For the latest info about disclosures, privacy act, and paperwork reduction act requirements, go to. Form 709 Instructions These instructions are posted online in PDF format. For more info, visit Our FAQ page for the most recent version of These instructions are posted online in PDF format. For more info, visit.

Form 709 Instructions

How To Pay The 2018 Individual Gift Tax Bill

Form 709 Instructions — 2018

Instructions For Form 709, Payment of the 2018 Individual Gift Tax Bill

How to Make Payments

Instructions For General Information

If you don't have internet access, you may prefer to follow these instructions:

Complete the completed Payment for Federal Gift and Generation-Skipping Transfer Tax Forms. (For instructions, see Payment for gift tax forms) Send a check or money order made payable to: United States Treasury

General Information

Attn: Form 709 Payment (to receive the 2018 Individual Gift Tax Bill) Send an electronic check to the address for: U.S. Treasury (form 709) Payment (payment must be received by November 12, 2018, to receive the 2018 Individual Gift Tax Bill) Your payment MUST be received by November 12, 2018, to receive the 2018 Individual Gift Tax Bill for 2018. Please note, payments may be delayed by other tax obligations related to tax returns and audits.

Please indicate the exact amount(s) in full. If the payment is for more than one individual, you must list each individual's name, date or dates of birth, and Social Security Number (SSN) as the person paying for the amount.

Note: If you choose to make a payment in any amount for multiple individuals, be aware that only payment made for the individual with the highest combined amount of gift and/or generation-skipping transfer tax is recognized.

Your payment must be received by the following U.S. Treasury (form 709) (Payment) Your payment MUST be received by, November 12, 2018, to receive the 2018 Individual Gift Tax Bill for 2018. Please note, payments may be delayed by other tax obligations related to tax returns and audits. If you choose to make a payment in, you must list each individual's name, date or dates of birth, and Social Security Number (SSN) as the person paying for the amount.

Get the free 2012 Instructions for Form 709. Instructions for Form 709, United States Gift (and G...

Show details

2012 Department of the Treasury Internal Revenue Service Instructions for Form 709 United States Gift (and Generation-Skipping Transfer) Tax Return For gifts made during calendar year 2012. Section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2012 instructions for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 instructions for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 instructions for form online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2012 instructions for form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

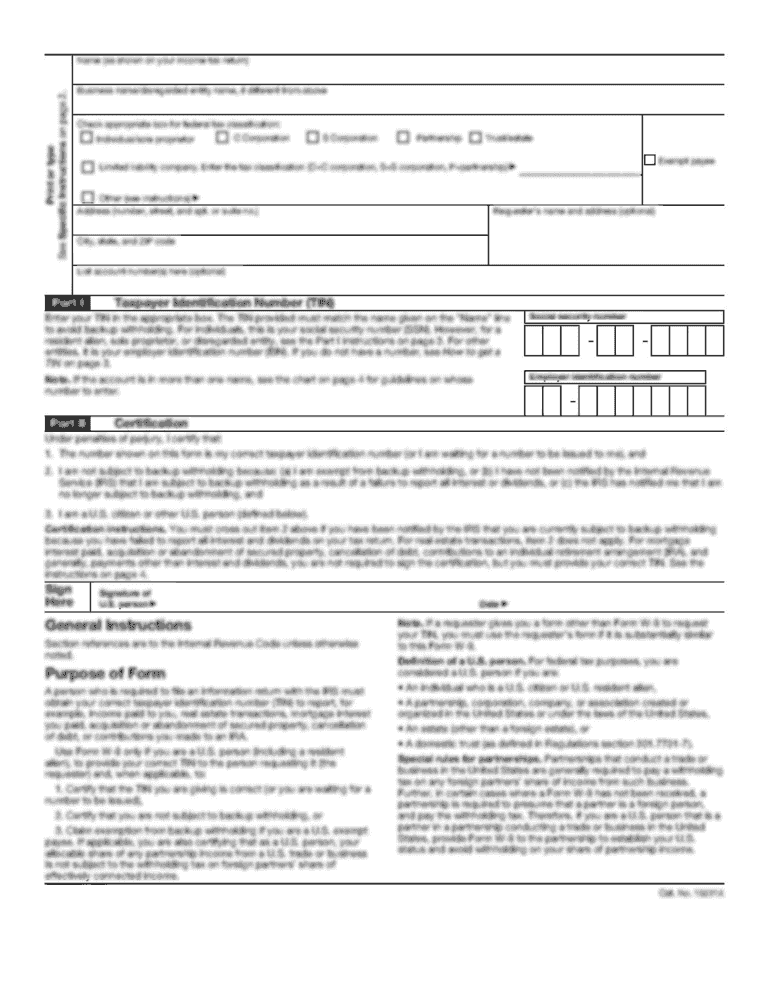

What is instructions for form 709?

The instructions for form 709 provide guidance on how to complete and file Form 709, which is used to report gifts and transfers subject to federal gift and generation-skipping transfer taxes.

Who is required to file instructions for form 709?

Individuals who make gifts or transfers subject to federal gift and generation-skipping transfer taxes are required to file Form 709 and follow the instructions provided.

How to fill out instructions for form 709?

To fill out the instructions for form 709, carefully read and follow the guidelines provided in the instructions document. It includes information on how to report various types of gifts and transfers, calculation of taxes owed, and necessary attachments.

What is the purpose of instructions for form 709?

The purpose of the instructions for form 709 is to assist taxpayers in accurately reporting gifts and transfers subject to federal gift and generation-skipping transfer taxes. It ensures compliance with tax laws and provides guidance on the necessary documentation and calculations for reporting.

What information must be reported on instructions for form 709?

The instructions for form 709 specify the information that must be reported, which includes details about the donor, recipient, and the value of the gift or transfer. It may also require additional information such as the fair market value of the assets, any deductions or exclusions claimed, and other relevant financial information.

When is the deadline to file instructions for form 709 in 2023?

The deadline to file instructions for form 709 in 2023 is generally April 15th, which is the same as the individual income tax filing deadline. However, it is always advisable to check the official IRS website or consult with a tax professional for any updates or extensions.

What is the penalty for the late filing of instructions for form 709?

The penalty for the late filing of instructions for form 709 can vary depending on several factors. It is best to refer to the official IRS guidelines or consult with a tax professional to determine the exact penalty amount and any potential exceptions or waivers that may apply.

How can I edit 2012 instructions for form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 2012 instructions for form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I fill out 2012 instructions for form using my mobile device?

Use the pdfFiller mobile app to fill out and sign 2012 instructions for form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete 2012 instructions for form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 2012 instructions for form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your 2012 instructions for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.