Get the free 2006 BA - 410 - tax vermont

Show details

VT DEPARTMENT OF TAXES, Montpelier, Vermont 05633-1401 / (802) 828-5723 2007 VT Corporate Income Tax Affiliation Schedule Month Year *074101199* VT Business Account Number VT Business Activity Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

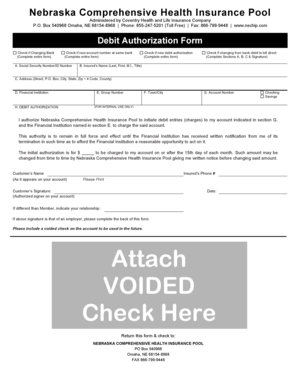

Edit your 2006 ba - 410 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2006 ba - 410 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2006 ba - 410 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2006 ba - 410. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out 2006 ba - 410

How to fill out 2006 ba - 410:

01

Start by entering the current date in the designated space.

02

Fill in your personal information, such as your name, address, and contact details.

03

Provide any additional information required, such as your social security number or taxpayer identification number.

04

If applicable, indicate your filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

05

Follow the instructions to report your income from various sources, such as wages, self-employment, rental properties, and investments.

06

Deduct any eligible expenses, such as student loan interest, medical expenses, or business-related costs.

07

Calculate your tax liability using the appropriate tax tables or the tax software you are using.

08

If you owe taxes, include your payment information, such as your bank account number or credit card details.

09

Review your completed form for accuracy and make any necessary corrections before submitting it.

Who needs 2006 ba - 410:

01

Individuals who earned income during the year 2006 and are required to file their taxes with the Internal Revenue Service (IRS).

02

Anyone who wants to ensure compliance with tax laws and avoid penalties or legal issues.

03

Individuals who are eligible for tax credits, deductions, or refunds and need to claim them by completing the form.

04

Self-employed individuals, freelancers, or small business owners who need to report their income and expenses.

05

Students or recent graduates who may need to report their income from part-time jobs or scholarships received.

06

Retirees who may have pension income or other taxable investments.

07

Anyone with complex financial situations, such as multiple sources of income or significant deductions, may need to use this form to accurately report their taxes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ba - 410?

ba - 410 refers to a specific form or document used for reporting financial information.

Who is required to file ba - 410?

ba - 410 is typically required to be filed by certain individuals or entities as mandated by the relevant authorities.

How to fill out ba - 410?

Filling out ba - 410 involves providing the necessary financial information in the designated sections of the form.

What is the purpose of ba - 410?

The purpose of ba - 410 is to gather and report financial data for various purposes, such as regulatory compliance or financial analysis.

What information must be reported on ba - 410?

ba - 410 typically requires the reporting of specific financial details, such as income, expenses, assets, liabilities, and other related information.

When is the deadline to file ba - 410 in 2023?

The deadline to file ba - 410 in 2023 may vary depending on the specific regulations or guidelines set by the relevant authorities.

What is the penalty for the late filing of ba - 410?

The penalty for the late filing of ba - 410 can vary and may be imposed as per the rules and regulations set by the relevant authorities.

How can I manage my 2006 ba - 410 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 2006 ba - 410 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify 2006 ba - 410 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 2006 ba - 410 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the 2006 ba - 410 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2006 ba - 410 in minutes.

Fill out your 2006 ba - 410 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.