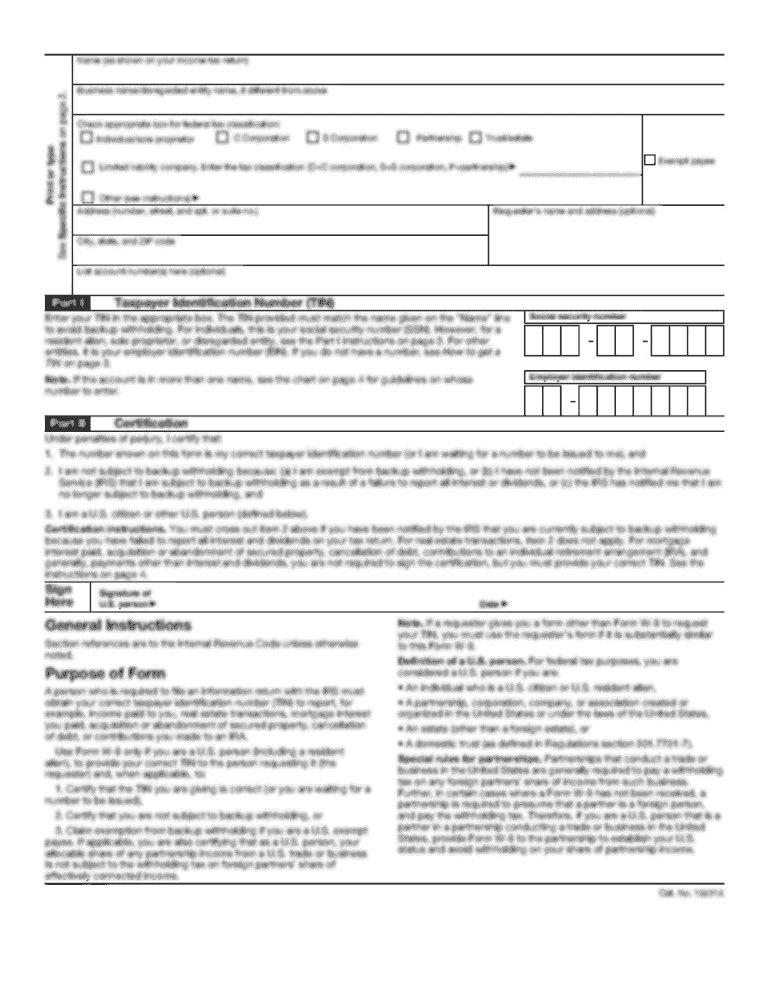

D.D.VIP (date of declaration) ANNA (date of declaration) P.S. I have sent tax-return information and income information about, e.g., residence of the principal place of business or the residential address of the main place of accommodation or the dwelling place of the principal place of residence when the person is a resident of a designated country or territory or on the basis of a legal declaration attested by the local tax authority or under a tax convention, convention or other international agreement which relates to the tax system of a designated country or territory. The information provided is subject to the requirement contained in Art. 17 of the Tax Code of South Africa (SA) and must be submitted by 31.06.2013. However, if the person does not have any residence address and is not a resident of a designated country or territory the Tax Collector may ask the person to submit information by fax to 011-31-14-05-5553 or by e-mail at If the person does not have any information to submit, they may continue with the declaration form. TSM / Form TSM / Form SASS / Form SASS Kept plates 01.01.2012 tested v ljamaksetele / Applicable from 01.01.

Get the free vorm tsm form - emta

Show details

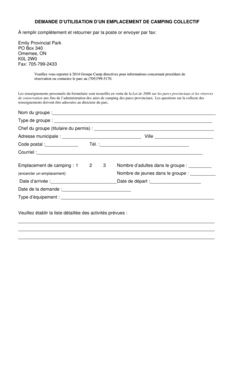

Vorm TSM / Form TSM Kehtiv alates 01. 01. 2012 tehtud v ljamaksetele / Applicable from 01. 01. 2012 Maksu- ja Tolliamet / Tax and Customs Board MAKSUKOHUSTUSLANE / TAXABLE PERSON Registri- v i isikukood / Registration code or personal ID code Nimi v i ees- ja perekonnanimi / Name or first name and surname Asu- v i elukoha aadress maakond sihtnumber k la talu v i t nav maja nr korteri nr vald asula v i linn Address of residence country postal code...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vorm tsm form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vorm tsm form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vorm tsm form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vorm tsm form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

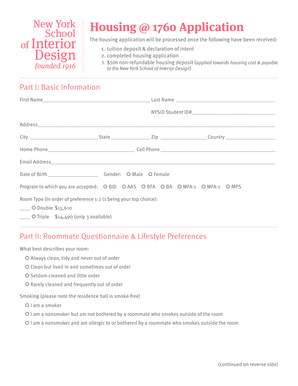

What is vorm tsm form?

Vorm TSM form is a tax form used for reporting certain financial transactions.

Who is required to file vorm tsm form?

Individuals and businesses who have engaged in specified financial transactions are required to file vorm tsm form.

How to fill out vorm tsm form?

To fill out vorm tsm form, you need to provide information about the financial transactions, including the date, amount, and parties involved.

What is the purpose of vorm tsm form?

The purpose of vorm tsm form is to ensure the reporting and transparency of certain financial transactions for tax purposes.

What information must be reported on vorm tsm form?

The information that must be reported on vorm tsm form includes the details of the financial transactions, such as the type, date, amount, and the parties involved.

When is the deadline to file vorm tsm form in 2023?

The deadline to file vorm tsm form in 2023 is April 15th.

What is the penalty for the late filing of vorm tsm form?

The penalty for the late filing of vorm tsm form is a fine of $100 per day, up to a maximum of $5,000.

How do I edit vorm tsm form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your vorm tsm form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the vorm tsm form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your vorm tsm form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete vorm tsm form on an Android device?

Use the pdfFiller mobile app and complete your vorm tsm form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your vorm tsm form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.