Get the free bn8 form

Show details

FORM IN 8 Rev.1.2011 REGISTRATION OF BUSINESS NAMES ACT STATUTORY DECLARATION VERIFYING A STATEMENT FURNISHED UNDER THE ACT. (Pursuant to Section 15 of the Act) Detailed instructions on the Reverse.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bn8 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bn8 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bn8 online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bn8 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out bn8 form

Point by point, here's how you can fill out bn8:

01

Start by gathering all the necessary information required to complete bn8. This may include personal details, contact information, and any specific inputs requested on the form.

02

Read the instructions carefully. Make sure you understand what each section is asking for and if any supporting documents or signatures are needed.

03

Begin filling out bn8 by following the order of the sections. Provide accurate and truthful information. If any sections are not applicable, clearly indicate it, or follow the instructions for alternative steps.

04

Double-check the entries made on bn8 for any errors or missing information. Ensure that all the required fields have been filled properly.

05

If there are any supporting documents required, attach them securely to the form. Ensure that all attachments are properly labeled and organized.

06

Once the form is completely filled out and all the necessary documents are attached, review everything one final time to ensure accuracy and completeness.

07

If possible, make a copy or take a digital scan of the filled-out form and all the attached documents for your records. This can serve as a backup and proof of submission.

08

Submit the completed bn8 form and any required documents as per the instructions provided. This may include mailing the physical copy or uploading the digital version to a designated platform.

Who needs bn8:

01

Individuals who are required to provide specific information or complete certain processes as per the regulations, such as compliance with legal or administrative requirements, may need to fill out bn8.

02

Organizations or entities that request bn8 as a part of their standard procedures, such as employers, government agencies, or educational institutions, may need individuals to complete bn8.

03

It is essential to check the specific instructions or requirements provided by the requesting party to determine if bn8 needs to be filled out in a particular situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bn8?

BN8 (also known as BN-8 or BN8) could refer to several different things, depending on the context. Without more information, it is difficult to determine the exact meaning. Here are a few possibilities:

1. BN8 as a text abbreviation: In texting and online messaging, "BN8" is a shortened form of "be (mine) tonight". It is commonly used as a flirtatious or romantic phrase.

2. BN8 as a postal code: In some regions, "BN8" is a postal code used to identify a specific area for mail delivery. The specific location would vary based on the country or region.

3. BN8 as a product or brand name: "BN8" may also represent a specific product or brand, which could vary across industries. Without more details, it is not possible to determine the specific product or brand associated with "BN8".

How to fill out bn8?

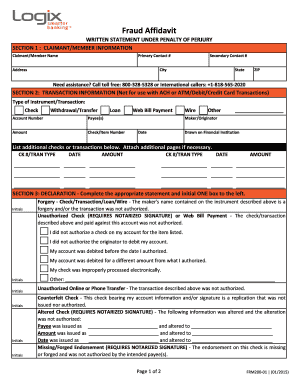

BN8 refers to a form used for reporting non-occupational disability claims. The form may vary depending on the specific organization or insurance provider requesting it, so it's recommended to refer to the provided instructions for accurate completion.

Generally, when filling out BN8, you will need to provide personal information, details about the disability, and other relevant information. Here is a general guideline on how to fill out the form:

1. Personal Information:

- Start by entering your full name, address, contact number, and email (if applicable).

- Fill in your date of birth, social security number, and any additional identification numbers requested.

2. Disability Information:

- Indicate the date the disability began, whether it's a new condition or a pre-existing one.

- Specify the nature of the disability and conditions associated with it, providing a detailed description of symptoms and limitations.

- Mention any medical treatments received, such as surgeries, therapies, medications, or rehabilitation.

3. Attending Physician Information:

- Provide the name, address, and contact information of the primary physician responsible for treating the disability.

- Include the dates of the first visit and the last visit to the physician.

- If applicable, provide information about other healthcare professionals involved in the treatment.

4. Employment and Disability Details:

- Mention your occupation before the disability and the date you last worked.

- Specify if the disability is work-related or not.

- Indicate whether you have received or applied for any other disability benefits.

5. Authorization and Consent:

- Sign and date the form to acknowledge that all the provided information is accurate to the best of your knowledge.

- If required, have your physician or healthcare provider sign and complete their section of the form.

6. Additional Documentation:

- Attach any supporting documents requested, such as medical records, test results, hospital reports, or any other evidence supporting your claim.

It's important to carefully review the completed form to ensure accuracy and completeness before submitting it to the designated recipient. If you have any doubts or questions, consult with the organization or insurance provider to get guidance specific to their requirements.

What is the purpose of bn8?

As of my knowledge, there is no specific or widely known reference to "bn8". It could be a specific term, code, or abbreviation used in a particular context or industry that I am not aware of. If you can provide more information or context, I may be able to assist you better.

What information must be reported on bn8?

The BN8 form, also known as the Employer's Payroll Deductions Supplementary Slip, is used in Canada to report various payroll deductions made by an employer. The information required to be reported on BN8 includes:

1. Employer and Employee Information: The form requires details such as the employer's name, address, and business number (BN) along with the employee's name, social insurance number (SIN), and address.

2. Pay Period Information: The form should indicate the pay period for which the deductions are being reported, including the start and end dates of the pay period.

3. Deduction Information: The BN8 form lists various types of payroll deductions, and the appropriate boxes must be checked based on the deductions made. These deductions may include income tax, Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and other types of deductions like union dues or contributions to employee benefit plans.

4. Deduction Amounts: The form requires the employer to report the total amount of each deduction made during the specified pay period for each employee. This information should be provided in Canadian dollars.

5. Additional Information: The BN8 form may have space to report additional information or notes regarding the deductions made or any other relevant details.

It is important to note that the BN8 form is used to report deductions made by an employer, and it is typically submitted to the Canada Revenue Agency (CRA) along with other payroll documentation. The specific reporting requirements may vary depending on the province or territory in which the business operates, so it is advisable to consult the CRA or a tax professional for accurate information regarding payroll reporting obligations.

What is the penalty for the late filing of bn8?

The BN8 form is specific to the United Kingdom's HM Revenue and Customs (HMRC) and is used to report certain changes or events related to a non-resident company or an overseas company with a UK establishment. However, it is unclear if "late filing" specifically refers to late submission of the BN8 form.

If late filing refers to the late submission of the BN8 form, HMRC generally imposes penalties for late filing. The penalty amount varies depending on the circumstances, such as the duration of the delay and the company's turnover. You may face the following penalties:

1. Automatic penalty: In case of late filing, HMRC can impose an automatic penalty, which starts at £100 and increases depending on the length of the delay.

2. Continued non-compliance: If the company fails to file the BN8 form for several years consecutively, HMRC may escalate the penalties and pursue additional enforcement actions.

It is essential to consult with HMRC or a tax professional to get accurate and up-to-date information on specific penalties related to late filing of the BN8 form or any other tax-related matters.

How can I modify bn8 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your bn8 form into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the bn8 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your bn8 form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit bn8 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign bn8 form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your bn8 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.