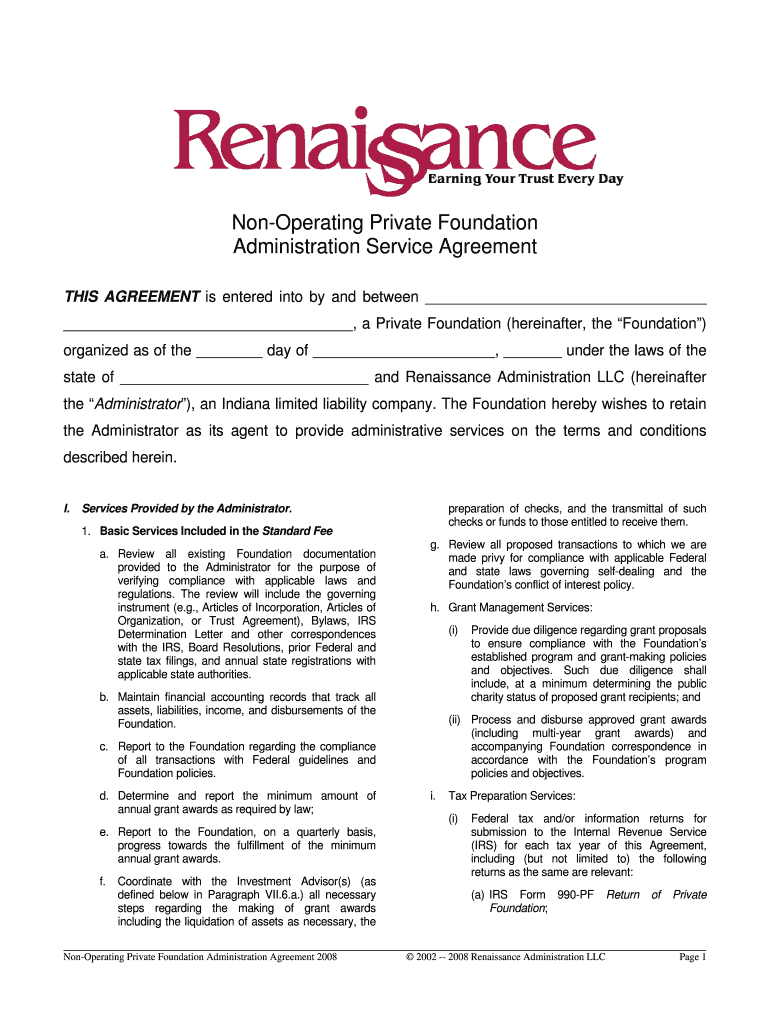

Get the free Non-Operating Private Foundation Administration Service Agreement

Show details

Non-Operating Private Foundation Administration Agreement 2008 ... (a) IRS Form 990-PF Return of Private ... (d) IRS Form 8868 Application for Extension of ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your non-operating private foundation administration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-operating private foundation administration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-operating private foundation administration online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non-operating private foundation administration. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out non-operating private foundation administration

01

Non-operating private foundation administration refers to the management and oversight of a foundation that exists solely to distribute funds to charitable causes, rather than engaging in direct charitable activities.

02

To fill out the non-operating private foundation administration, you will need to follow specific steps:

2.1

Start by gathering all necessary legal documents, including the foundation's articles of incorporation, bylaws, and any required tax-exemption forms. These documents establish the foundation's purpose, governance structure, and eligibility for tax benefits.

2.2

Develop a comprehensive investment strategy that aligns with the foundation's mission and long-term goals. This may involve consulting with financial professionals or hiring a professional investment manager to handle the foundation's assets.

2.3

Create a grants management process to ensure that funds are distributed in accordance with the foundation's mission and priorities. This may include developing grantmaking guidelines, establishing a grant application process, and implementing evaluation and reporting mechanisms for grant recipients.

2.4

Maintain detailed and accurate financial records, including annual financial statements and tax filings. It is essential to comply with all applicable tax laws and regulations to maintain the foundation's tax-exempt status.

2.5

Establish a governance structure that includes a board of directors or trustees responsible for overseeing the foundation's activities. This board should consist of individuals with diverse expertise and a commitment to the foundation's mission.

Who needs non-operating private foundation administration?

01

Non-operating private foundations are typically established by individuals or families with significant wealth who want to create a lasting philanthropic legacy. They are suitable for those who wish to have ongoing charitable impact through the distribution of funds to various nonprofit organizations.

02

Wealthy individuals or families who want to maintain control over how their charitable dollars are spent often choose non-operating private foundation administration. This allows them to establish grantmaking priorities, shape the foundation's strategic focus, and involve family members or trusted advisors in the decision-making process.

03

Non-operating private foundation administration may also be suitable for those who want to receive the tax benefits associated with philanthropic giving. By establishing a legally compliant foundation, individuals can potentially receive tax deductions for their charitable contributions and enjoy tax-exempt investment growth on the foundation's assets.

In summary, non-operating private foundation administration is necessary for individuals or families who seek to establish a long-term philanthropic legacy, maintain control over charitable giving, and receive tax benefits through strategic and compliant management of their foundation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is non-operating private foundation administration?

Non-operating private foundation administration refers to the management and governance of a private foundation that does not engage in its own charitable activities, but instead provides funds and grants to other charitable organizations.

Who is required to file non-operating private foundation administration?

Non-operating private foundations are required to file Form 990-PF, which is the annual informational return for private foundations, with the Internal Revenue Service (IRS).

How to fill out non-operating private foundation administration?

To fill out non-operating private foundation administration, you need to complete Form 990-PF and provide information such as income, assets, grants, expenses, and governance details of the foundation. Detailed instructions can be found on the IRS website.

What is the purpose of non-operating private foundation administration?

The purpose of non-operating private foundation administration is to ensure transparency and accountability in the management and financial activities of private foundations. It allows for public disclosure of the foundation's financial information and ensures compliance with tax regulations.

What information must be reported on non-operating private foundation administration?

The information that must be reported on non-operating private foundation administration includes the foundation's financial activities, such as income from investments, grants made to other organizations, administrative expenses, and details about the foundation's board of directors and officers.

When is the deadline to file non-operating private foundation administration in 2023?

The deadline to file non-operating private foundation administration in 2023 is typically May 15th, unless an extension has been requested and granted by the IRS.

What is the penalty for the late filing of non-operating private foundation administration?

The penalty for the late filing of non-operating private foundation administration can be significant. It is calculated based on the foundation's assets and can range from $20 to $200 per day that the return is late, with a maximum penalty of $50,000 or 5% of the foundation's assets, whichever is less.

How do I execute non-operating private foundation administration online?

Completing and signing non-operating private foundation administration online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in non-operating private foundation administration without leaving Chrome?

non-operating private foundation administration can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out non-operating private foundation administration on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your non-operating private foundation administration. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your non-operating private foundation administration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.