Get the free 2005 BI - 471 - tax vermont

Show details

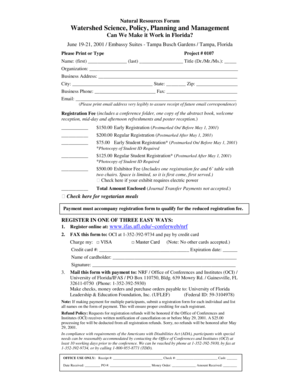

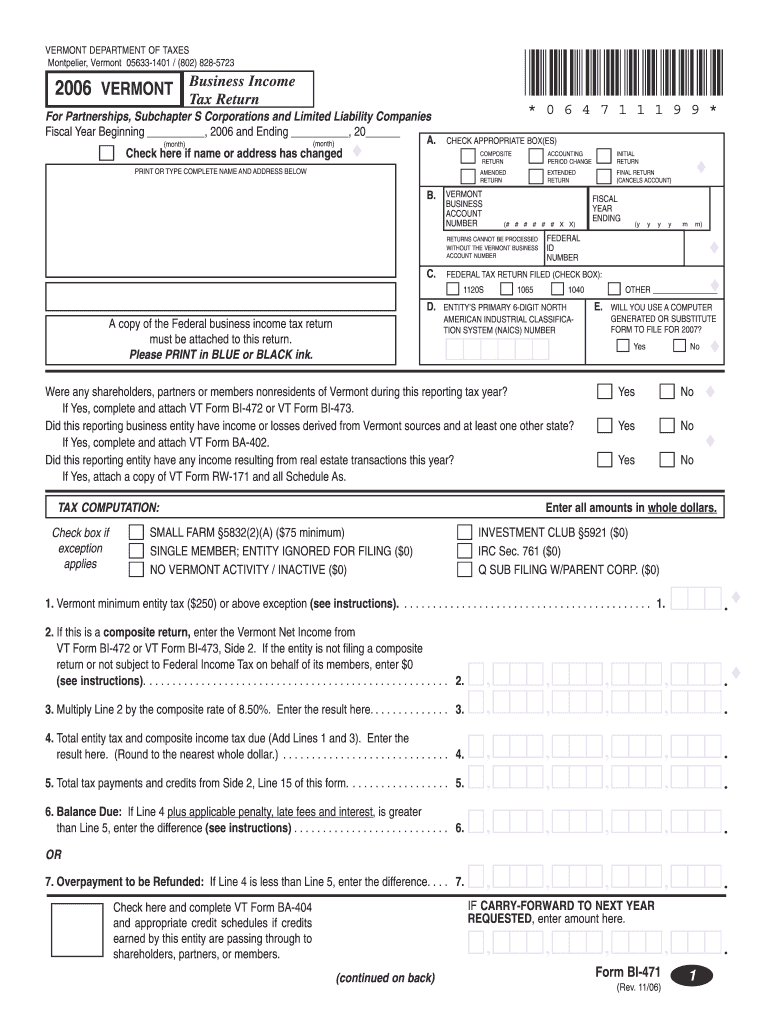

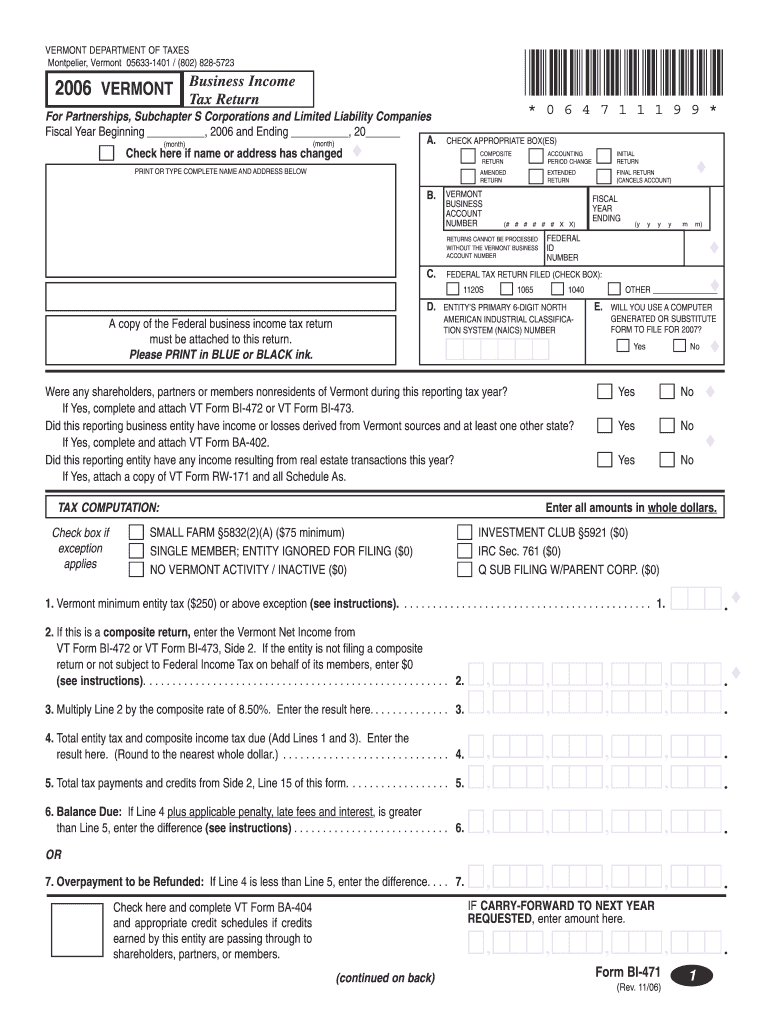

VERMONT DEPARTMENT OF TAXES Montpelier, Vermont 05633-1401 / (802) 828-5723 2006 VERMONT (month) Business Income Tax Return (month) *064711199* * 0 6 4 7 1 1 1 9 9 * ACCOUNTING PERIOD CHANGE EXTENDED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2005 bi - 471 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2005 bi - 471 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2005 bi - 471 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2005 bi - 471. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out 2005 bi - 471

01

To fill out the 2005 bi - 471 form, you must first gather all the necessary information and documents. This may include your personal details, such as your name, address, and social security number, as well as any relevant financial information.

02

Next, carefully read the instructions provided with the form. These instructions will outline the specific information required for each section of the form and any additional documents that need to be submitted.

03

Begin filling out the form by entering your personal information in the appropriate fields. Double-check that all the details are accurate and up to date.

04

Proceed to the financial section of the form, where you will need to provide information about your income, assets, and liabilities. This may include details about your employment, investments, and any debts you may have.

05

Take the time to review your completed form for any errors or omissions. Ensure that all sections are filled out correctly and that you have provided all required information.

06

If there are any supporting documents required, such as tax returns or bank statements, make sure to attach them securely to the form.

07

Once you have reviewed and completed the form, sign and date it. If you are filing the form on behalf of someone else, make sure to include your relationship to the individual and provide your contact information.

Who needs the 2005 bi - 471 form?

01

Any individual or organization that is required to report their financial information for a specific purpose may need to fill out the 2005 bi - 471 form. This may include individuals filing their personal income taxes, businesses reporting their financial statements, or organizations meeting certain regulatory requirements.

02

Additionally, the 2005 bi - 471 form may be required by government agencies or institutions for various purposes, such as determining eligibility for government benefits, obtaining a loan, or conducting audits.

03

It is essential to consult the specific guidelines and regulations related to the form to determine if it is required in your particular situation and who should fill it out. This information can usually be found on the official website of the relevant agency or institution.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bi - 471?

bi - 471 is a form used for reporting financial information regarding business expenditures.

Who is required to file bi - 471?

Any business or individual who has incurred eligible business expenses must file bi - 471.

How to fill out bi - 471?

Bi - 471 is filled out by providing accurate financial information and details about business expenditures in the designated sections of the form.

What is the purpose of bi - 471?

The purpose of bi - 471 is to accurately report business expenses and financial information for tax and regulatory compliance purposes.

What information must be reported on bi - 471?

bi - 471 requires the reporting of various financial information including income, expenses, deductions, and credits related to business activities.

When is the deadline to file bi - 471 in 2023?

The deadline to file bi - 471 in 2023 is usually April 15th, but it's always recommended to check with the relevant tax authorities for any specific changes or extensions.

What is the penalty for the late filing of bi - 471?

The penalty for the late filing of bi - 471 may vary depending on the jurisdiction and specific circumstances. It is advisable to consult with the relevant tax authorities for accurate penalty information.

How can I send 2005 bi - 471 for eSignature?

To distribute your 2005 bi - 471, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find 2005 bi - 471?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 2005 bi - 471 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the 2005 bi - 471 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 2005 bi - 471 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your 2005 bi - 471 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.