Get the free State of West Virginia Electioneering Communications and Last inute - apps sos wv

Show details

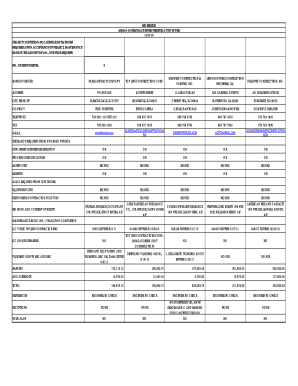

Of coal Form F-14 Revised 9/09 Issued by the Secretary of State (/W Code 3-8- 2b) Page 3

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your state of west virginia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of west virginia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of west virginia online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state of west virginia. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out state of west virginia

How to fill out state of West Virginia:

01

Obtain the necessary forms: Visit the official website of the West Virginia State Tax Department or contact the department directly to request the appropriate tax forms for your specific needs.

02

Gather all required information: Before starting to fill out the forms, collect all the necessary information such as your personal identification details, income details, expenses, and any relevant supporting documents.

03

Follow the instructions: carefully read and understand the instructions provided with the tax forms. Make sure to follow them accurately while filling out the forms to avoid any mistakes or delays in processing.

04

Provide accurate information: Fill in all the required fields with accurate information. Double-check your entries to ensure precision and avoid any errors that may cause issues in the future.

05

Calculate the tax owed or refund due: Use the provided guidelines or a tax calculator to determine the amount of tax you owe or the refund you are eligible for. Fill in these details accurately in the respective sections of the forms.

06

Sign and submit: Once you have completed filling out the forms, sign them where required. Make copies of all the forms for your records and submit the originals, along with any supporting documents, to the West Virginia State Tax Department by mail or through their online portal, depending on the submission method indicated.

07

Follow up: After submitting your forms, keep track of your return and check for any updates or notifications from the tax department. If you have any questions or concerns, contact the department directly for assistance.

Who needs state of West Virginia:

01

Residents: Any individual residing in West Virginia for a significant portion of the year is required to file a state tax return to report their income earned within the state.

02

Non-residents: Non-residents who have earned income from West Virginia sources, such as employment or rental properties, may also be required to file a state tax return in West Virginia.

03

Businesses: Companies operating within West Virginia, including corporations, partnerships, and sole proprietorships, may need to file various state tax returns, depending on their business activities and income earned within the state.

04

Out-of-state sellers: With the implementation of economic nexus laws, out-of-state sellers that reach a certain sales threshold in West Virginia may be obligated to collect and remit sales tax.

05

Individuals with withholding: If you are an employee or receive income subject to West Virginia income tax withholding, you will need to file a state tax return to reconcile your taxes paid throughout the year.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state of west virginia?

The state of West Virginia refers to the government and administrative body that governs the state and its institutions.

Who is required to file state of west virginia?

Certain individuals and businesses may be required to file state of West Virginia, including residents who meet the state's income tax filing requirements, businesses with a physical presence in the state, and out-of-state businesses with sales or transactions in West Virginia that exceed a certain threshold.

How to fill out state of west virginia?

To fill out the state of West Virginia, individuals and businesses need to gather their relevant financial information, such as income, expenses, and deductions. They can then use the official West Virginia state tax forms or electronic filing systems to report their information accurately.

What is the purpose of state of west virginia?

The purpose of the state of West Virginia is to collect revenue from individuals and businesses to fund the operations and services provided by the state government, such as education, infrastructure, healthcare, and public safety.

What information must be reported on state of west virginia?

The specific information that must be reported on the state of West Virginia varies depending on the individual or business. Generally, it includes income, deductions, tax credits, and other information related to the taxpayer's financial situation.

When is the deadline to file state of west virginia in 2023?

The deadline to file the state of West Virginia in 2023 is typically April 15th for individual taxpayers. However, it is always recommended to check the official West Virginia state tax website or consult a tax professional for the most up-to-date information.

What is the penalty for the late filing of state of west virginia?

The penalty for the late filing of the state of West Virginia can vary depending on the circumstances. Generally, taxpayers may face penalties and interest charges on any outstanding tax balance if they fail to file their state tax return by the deadline. The specific penalty amounts and calculations are determined by the West Virginia Department of Revenue.

How can I get state of west virginia?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific state of west virginia and other forms. Find the template you need and change it using powerful tools.

How do I make changes in state of west virginia?

With pdfFiller, the editing process is straightforward. Open your state of west virginia in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the state of west virginia in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your state of west virginia in minutes.

Fill out your state of west virginia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.