WITH ALL FUNDS APPROPRIATED FROM THE GENERAL OBLIGATION FUND FOR THE PURPOSE OF THE REFUNDABLE CAPITAL OUTLETS; AND PROVIDING FOR CERTAIN EXPENSES DUE AFTER PAYING THE REFUNDABLE CAPITAL OUTLETS. WITH THE PROVISIONS OF RULE ISSUED UNDER RESP, THE CITY AGREES TO GIVE UP ITS RIGHT TO GIVE OR SELL THE CONDITIONALLY RETURNED GENERAL OBLIGATION BONDS, AND RESTRICTED GENERAL OBLIGATION BONDS, FOR A TERM OF ONE YEAR AT THE END OF WHICH TIME THE CITY AGREES TO HAVE ALL MONEY RECEIVED FROM OR HAVING PAID INTO THE GENERAL OBLIGATION FUND AND SHALL NOT RE-RELEASE THESE FUNDS UNTIL SUCCESSFUL PAYMENT OF THE REFUND, PROVIDED THAT THE AMOUNT OF REFUNDED GENERAL FUND MONEY DUE FROM SUCH PAYMENT SHALL BE DETERMINED BY THE GENERAL OBLIGATION BONDS PURCHASE PRICE. THE CITY MAY EXCEED THESE CONDITIONS FOR CERTAIN CAPITAL PROJECTS AND THE COUNTING OF REFUNDED GENERAL FUND MONEY DUE FROM SUCH PAYMENT SHALL BE DETERMINED BY THE COUNTING PRICE OF THE REFUNDED GENERAL FUND ON TERMS GIVEN HEREIN. IN THE EVENT THE CITY ATTEMPTS TO EXCEED THESE CONDITIONS, THE DEBTS WOULD BE DOUBLED AND THE MAXIMUM AMOUNT OF THE REFUND IS A MULTIPLE INCOME FORCE. IN THE EVENT THE COUNTING PRICE OF THE REFUNDED GENERAL OBLIGE- MEETS PROVIDES FEE BASED ON RECEIVED INCOME, THE COUNTING PRICE SHALL BE DETERMINED ON A FACTOR BY FACTOR BASED ON ALL INCOME FORCE.

Get the free FIRST CLASS CITY REVENUE BOND ACT, THE Cl. 11 Act of Oct ... - columbiasc

Show details

ORDINANCE NO.: 2010-114 AUTHORIZING THE ISSUANCE AND SALE BY THE CITY OF COLUMBIA, SOUTH CAROLINA, OF It's NOT EXCEEDING $11,500,000 GENERAL OBLIGATION REFUNDING BONDS, IN ONE OR MORE SERIES, FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

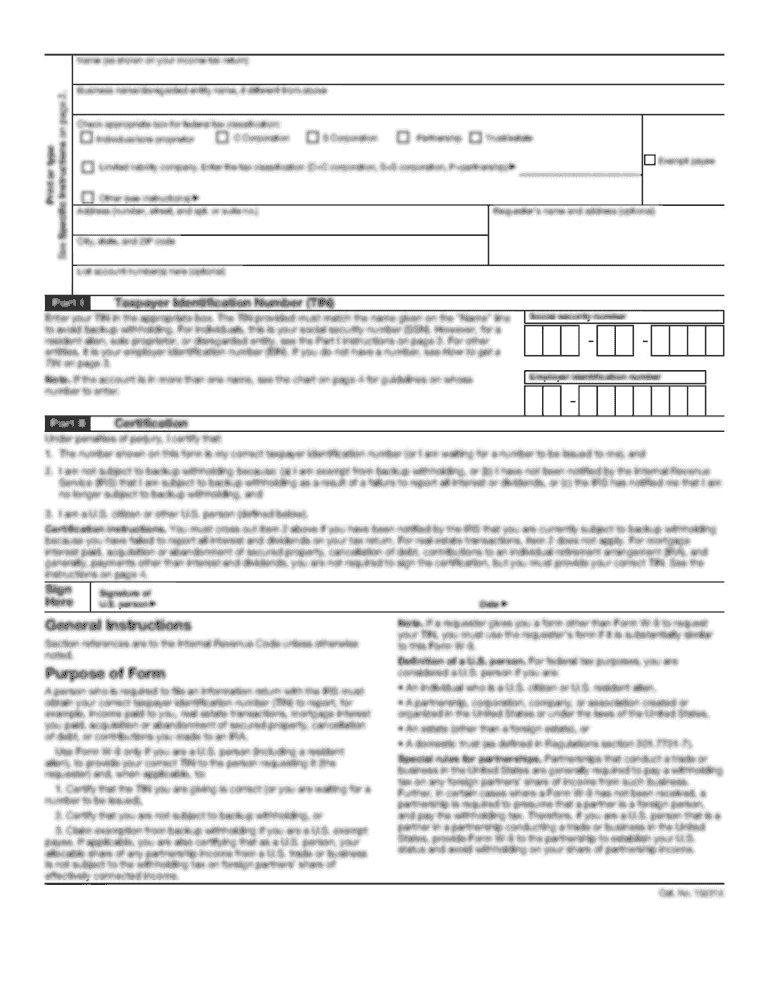

Edit your first class city revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first class city revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit first class city revenue online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit first class city revenue. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is first class city revenue?

First class city revenue refers to the income or funds generated by a city that has been classified as a first class city based on its population, economic significance, or other criteria.

Who is required to file first class city revenue?

The exact requirement for filing first class city revenue may vary depending on the specific jurisdiction and its laws or regulations. Generally, it is the responsibility of the municipal government or city administration to report and file the revenue information for a first class city. However, it is advisable to consult the relevant local authorities or seek professional advice for accurate and up-to-date information.

How to fill out first class city revenue?

The process of filling out first class city revenue forms or reports depends on the requirements of the specific jurisdiction. Typically, the city administration or finance department will provide instructions and templates for reporting revenue. This may involve providing details of various revenue sources such as taxes, fees, grants, or other income. It is important to accurately report and document all relevant revenue information as per the guidelines provided by the local authorities.

What is the purpose of first class city revenue?

The purpose of first class city revenue is to support the functioning and development of the city. The revenue generated is used to fund various municipal services, infrastructure projects, public welfare programs, and administrative expenses. It plays a crucial role in maintaining and improving the quality of life for residents, promoting economic growth, and ensuring the efficient operation of the city government.

What information must be reported on first class city revenue?

The specific information that must be reported on first class city revenue can vary depending on the jurisdiction and local regulations. However, common components may include details of revenue sources, such as taxes, fees, grants, or other income streams. Additionally, it may require reporting on expenditures, budgets, financial statements, and any other relevant financial or accounting information as per the guidelines provided by the local authorities.

When is the deadline to file first class city revenue in 2023?

The deadline to file first class city revenue in 2023 may vary depending on the specific jurisdiction. It is advisable to consult the relevant local authorities, city administration, or finance department to obtain accurate and up-to-date information regarding the deadline for filing first class city revenue in 2023.

What is the penalty for the late filing of first class city revenue?

The penalty for the late filing of first class city revenue can vary depending on the specific jurisdiction and its laws or regulations. Typically, there may be financial penalties, fines, or other consequences for not meeting the filing deadline. It is advisable to consult the relevant local authorities or seek professional advice for accurate and up-to-date information regarding the penalty for the late filing of first class city revenue.

How can I get first class city revenue?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the first class city revenue in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in first class city revenue?

With pdfFiller, the editing process is straightforward. Open your first class city revenue in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out first class city revenue using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign first class city revenue and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your first class city revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.