Get the free Supplementary Business Card Application

Show details

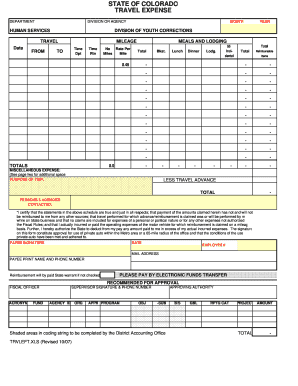

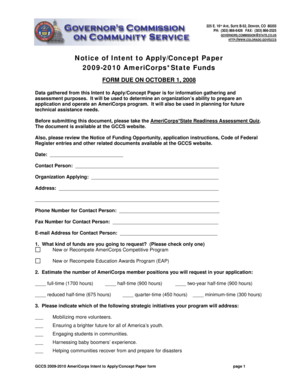

This document is an application form to apply for a Supplementary Business Card from American Express, including options for Green and Gold cards. It requires personal details from the basic cardmember

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplementary business card application

Edit your supplementary business card application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplementary business card application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supplementary business card application online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit supplementary business card application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplementary business card application

How to fill out Supplementary Business Card Application

01

Obtain a Supplementary Business Card Application form from the issuing bank or their website.

02

Fill in your personal details including your name, address, and contact information.

03

Provide the primary cardholder's details since they must be linked to your supplementary card.

04

Specify the type of supplementary card you wish to apply for, if there are different options available.

05

Include any required identification documents, such as government-issued ID or proof of income.

06

Review the application for accuracy and completeness.

07

Submit the application form along with any necessary documents as per the bank's instructions.

Who needs Supplementary Business Card Application?

01

Individuals who are already a primary cardholder and want to extend card benefits to family members or partners.

02

People who wish to manage shared business expenses with trusted colleagues or partners.

03

Anyone looking to build credit history for someone else by adding them as a supplementary cardholder.

Fill

form

: Try Risk Free

People Also Ask about

Does Amex supplementary card affect credit score?

It's important to note that while authorized user status may help your credit, it can also negatively impact your score if the primary cardholder doesn't manage credit responsibly. For example, your credit score may take a hit if they have bad credit or pay their credit card bills late.

Do Amex supplementary cards get priority pass?

Both the Basic and Supplementary Cardmember must enrol into Priority Pass.

Can an additional card holder use a Priority Pass?

No, Priority Pass memberships are non-transferable so your wife, husband or partner cannot use your membership without you. Only the named member can use the membership for lounge access. Additional eligible guests can accompany the member, typically for an extra fee.

Do supplementary card holders get Priority Pass?

Who can apply for the Priority Pass? The Basic Card Member and one Supplementary Card Member.

What is the difference between additional card and supplementary card?

An additional cardholder is someone the primary cardholder authorises to use their account. Additional cardholders use supplementary ('secondary') credit cards linked to the primary cardholder's account.

Do supplementary cards get the same benefits?

There is no actual benefit to supplementary cards apart from the fact that it is an extra physical card that you can give to your wife/parents/family members to use. There is no catch in these as it is literally like a 2nd card to your original card. The dues will still be charged on your original account.

Do supplementary Amex card holders get lounge access?

Additional Cardmembers share benefits such as airport lounge access9, car rental benefits, access to the Fine Hotel and Resorts programme10. Extended access to Amex Offers, Amex Experiences® and Purchase and Refund protection. They will also benefit from Worldwide Travel Insurance.

Do additional Amex card members get Priority Pass?

Relax in one of over 1,200 lounges across over 130 countries. After all, you and your Supplementary Cardmember plus one guest, have access to one of the world's largest independent airport lounge access programmes – Priority PassTM.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplementary Business Card Application?

The Supplementary Business Card Application is a form used by businesses to request additional business credit cards under their existing account, allowing multiple employees to make purchases on behalf of the business.

Who is required to file Supplementary Business Card Application?

Typically, the business owner or an authorized representative of the business is required to file the Supplementary Business Card Application.

How to fill out Supplementary Business Card Application?

To fill out the Supplementary Business Card Application, provide necessary details such as the business name, account number, the name of the employee for whom the card is requested, their contact information, and any spending limits.

What is the purpose of Supplementary Business Card Application?

The purpose of the Supplementary Business Card Application is to allow businesses to grant access to credit to additional employees to facilitate business-related expenses without needing to reimburse directly from the business account.

What information must be reported on Supplementary Business Card Application?

The information that must be reported includes the business name, account number, employee's name, contact information, spending limits, and any other relevant business details required by the credit card issuer.

Fill out your supplementary business card application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplementary Business Card Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.