Get the free formulir asuransi

Show details

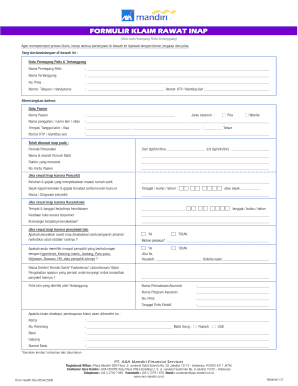

Staples rising Noor SPAN Formula Claim Rabat Snap Bengali color AAU core bill Peru. Bill Persian Salah, harp direct Dan Diana tangent (cereal director tidal dibenarkan) Agar mempercepat prose claim

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your formulir asuransi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your formulir asuransi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing formulir asuransi online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit klaim axa mandiri form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out formulir asuransi

How to fill out formulir asuransi:

01

Begin by obtaining the formulir asuransi from the insurance company or agency. This can often be done online or through a physical form provided by the insurance provider.

02

Carefully read through the instructions on the formulir asuransi. Make sure you understand the information required and any specific sections that need to be completed.

03

Start filling out the personal information section of the formulir asuransi. This typically includes details such as your full name, address, contact number, and email address. Ensure that you provide accurate and up-to-date information.

04

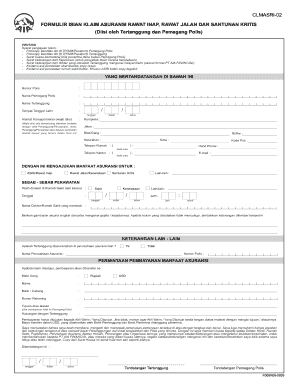

Move on to the coverage details section. Here, you will need to specify the type of insurance coverage you are seeking, such as health insurance, car insurance, or property insurance. Provide any additional information or specific requirements requested by the insurance company.

05

In the next section, you will usually need to provide information regarding your assets or belongings that require coverage. This may include details such as the value of your home, car, or any other items you wish to insure. Remember to provide accurate and precise information to avoid any potential complications in the future.

06

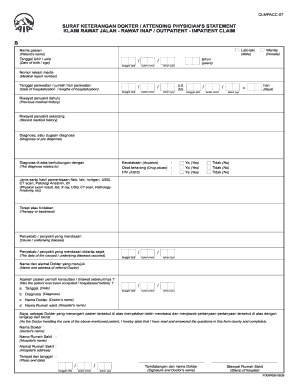

If applicable, you may need to complete a section about your medical history or any pre-existing conditions related to health insurance. Be thorough and honest with this information to ensure proper coverage.

07

Review the formulir asuransi once you have filled it out completely. Double-check all the details and make corrections if needed. It is crucial to ensure that all the provided information is correct as any mistakes or inaccuracies may affect the validity of your insurance coverage.

08

Lastly, sign and date the formulir asuransi. This indicates that you have completed the form accurately and truthfully. Keep a copy of the filled-out form for your records.

Who needs formulir asuransi:

01

Individuals who wish to obtain insurance coverage for their assets, including their home, car, health, or property.

02

Business owners who want to insure their company's assets, employees, or liabilities.

03

Anyone who wants to protect themselves financially against potential risks or losses, such as accidents, theft, or damage to their belongings.

Fill formulir klaim rawat inap axa mandiri : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is formulir asuransi?

Formulir asuransi adalah dokumen yang harus diisi oleh pemohon asuransi untuk mengajukan permohonan asuransi. Formulir ini berisi informasi terkait dengan pemohon, termasuk informasi pribadi seperti nama, alamat, tanggal lahir, serta informasi lain yang diperlukan seperti jenis asuransi yang diajukan, nilai pertanggungan, dan detail mengenai aset atau risiko yang akan diasuransikan. Formulir asuransi juga biasanya mencakup pertanyaan-pertanyaan mengenai riwayat kesehatan atau risiko yang perlu diketahui oleh perusahaan asuransi dalam menentukan premi dan persyaratan asuransi yang tepat.

Who is required to file formulir asuransi?

Typically, individuals who have purchased an insurance policy are required to file an insurance claim form, also known as "Formulir Asuransi." This form is used to notify the insurance company of a loss or damage covered under the policy and to initiate the claims process.

How to fill out formulir asuransi?

To fill out an insurance form, follow these steps:

1. Read the form: Carefully read the entire form to understand what information is required and ensure you provide accurate details.

2. Personal Information: Fill in your personal details like your full name, address, contact number, date of birth, and social security number.

3. Policy Details: Enter the policy number or any other related information asked by the form.

4. Insurance Coverage: Specify the type of coverage you are applying for, such as health, life, property, or auto insurance.

5. Beneficiary Information: If applicable, provide the details of the beneficiary who will receive the insurance benefits in case of any eventuality.

6. Declaration: Sign the form at the designated place or provide an electronic signature if submitting the form online.

7. Supporting Documents: Attach any necessary supporting documents, such as copies of identification cards, proof of address, or medical records, if required.

8. Review the Form: Review the filled-out form for any errors or missing information. Make sure all sections are completed accurately.

9. Submit the Form: Submit the form as per the instructions provided. It may involve mailing it to the insurance company or submitting it through an online portal.

Remember to keep a copy of the filled-out form for your records.

What is the purpose of formulir asuransi?

The purpose of formulir asuransi (insurance form) is to collect and record pertinent information about the insured individual or entity, as well as the details of the insurance policy being sought. This form is used by insurance companies to assess the risk and determine the premium for providing insurance coverage.

The formulir asuransi typically includes sections for personal or organizational details, such as name, address, contact information, and identification documents. It also contains sections to specify the type of insurance coverage required, the sum insured, and any additional riders or endorsements.

By filling out the insurance form accurately and completely, the applicant helps the insurance company evaluate the risk profile and determine the appropriate premium and terms of coverage. The form assists in proper underwriting, claims processing, and policy management. Additionally, it serves as a legal document that outlines the terms and conditions agreed upon by both parties – the insured and the insurer.

What information must be reported on formulir asuransi?

The information that must be reported on an insurance form (formulir asuransi) may vary depending on the type of insurance and the specific requirements of the insurance company. However, some common information that is typically required to be reported on an insurance form includes:

1. Personal information: This includes the insured person's full name, address, contact details, and date of birth.

2. Policy details: This includes information about the type of insurance policy being applied for, such as life insurance, health insurance, car insurance, etc. It may also include details about the coverage limits, deductible, and any additional riders or endorsements.

3. Property details: If the insurance is for property (such as home insurance or property insurance), the form may require information about the property itself, such as its location, value, construction type, and any safety features.

4. Vehicle details: If the insurance is for a vehicle (such as car insurance), the form may require information about the vehicle, such as its make, model, year of manufacture, registration number, and any modifications made to it.

5. Medical history: In the case of health insurance or life insurance, the form may require information about the insured person's medical history, including any pre-existing conditions, past illnesses, surgeries, or medications.

6. Employment details: The form may ask for information about the insured person's occupation and income, especially in the case of disability insurance or income protection insurance.

7. Claims history: The form may require information about any past insurance claims made by the insured person, including details about the nature of the claim, the amount claimed, and the outcome of the claim.

8. Beneficiary information: In the case of life insurance, the form may require information about the beneficiaries who will receive the insurance payout in the event of the insured person's death.

It is important to carefully read and fill out the insurance form to ensure that all required information is provided accurately. Failure to provide complete or accurate information can potentially result in the denial of a claim or the cancellation of the insurance policy.

What is the penalty for the late filing of formulir asuransi?

The penalty for the late filing of insurance forms can vary depending on the insurance provider, policy terms, and the specific regulations in place. Some insurance companies may charge a late fee or penalty for late filing, while others may impose a higher premium or terminate the policy altogether. To determine the exact penalty, it is advisable to review the terms and conditions of the insurance policy or contact the insurance provider directly.

Can I create an eSignature for the formulir asuransi in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your klaim axa mandiri form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the formulir penutupan polis axa mandiri form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign formulir pendaftaran asuransi and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out surat keterangan dokter untuk klaim rawat inap axa financial form on an Android device?

On Android, use the pdfFiller mobile app to finish your formulir surat keterangan dokter untuk klaim rawat inap axa mandiri. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your formulir asuransi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Formulir Penutupan Polis Axa Mandiri is not the form you're looking for?Search for another form here.

Keywords relevant to surat ket dokter axa form

Related to form klaim axa mandiri

If you believe that this page should be taken down, please follow our DMCA take down process

here

.