Get the free FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST

Show details

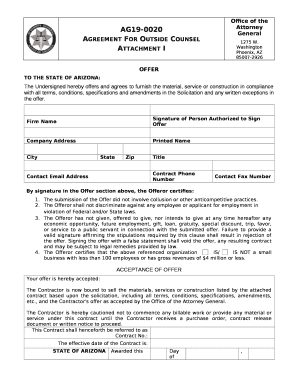

This document serves as a checklist for foreign profit or nonprofit corporations applying to conduct business in Arizona, detailing the necessary information and attachments required for filing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign profit or nonprofit

Edit your foreign profit or nonprofit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign profit or nonprofit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foreign profit or nonprofit online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit foreign profit or nonprofit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign profit or nonprofit

How to fill out FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST

01

Gather necessary documentation, including your corporation's formation documents and proof of your business entity's good standing in its home state.

02

Complete the FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST form, ensuring all sections are accurately filled out.

03

Provide details such as the corporation name, the state of incorporation, and the principal office address.

04

List the names and addresses of the current officers and directors of the corporation.

05

Include a registered agent's name and address for service of process in the state where you are filing.

06

Attach any additional required documentation, such as a Certificate of Good Standing if required by the state.

07

Review the checklist for completeness, ensuring that all required signatures and dates are included.

08

Submit the checklist along with any applicable filing fees to the appropriate state agency.

Who needs FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST?

01

Any corporation that is looking to operate in a state different from where it was originally incorporated.

02

Businesses that wish to expand their operations and engage in business activities outside their home states.

03

Nonprofit organizations that plan to solicit donations or provide services in a different state.

Fill

form

: Try Risk Free

People Also Ask about

What is form 1120 and when must it be filed?

A 1120 tax form is an Internal Revenue Service (IRS) form that corporations use to find out their tax liability, or how much business tax they owe. It is also called the U.S. Corporation Income Tax Return. American corporations use this form to report to the IRS their income, gains, losses deductions and credits.

What IRS filings are required for non-profits?

A tax-exempt organization must file an annual information return or notice with the IRS, unless an exception applies. Annual information returns for most types of organizations include Form 990, Form 990-EZ or Form 990-PF.

What are the filing requirements for foreign corporations?

Every foreign corporation that is engaged in trade or business in the United States at any time during the tax year or that has income from United States sources must file a return on Form 1120-F, U.S. Income Tax Return of a Foreign Corporation.

What is the difference between 1120 and 1120f?

In essence, while both forms are used to report income, gains, losses, deductions, and credits, Form 1120 is used by domestic corporations, while Form 1120-F is used by foreign corporations. The key difference lies in the type of income they include in taxable income.

When must a foreign corporation file a Form 1120-F?

A foreign corporation that maintains an office or place of business in the United States must generally file Form 1120-F by the 15th day of the 4th month after the end of its tax year. A new corporation filing a short-period return must generally file by the 15th day of the 4th month after the short period ends.

How do I report ownership of a foreign corporation?

If you are living abroad and operating a business from a foreign country, you must file a U.S. federal tax return if you own at least 10 percent of a foreign corporation, and your return must include Form 5471.

Who is required to file F-1120?

Corporations must file Florida Form F-1120 each year, even if no tax is due. The due date is based on the corporation's tax year.

Who is required to file form 1120F?

A foreign corporation that maintains an office or place of business in the United States must generally file Form 1120-F by the 15th day of the 4th month after the end of its tax year. A new corporation filing a short-period return must generally file by the 15th day of the 4th month after the short period ends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST?

The FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST is a document that outlines the necessary steps and requirements for a foreign corporation to register and operate within a different jurisdiction, ensuring compliance with local laws.

Who is required to file FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST?

Any foreign corporation, whether for-profit or non-profit, that intends to conduct business or establish a physical presence in a different state or country is required to file the FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST.

How to fill out FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST?

To fill out the checklist, the foreign corporation must provide accurate and complete information regarding its formation, operations, registered agents, and compliance with regulatory requirements in the jurisdiction where it seeks to operate.

What is the purpose of FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST?

The purpose of the checklist is to ensure that foreign corporations correctly follow legal procedures for registration, maintain compliance, and fulfill their obligations under local laws to operate legally in the new jurisdiction.

What information must be reported on FOREIGN PROFIT OR NONPROFIT CORPORATION FILING CHECKLIST?

The checklist typically requires information such as the corporation's name, registration number, principal office address, details of its officers and directors, nature of business activities, and the jurisdiction of original incorporation.

Fill out your foreign profit or nonprofit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Profit Or Nonprofit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.