Get the free that the enclosed form be completed and sent to our Office before August 15, - ocs g...

Show details

That the enclosed form be completed and sent to our Office before August 15,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your that the enclosed form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your that the enclosed form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit that the enclosed form online

Follow the steps down below to use a professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit that the enclosed form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

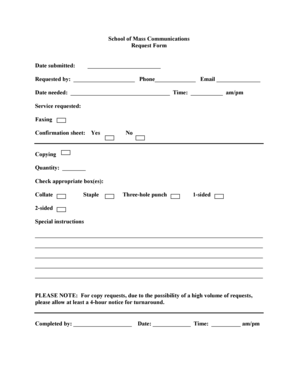

How to fill out that the enclosed form

Point by point instructions for filling out the enclosed form:

01

Start by carefully reading all the instructions provided on the form.

02

Fill in your personal information accurately and legibly, including your name, address, and contact details.

03

Provide any additional information or documentation that may be required, such as identification or proof of income.

04

Ensure that you understand the purpose of the form and the specific information being requested.

05

Double-check all the entries for any errors or omissions before submitting the form.

06

If you have any questions or need clarification, don't hesitate to seek assistance from relevant authorities or personnel.

07

Finally, sign and date the form as required.

Who needs the enclosed form?

The enclosed form may be required by individuals or organizations that have specific administrative or legal processes to follow. This can include government agencies, employers, educational institutions, healthcare providers, or other entities that require certain information and documentation from individuals. The purpose of the form will depend on the circumstances and requirements set by the organization requesting it.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

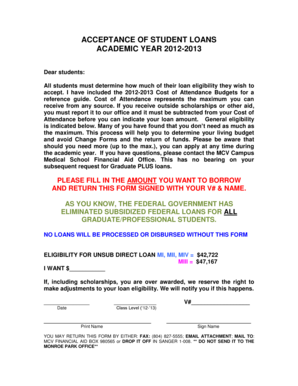

What is that the enclosed form?

The enclosed form is Form 1040, also known as the U.S. Individual Income Tax Return.

Who is required to file that the enclosed form?

Every individual taxpayer whose income meets certain criteria and exceeds the filing threshold is required to file Form 1040.

How to fill out that the enclosed form?

To fill out Form 1040, you need to provide information about your income, deductions, credits, and personal information. The form must be completed accurately and signed before filing.

What is the purpose of that the enclosed form?

The purpose of Form 1040 is to report an individual's income, calculate the amount of tax owed or refunded, and claim any applicable credits or deductions.

What information must be reported on that the enclosed form?

Information that must be reported on Form 1040 includes income from various sources, such as wages, self-employment earnings, and investments. Additionally, deductions, credits, and personal information such as filing status and Social Security number must also be reported.

When is the deadline to file that the enclosed form in 2023?

The deadline to file Form 1040 for the 2023 tax year without an extension is typically April 15th. However, it is recommended to check with the IRS or consult a tax professional for any changes or extensions to the deadline.

What is the penalty for the late filing of that the enclosed form?

The penalty for late filing of Form 1040 depends on the amount of tax owed and the duration of the delay. The penalty is generally calculated as a percentage of the unpaid tax and increases the longer the form is filed after the deadline. It is advisable to file the form as soon as possible to avoid further penalties and interest charges.

How do I edit that the enclosed form in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your that the enclosed form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my that the enclosed form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your that the enclosed form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out that the enclosed form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your that the enclosed form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your that the enclosed form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.