you want to give your agent. Get a power of attorney form. Complete the form, sign it, and have it witnessed and notarized.

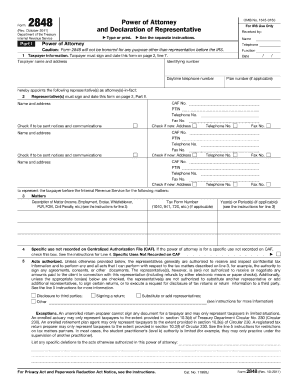

What is a NYS tax POA-1 form?

Use Form POA-1, Power of Attorney, when you want to give one or more individuals the authority to obligate or bind you, or appear on your behalf. You may only appoint individuals (not a firm) to represent you. Note: Authorizing someone to represent you does not relieve you of your tax obligations.

What is the power of attorney form for NYS income tax?

Use Form POA-1, Power of Attorney, when you want to give one or more individuals the authority to obligate or bind you, or appear on your behalf. You may only appoint individuals (not a firm) to represent you. Note: Authorizing someone to represent you does not relieve you of your tax obligations.

Where do I file a NYS POA 1?

If you still want to use the paper form Fax to:518-435-8617Mail to:NYS TAX DEPARTMENT POA CENTRAL UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0864 Mar 27, 2023

Does a power of attorney need to be recorded in NY?

New York power of attorney agreements only need to be filed if they are used in a real estate transaction. Aside from this, filing is not required. That said, you can still file your POA agreement with your County Clerk to ensure that you're able to obtain copies of your agreement if you ever need it.

What is a POA in NY State Tax Department?

A New York tax power of attorney (Form POA-1) allows a principal to appoint another party to represent them to file State taxes or handle any other matters related to the New York State Department of Taxation and Finance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY DTF POA-1 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including NY DTF POA-1. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the NY DTF POA-1 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your NY DTF POA-1 in minutes.

How do I edit NY DTF POA-1 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing NY DTF POA-1.

What is NY DTF POA-1?

NY DTF POA-1 is a Power of Attorney form used in New York State for granting authority to an individual or entity to act on behalf of a taxpayer regarding their tax matters.

Who is required to file NY DTF POA-1?

Any taxpayer who wishes to authorize another person or entity to represent them concerning their New York State tax affairs must file the NY DTF POA-1 form.

How to fill out NY DTF POA-1?

To fill out NY DTF POA-1, the taxpayer must provide their information, including name, address, and taxpayer identification number, as well as the representative's details and the specific tax matters for which the authority is granted.

What is the purpose of NY DTF POA-1?

The purpose of NY DTF POA-1 is to authorize a designated representative to act on behalf of the taxpayer in tax matters, enabling them to receive information and make decisions related to the taxpayer's tax obligations.

What information must be reported on NY DTF POA-1?

The information that must be reported on NY DTF POA-1 includes the taxpayer's name, address, taxpayer identification number, the representative's name and address, and a description of the tax matters and years for which the power of attorney is being granted.

Fill out your NY DTF POA-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF POA-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.