For more information apply online or by phone at.

Mansion or Multiple Dwelling Property The Lifetime Assessment Reduction on your Lifetime Assessment Certificate will be calculated at the amount provided on your confirmation of sale.

Mortgage Lender Rebate Information If you are applying for a Lifetime Assessment Reduction on your Lifetime Assessment Certificate, you must include a mortgage lender rebate application. Click here for more information on the Mortgage Lender Rebate Application Form.

New Construction Rebate Information If you are applying for a Lifetime Assessment Reduction on your Lifetime Assessment Certificate, you must use the following format with your confirmation of sale: If you are applying on an existing property (for example by selling your home and installing residential insulation or replacing or repairing a basement, etc.), you must apply online (or fax in your confirmation of sale) or in person (by appointment). You can also mail in the rebate application or fax in your confirmation of sale. Include your confirmation of sale, your Certificate of Land Title — Personal Property (LTV) Number, payment slip, and a written explanation as to why you are applying for a rebate.

Non-Resident Landlord Rebate Details The following conditions apply to a Non-Resident Landlord Rebate: Your rebate application must include a copy of the Residential Tenancies Act, the Building Code Act (if applicable), and the by-laws of your municipality.

Your rebate application must be received by the Landlord Services Office 6 weeks prior to the expected commencement of your tenancy, or the date on which you sign for tenancy, whichever comes first.

If your rebate application is received prior to the commencement of your tenancy, it is not valid.

You are eligible to claim the rebate only once (i.e., if you are re-subletting your unit during the rebate period to a different tenant or if you are replacing a leasehold unit without an offer on which to re-let). Rebate application fees are payable.

Redid, and Manitoba Hydro are required to send you a copy of your rebate application.

Payment received in error is eligible for a complete refund.

The Lifetime Assessment Reduction is not available on new construction or on any properties built or purchased by a non-resident owner of any residential property.

homeowner's Lien Certificate Details If you have a homeowner's Lien Certificate, this is valid for the Lifetime Assessment Reduction you are claiming.

Get the free Heritage Property Rebate Application - Government of Nova Scotia - gov ns

Show details

Heritage Property Rebate Application Rebate Based on Provincial Portion of the HST Eligibility Information Rebate is equal to the provincial portion of the Harm ionized Sales Tax (HST) paid, after

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your heritage property rebate application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your heritage property rebate application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing heritage property rebate application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit heritage property rebate application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

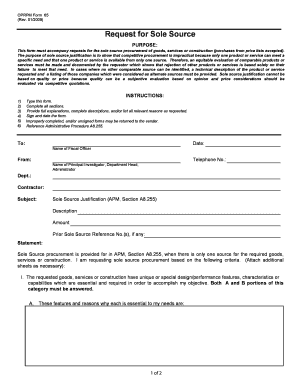

What is heritage property rebate application?

The heritage property rebate application is a form that allows eligible property owners to apply for a rebate on their property taxes for designated heritage properties.

Who is required to file heritage property rebate application?

Property owners who have designated heritage properties are required to file a heritage property rebate application if they wish to claim a rebate on their property taxes.

How to fill out heritage property rebate application?

To fill out a heritage property rebate application, you will need to provide information about the designated heritage property, property ownership details, and any other required documentation. The application can be submitted electronically or in paper form.

What is the purpose of heritage property rebate application?

The purpose of the heritage property rebate application is to allow eligible property owners to receive a rebate on their property taxes as an incentive to preserve and maintain heritage properties.

What information must be reported on heritage property rebate application?

The heritage property rebate application typically requires information such as property address, ownership details, property classification, designated heritage status, and any supporting documentation required by the local heritage preservation authority.

When is the deadline to file heritage property rebate application in 2023?

The deadline to file the heritage property rebate application in 2023 is typically specified by the local heritage preservation authority and can vary. It is recommended to contact the authority or check their website for the exact deadline.

What is the penalty for the late filing of heritage property rebate application?

The penalty for the late filing of the heritage property rebate application is determined by the local heritage preservation authority. It can include a reduction or denial of the rebate, additional fees, or other consequences as specified by the authority. It is important to submit the application on time to avoid any penalties.

How can I send heritage property rebate application for eSignature?

heritage property rebate application is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit heritage property rebate application online?

With pdfFiller, the editing process is straightforward. Open your heritage property rebate application in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit heritage property rebate application on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute heritage property rebate application from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your heritage property rebate application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.