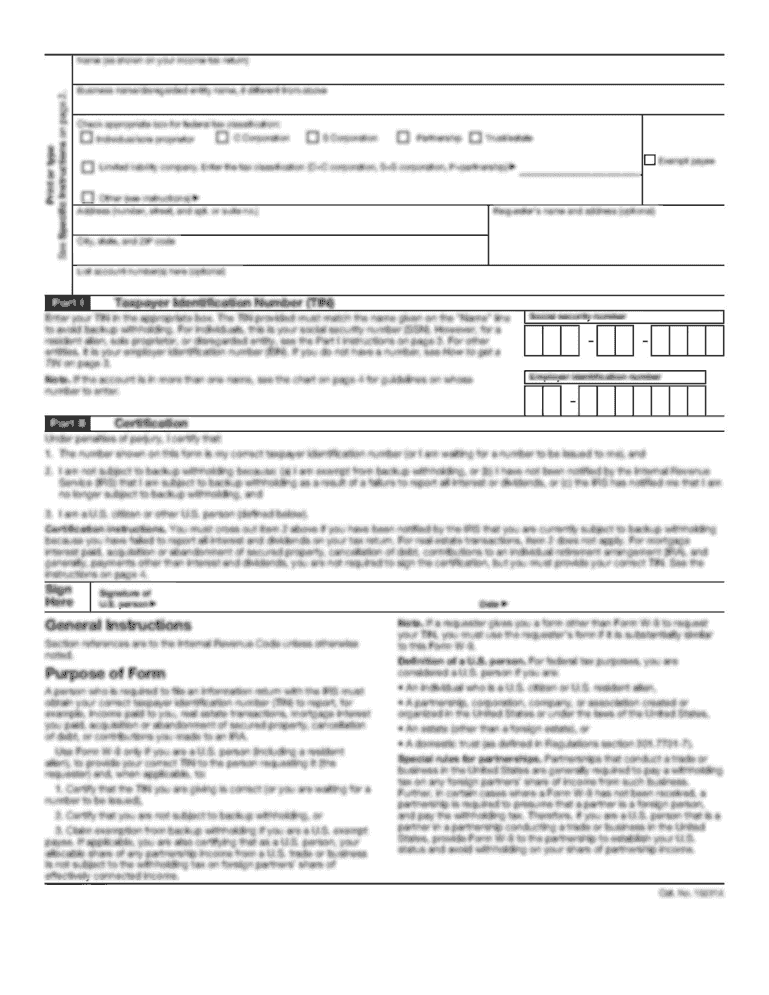

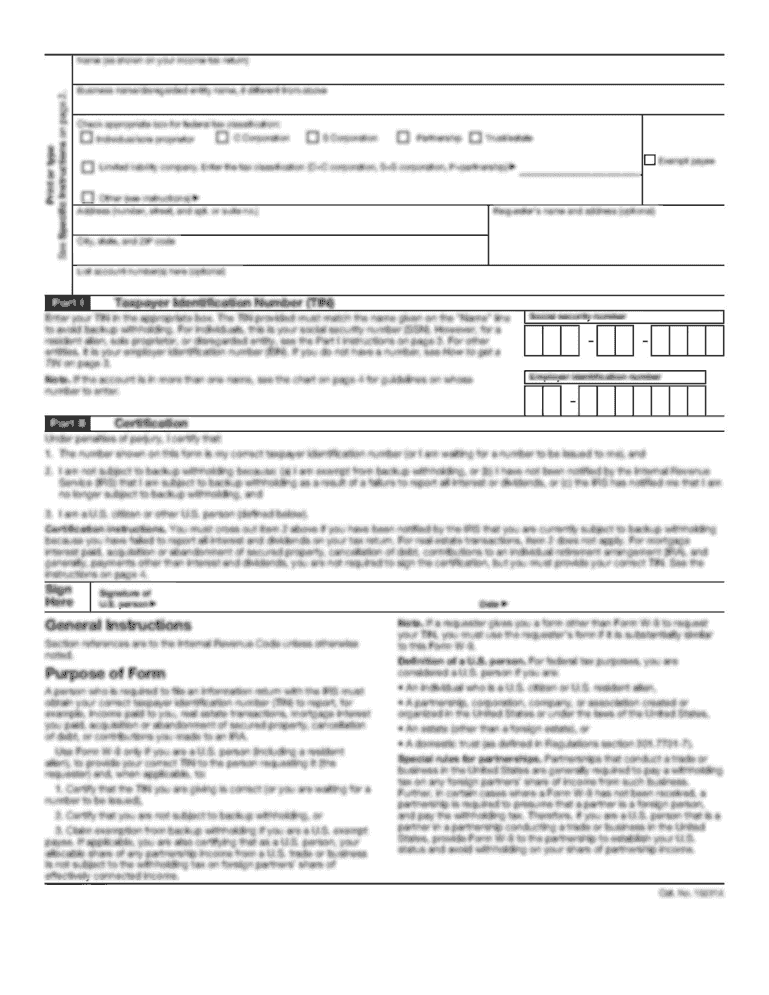

Complete this form to start, change, or stop an automatic investment from your personal bank account, or to add or change bank account information for periodic contributions by electronic bank transfer. Submit a separate form for each PA 529 Investment Plan account you own.

BENEFITS OF AN AUTOMATIC INVESTMENT PLAN (ASAP) We offer a broad range of investment options for our customers to choose from. Below are the benefits of our AEP Plan (ARP, automatic investment plan), which can automatically contribute to your student loan account. 1. Portfolio diversification. All the funds in your personal bank account belong to one or more of the 529 College Savings plans in which you are a participant. When the investment income produced by your investments exceeds a certain amount, your bank transfers the excess earnings to your personal bank account. We automatically distribute the excess earnings on your behalf.

2. Account fees. We pay no fees to our customers in connection with the creation or opening of a student loan account.

3. Accessibility. We believe that investments in a college savings account can improve your college savings plan investment performance.

4. Portfolio management. We select investment categories for each participant in the AEP Plan based upon an assessment of their investment objectives and risk tolerance, based upon the criteria used to select investments for a plan to have an automatic investment option.

5. Investment strategies. We determine investment strategies for each participant based upon a portfolio of more than 50 investments, including diversified ones where there is some overlap in portfolios. The portfolio's investment targets and allocation limits are set by the adviser or fund manufacturer.

6. Additional benefit. We offer additional benefits for our customers, such as access to educational counseling if they are enrolled in a high school financial planning program, and we receive sufficient information from the program to complete a college savings plan account.

Automatic Transfer for PA 529 Plans

PA 529 Plans must be transferred to any student loan account that is maintained by an institution of higher education in this Commonwealth. To transfer your plan to a college savings account, contact your adviser or your plan administrator.

For current information regarding transferring AEP plans and AEP contribution limits, visit:.

Get the free vanguard aip form - a248 e akamai

Show details

PA AIP Pennsylvania 529 Investment Plan Automatic Investment Plan/ Electronic Bank Transfer Form Complete this form to start, change, or stop an automatic investment from your personal bank account,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vanguard aip form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vanguard aip form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vanguard aip form online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vanguard aip form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vanguard aip form?

The Vanguard AIP form, also known as the Automatic Investment Plan form, is a document provided by Vanguard that allows investors to set up automatic contributions to their investment accounts.

Who is required to file vanguard aip form?

Individuals who have investment accounts with Vanguard and wish to set up automatic contributions are required to file the Vanguard AIP form.

How to fill out vanguard aip form?

To fill out the Vanguard AIP form, you will need to provide your personal information, including your name, address, and Social Security number. You will also need to specify the investment account you want to contribute to, the frequency and amount of contributions, and provide your banking information for the automatic transfers.

What is the purpose of vanguard aip form?

The purpose of the Vanguard AIP form is to simplify the process of contributing funds to your Vanguard investment account by setting up automatic transfers from your bank account. This helps investors save time and maintain a consistent investment strategy.

What information must be reported on vanguard aip form?

The Vanguard AIP form requires you to report your personal information such as your name, address, and Social Security number. You also need to provide the details of the investment account, including the account number and the amount and frequency of contributions.

When is the deadline to file vanguard aip form in 2023?

The specific deadline to file the Vanguard AIP form in 2023 may vary. It is recommended to check with Vanguard or refer to the instructions provided with the form for the exact deadline.

What is the penalty for the late filing of vanguard aip form?

The penalty for the late filing of the Vanguard AIP form may depend on Vanguard's policies and the specific circumstances. It is advisable to contact Vanguard directly or consult their guidelines to understand the potential penalties for late filing.

How do I modify my vanguard aip form in Gmail?

vanguard aip form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit vanguard aip form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your vanguard aip form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the vanguard aip form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your vanguard aip form in seconds.

Fill out your vanguard aip form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.