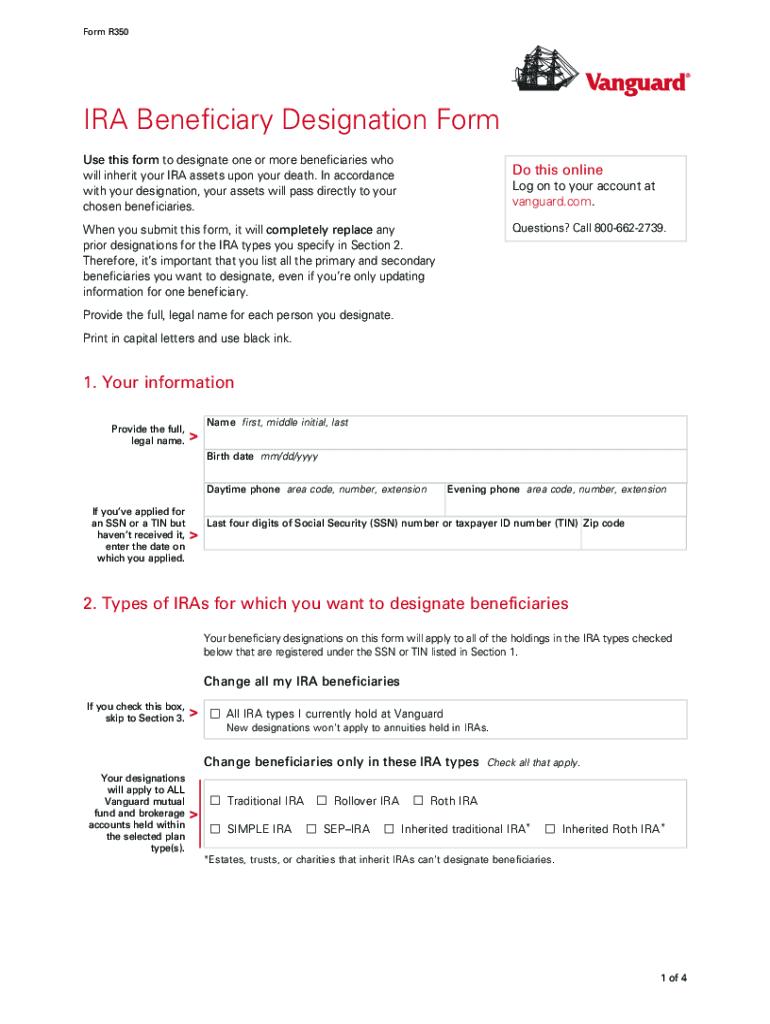

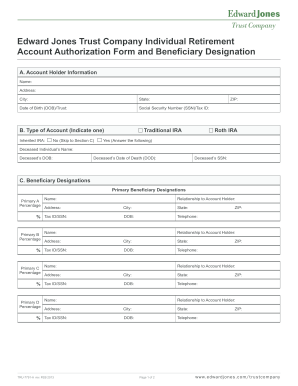

Get the free vanguard beneficiary form pdf

Get, Create, Make and Sign

Editing vanguard beneficiary form pdf online

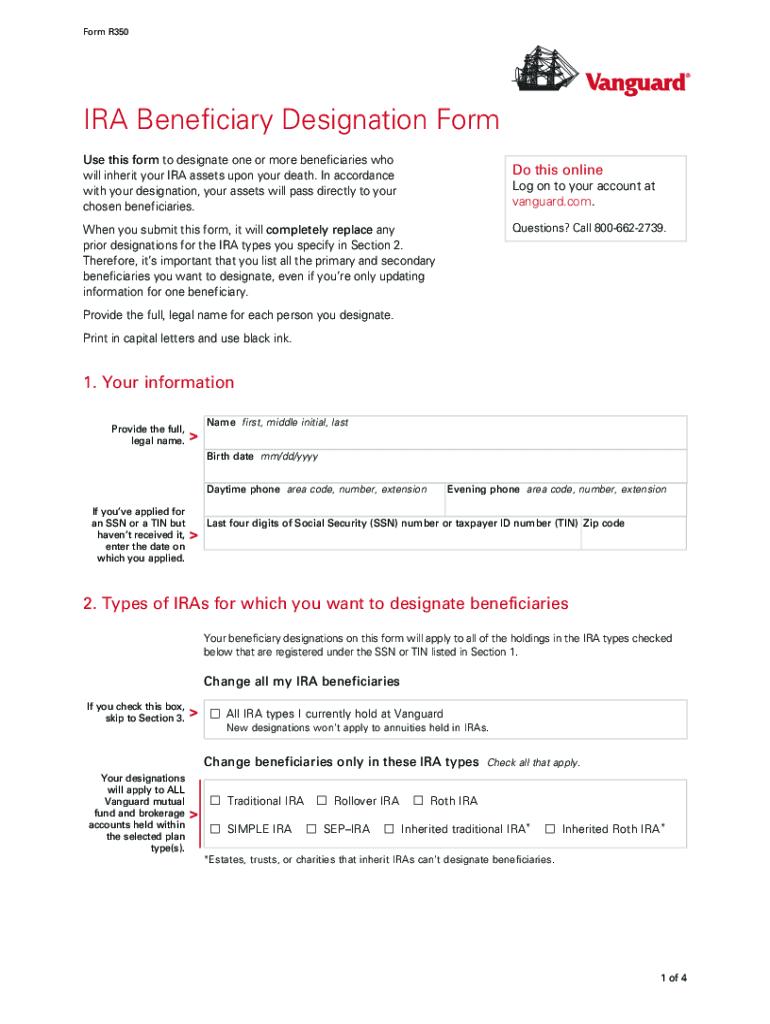

How to fill out vanguard beneficiary form pdf

How to fill out Vanguard beneficiary form PDF:

Who needs Vanguard beneficiary form PDF:

Video instructions and help with filling out and completing vanguard beneficiary form pdf

Instructions and Help about vanguard beneficiary change form

Today I want to create a short video for you that talks about how to open a Roth IRA at Vanguard Now a lot of low-cost investors love Vanguard because they are the leaders in low-cost ETFs and Mutual Funds They are one of the first companies that really created a full suite of ETFs and Mutual Funds for investors and the whole philosophy aroundVanguard is low cost index funds will boost your returns over time because fees eat away your returns A lot of people love this philosophy and as such they want to invest at Vanguard is now the largest Mutual Fund and ETF company in the world They have three trillion dollars in assets because people love their site and love their product offerings If you want to open a Roth IRA at Vanguard how do you get started That's what I'm going to walk you through right now This is the Vanguard website Vanguard honestly has one of the most antiquated websites of most investing firms, but it works If they're going to go low cost I mean they definitely show it on their website If you're here on their Home page you want to create the website for personal investors here Let's go to the site right here Now that you're here you have some options right here We want to open an account You can open an account right here at the top When you click that link here it pulls up this page and here are your options for an account at Vanguard You have their Retirement Accounts You have a regular IRA a Roth IRA a Rollover You have some General Investing Accounts You can do an Individual Account a JointAccount a Trust Account If you want to invest for a minor you could do a 529 saving for college or a Custodial Account Then you could also do your Business Account You can actually do an Individual 401k and different things right here I want to do a Roth IRA We're going to open a new account I'm going to just check or transfer Fromm bank I am not registered, so we will create this, and you'll sign up for access for after completing the online application Here's where you choose your account type Honestly this takes about five minutes guys As you can see it says five or ten minutes right here You can choose your account type Vanguard does take one to two days though afterwards to confirm that the account's open When you're here you want to tell us about your new account I want to invest in a Retirement Account We're going to do a Roth IRA Then you enter all your information here Then you transfer, and you review and you e-sign You sign up, and you're done It actually takes about five ten minutest sign up It's super easy I want to show you here what the pricing lookalike We're going to go here to the Vanguard site Let's go to the Vanguard Home page Ah I can't type Vanguard Official Site We're going to go down here, and we're going to choose the investment products You can see here Man their site is shard to navigate on It is not user-friendly Here we go Costs and Fees down at the bottom When you open an account with Vanguard you will have a...

Fill vanguard forms pdf : Try Risk Free

People Also Ask about vanguard beneficiary form pdf

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your vanguard beneficiary form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.