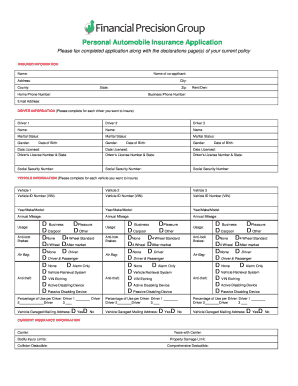

For 2001, the applicant estimates that the tax increase will be between 1,500 to 1,700 for seniors 62 and over, and between 1,000 to 1,150 for persons between the ages of 65 and 64. Under the current system, an increase of between 1,150 and 1,350 in the rate would equal 5 to 6 of tax relief per property. For the purposes of this application, any amount received from the increase will be treated as tax relief and applied to the applicant's property taxes. (2) The tax for 2002, is estimated to be 9,000. For 2002, the applicant estimates that the increase will be between 750 and 1,200 for seniors 62 and over, and between 550 and 890 for persons aged 60 and over. Under the current system, the applicant estimates an increase of between 400 and 800 in the rate would equal 3 to 4 of tax relief per property. For the purposes of this application, any amount received from the increase will be treated as tax relief and applied to the applicant's property taxes. For further information regarding the application, please contact: C. J. Leblanc (5th Floor) City of Elliot Lake, City of Toronto, Ontario, Canada Phone: Fax: E-mail: CJ.leblanceliot-lake.ca.

D.C. — 2

Application for tax relief in respect of tax increases for low-income seniors and low-income persons with disabilities pursuant to Section 319 (1) of The Municipal Act, 2001 Application Year Applicant Name: Registered Owners Name: Property Address: Mailing Address: City & Postal Code: Date of Birth: Social Insurance Number (mm/dd/YYY) How long have you resided at property address listed above. Years Months SELECT ONE: (attach.pdf, 20K) (1) The tax for 2001 will be estimated at approximately 38,000 for single occupancy. For 2001, the applicant estimates that the tax increase will be between 2,100 and 3,200 for seniors 62 and over, and between 900 and 1,300 for people aged 60 and over.

Get the free Application for Tax Relief in respect of tax - City of Elliot Lake

Show details

THE CORPORATION OF THE CITY OF ELLIOT LAKE Application for tax relief in respect of tax increases for low-income seniors and low-income persons with disabilities pursuant to Section 319 (1) of The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your application for tax relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for tax relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for tax relief online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for tax relief. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for tax relief?

An application for tax relief is a formal request made by an individual or entity to the tax authority seeking relief or exemption from certain taxes or tax penalties.

Who is required to file application for tax relief?

Any individual or entity who believes they qualify for tax relief based on specific criteria set by the tax authority may be required to file an application for tax relief.

How to fill out application for tax relief?

To fill out an application for tax relief, one needs to obtain the application form from the tax authority or their website, provide all the required information accurately, and submit the completed form within the specified deadline.

What is the purpose of application for tax relief?

The purpose of an application for tax relief is to request the tax authority to grant relief or exemption from certain taxes or tax penalties based on the individual's or entity's specific circumstances or eligibility criteria.

What information must be reported on application for tax relief?

The specific information required on an application for tax relief may vary depending on the tax authority and the type of relief sought. Generally, it may include personal or entity details, financial information, supporting documents, and a detailed explanation of the reasons for seeking tax relief.

When is the deadline to file application for tax relief in 2023?

The specific deadline to file an application for tax relief in 2023 may vary depending on the jurisdiction and the type of tax relief. It is recommended to consult the tax authority or relevant guidelines for the exact deadline.

What is the penalty for the late filing of application for tax relief?

The penalty for the late filing of an application for tax relief may vary depending on the jurisdiction and the specific circumstances. Common penalties may include fines, interest charges, or denial of the tax relief request. It is advisable to consult the tax authority or relevant guidelines for the specific penalty provisions.

Can I create an electronic signature for signing my application for tax relief in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your application for tax relief right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the application for tax relief form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign application for tax relief and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out application for tax relief on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your application for tax relief, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your application for tax relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.