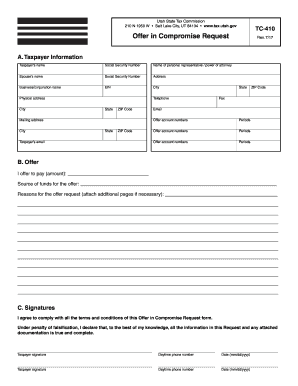

UT USTC Offer in Compromise Booklet 2012 free printable template

Get, Create, Make and Sign

How to edit booklet my online

UT USTC Offer in Compromise Booklet Form Versions

How to fill out booklet my 2012 form

How to fill out booklet my:

Who needs booklet my:

Video instructions and help with filling out and completing booklet my

Instructions and Help about booklet my 2012 form

Hi this is Anthony parent of parents and parent LLP the IRS medic and in this video I am going to be talking about form 656 which is the IRS form if you are going to submit an offer and compromise now I have up on my screen the IRS homepage IRS gov and here's a little problem that I've discovered lately I want to type in form 656 you see I've tried that already and let's go to it let's go right to form 656 oh wow we got a little problem here don't we have redesigning iron shot the website to make it easier to find the information you need well they've made it easier okay if you reach this patient by selecting a bookmark that worked previously it's likely the URL has changed to navigate click back to the home page you can search a site for a specific information hmm like I just did that though right I'm looking for this form 656 I'll do it again 656 where could it be okay well here's some other stuff there's 656 be I could try that let's see what his let's see what that is okay well 656 be okay that's good it's the booklet DOH that's not really the form is it I can't be it so where can I find it um here 656 out let's see what that is and that is 656 dough is to liability well that's fine if I dispute the fact that I owe the tax begin with but what I'm looking for is a form 656 when I claim I cannot pay the entire tax info, so this doesn't help me at all let me get rid of this what else do we have tax topics 20 5 204 offers and compromise okay let's take a look at this can this help me off oh boy there's all oh boy there's a lot of text here, here maybe I could do that okay lets's see here well's to hear they're linked in some forms here all right forum for our 33 an oh I see all right well that's not what I'm looking for 433 be not looking for that and here is form 6 noes I don't want me to just want instead of form what a way here it is this is form 656 can be found in the offer in compromise booklet form 656 be ah so where I was before here, so six sit form 656 booklets includes the booklet and according to this it should also include form 656 let's see if that is true there's that again there's my friend again going down there it is ah well isn't that wonderful so there you go that is how you find form 656 IRS offer in compromise and the mystery is solved maybe someday they will update the web page so that you can find this form but until now that is how you do it and for more information on six on submitting a successful IRS offer in compromise please visit our blog at IRS medico this is Anthony parent of parent and parent LLP the IRS medic, and thanks for watching, and please subscribe to this channel

Fill form : Try Risk Free

People Also Ask about booklet my

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your booklet my 2012 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.