OMB# 12-15013 C IRS Taxpayer Identification Number Department of Public Safety C OMB No. OMB# 12-10182 D OCCUPIED Covered by a section 501(c) organization (except black lung benefits trust or private foundation) Employment Contracting Company, LLC E EIN: 00-0 H Department of Revenue or the Department of Public Safety I IRS Form 1099-INT (IRS Form 1099) Covered business in which the employee served as the sole owner or principal financial investor, or where there was no significant financial interest in the employer.

You must also complete and send Form 941 to the employer for the years in which you did not have an employment contract with them (see instructions at the beginning of this publication).

2. Submit your return to the Internal Revenue Service. Do the following to make sure the IRS has your correct information:

Fill out and send a completed Form 941 to the appropriate agency.

The appropriate agency should send you a copy of your return. It should send the request by regular mail.

The request may be sent by email to OMB web (web address:) or by fax to (voice, international, or TTY:).

Contact the IRS at 1–800–829–4933.

If a request is to a person other than you, write the return to the correct address and include a copy of your written authorization. (The authorization may be in a separate envelope, and the return, as it is submitted to the IRS, will never be opened.)

You should also file the Form 941 with your state's employment trust or foundation.

Important Notice:

The information on this website is intended to help you understand tax requirements and comply with your state tax obligations. It is not designed, nor should it be construed, as legal or tax advice.

It is the responsibility of taxpayers and individuals to review, and if necessary change, their own particular circumstances, such as filing status, address, etc. Before making adjustments, there is a requirement to consult a tax professional.

Get the free To Form 990 - Lynn Sage Cancer Research Foundation

Show details

Form I Open to Public The organization may have to use a copy of this return to satisfy state reporting requirements. Inspection, 2011, and ending A For the 2011 calendar year, or tax year beginning,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your to form 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to form 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing to form 990 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit to form 990. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

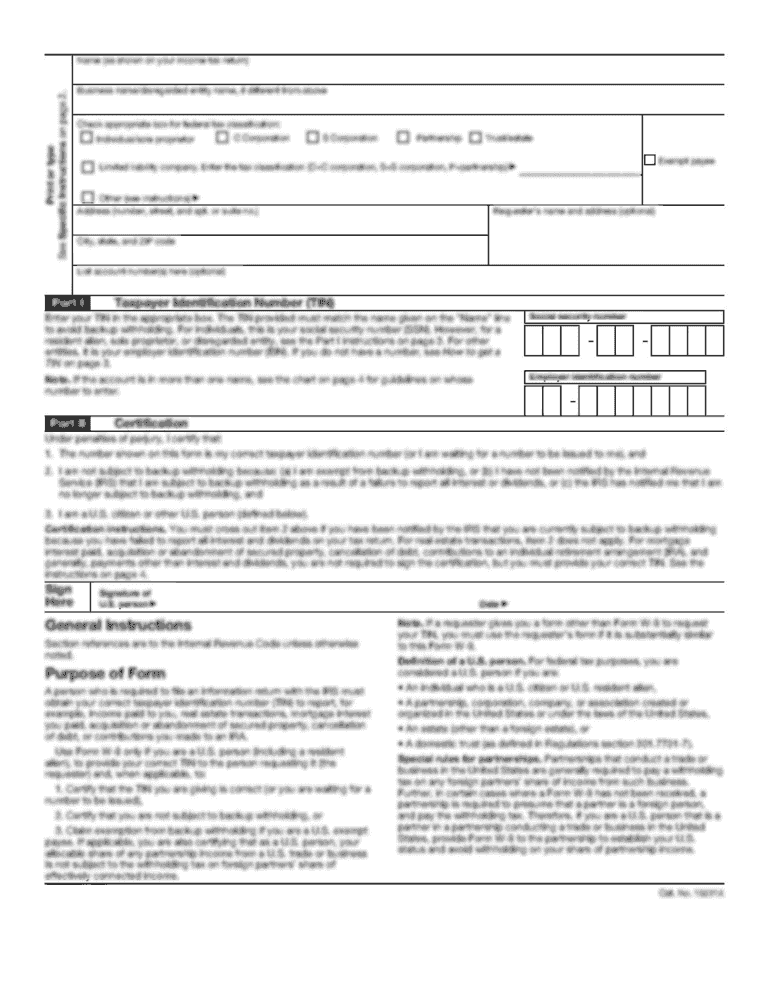

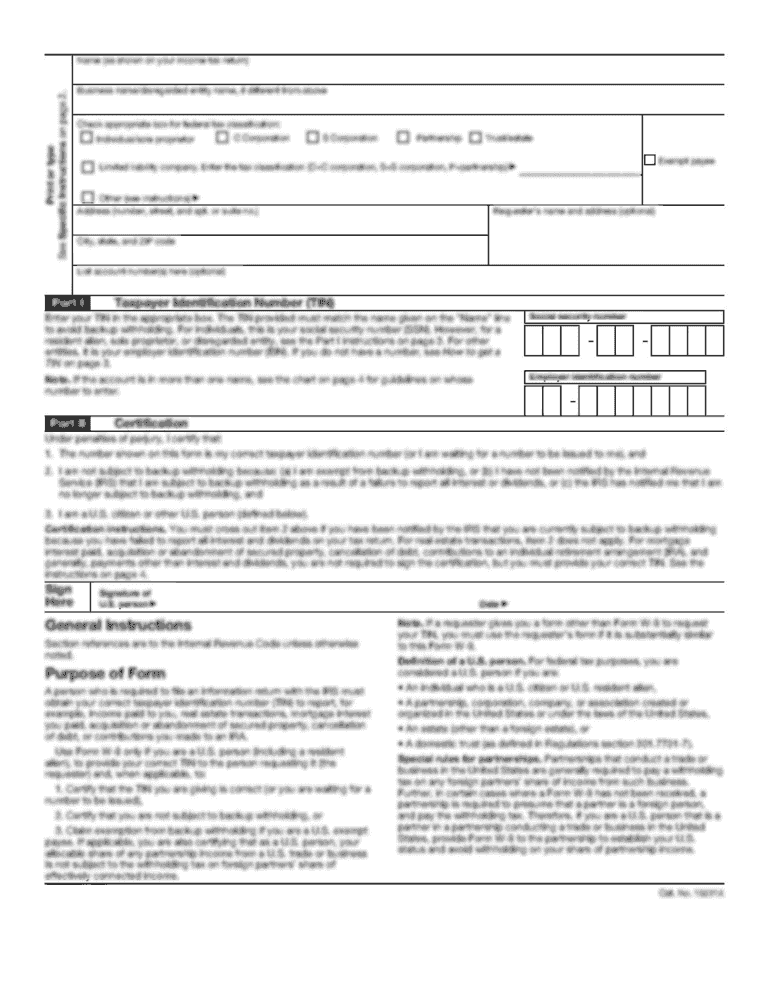

What is to form 990?

Form 990 is a tax form used by tax-exempt organizations, including non-profit organizations, to provide information about their finances and activities to the Internal Revenue Service (IRS).

Who is required to file to form 990?

Tax-exempt organizations, such as non-profit organizations, charities, and religious organizations, that meet certain criteria set by the IRS are required to file Form 990.

How to fill out to form 990?

Form 990 can be filled out manually using paper forms provided by the IRS, or it can be filled out electronically using tax preparation software or online services. The form requires organizations to provide information about their finances, governance, programs, and activities.

What is the purpose of to form 990?

The purpose of Form 990 is to provide transparency and accountability for tax-exempt organizations. It allows the IRS and the public to assess an organization's financial health, governance practices, and activities.

What information must be reported on to form 990?

Form 990 requires organizations to report their financial information, including revenue, expenses, assets, and liabilities. It also requires information about the organization's governance, programs, and activities, as well as compensation of key individuals.

When is the deadline to file to form 990 in 2023?

The deadline to file Form 990 for the tax year 2023 is typically on the 15th day of the 5th month after the end of the organization's fiscal year. However, it is important to check with the IRS for any specific deadline changes or extensions.

What is the penalty for the late filing of to form 990?

The penalty for the late filing of Form 990 can vary depending on the size of the organization's gross receipts. For organizations with gross receipts of $1 million or less, the penalty is $20 for each day the return is late, up to a maximum of $10,000. For organizations with gross receipts over $1 million, the penalty is $100 for each day the return is late, up to a maximum of $50,000.

How do I make changes in to form 990?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your to form 990 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the to form 990 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your to form 990 in seconds.

Can I edit to form 990 on an Android device?

You can edit, sign, and distribute to form 990 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your to form 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.