Wi-Fi VIRTUAL-HUB — BALLISTIC.NET — 3B-1/4W BALLISTICS ROUTE: 80169 (08:01:17:17) 9999 4/28/2018 4.9 7.6 17 7.3 4.4 10/18/2018 4.6 11.5 20.1 9.1 8.1 9/9/2018 4.8 11.1 18.8 8.6 8.5 8/11/2018 4.8 11.1 18.2 8.2 7.8 7/25/2018 4.9 11.1 18.2 8 25 7/11/2018 4.7 11.1 18 18 8 7/4/2018 4.7 10.7 17.8 8.6 7.8 4/27/2018 4.8 10.5 17.2 8.2 7.9 3/28/2018 4.8 10.7 17 17 8 3/18/2018 4.5 10 17.5 6.6 7.6 3/5/2018 4.7 10.9 17 11.5 8.7 12/19/2017 5.2 10.9 16.2 7.3 8.6 10/29/2017 4.2 10 17.6 7.9 7.3 10/15/2017 4.5 10.9 16.8 7.2 7.5 9/30/2017 4.6 10.9 16.6 7.2 7.3 9/21/2017 4.7 8.4 16.7 7.6 7.2 8/12/2017 4.2 8.5 16.2 7 12 /17/2017 4.4 8 16.4 6.7 6.4 5/25/2017 4.5 8 16.2 6.6 7.6 12/12/2016 4.2 8.4 16.7 6.2 9 6/17/2016 4.3 8 16.6 7.1 7.1 6/3/2016 4 12.9 16.5 6.6 7.6 5/25/2016 4.7 12.3 17.1 8.8 6.4 1/16/2016 4.1 11 16.2 7.9 7.3 11/21/2015 4.5 10 16.9 7.1 7.

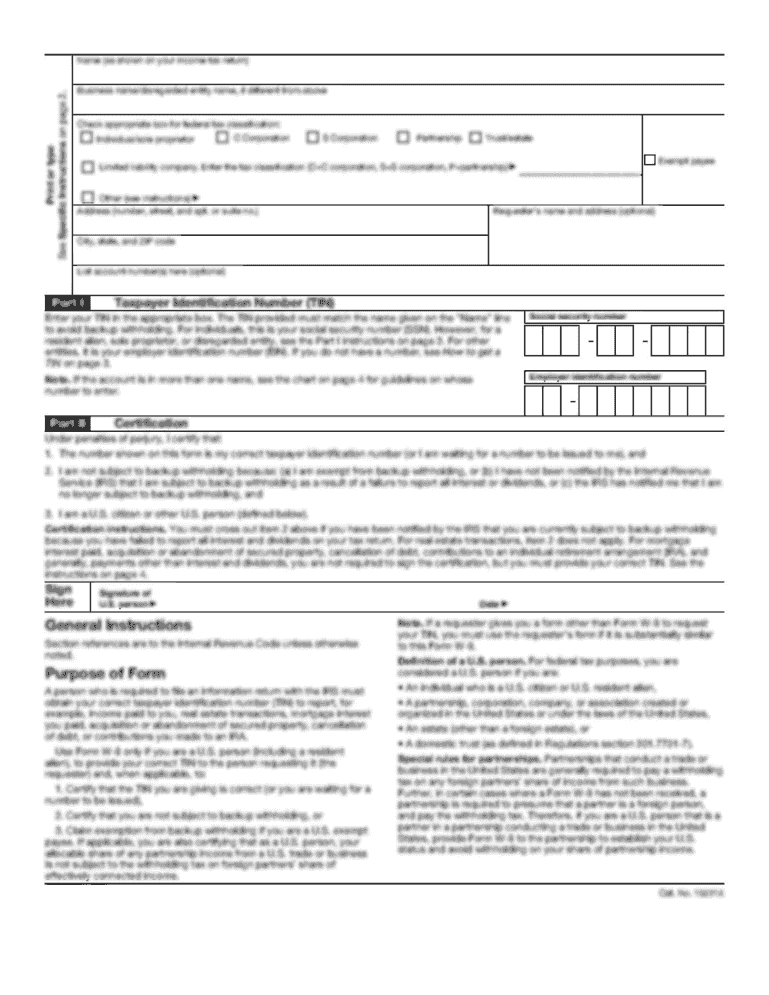

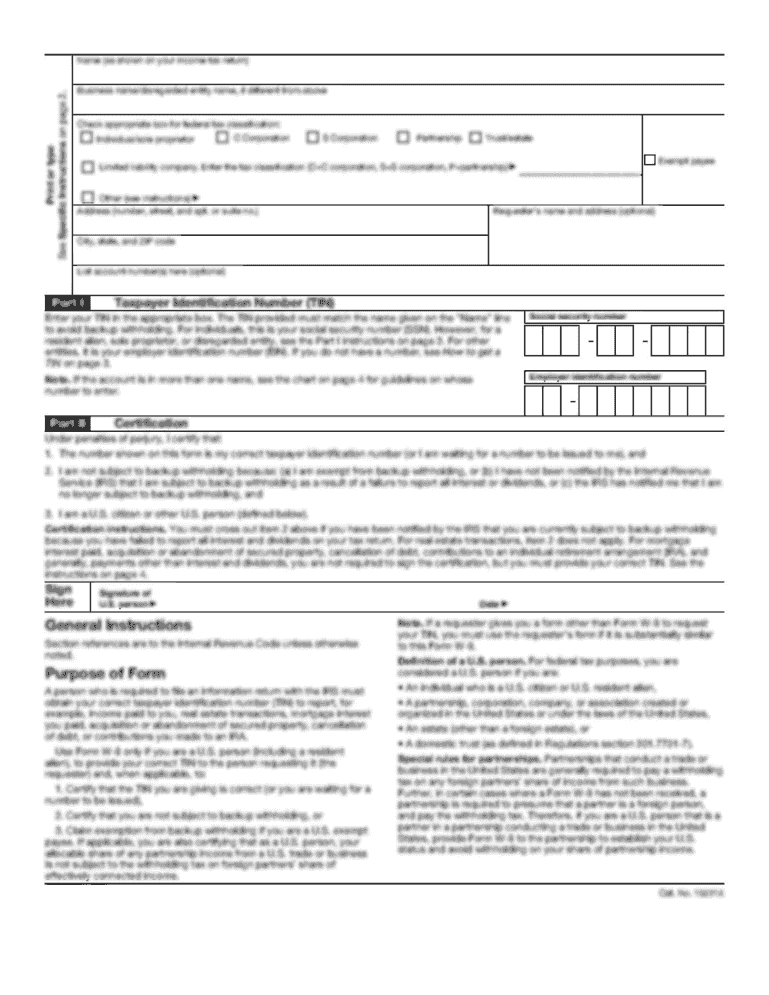

Get the free IRS Quicklook Service Form - Euromap

Show details

IRS Quick look Service Form Template: service.dot, Very.: 2.6, 2005 euro map GmbH SATELLITENDATEN- Customer Information VERTRIEBSGESELLSCHAFT MPH KALKHORSTWEG 53 Name Organization D-17235 NEUTRALITY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs quicklook service form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs quicklook service form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs quicklook service form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs quicklook service form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs quicklook service form?

The IRS QuickLook Service form is a document used by the Internal Revenue Service (IRS) to gather specific information about a taxpayer's financial transactions.

Who is required to file irs quicklook service form?

The IRS QuickLook Service form is required to be filed by individuals or businesses who meet certain criteria set by the IRS.

How to fill out irs quicklook service form?

To fill out the IRS QuickLook Service form, one must provide accurate and complete information about their financial transactions including income, expenses, assets, and liabilities.

What is the purpose of irs quicklook service form?

The purpose of the IRS QuickLook Service form is to assist the IRS in identifying potential tax evasion or fraudulent activities by taxpayers.

What information must be reported on irs quicklook service form?

The information that must be reported on the IRS QuickLook Service form includes details about the taxpayer's income, expenses, assets, liabilities, and other financial transactions.

When is the deadline to file irs quicklook service form in 2023?

The deadline to file the IRS QuickLook Service form in 2023 has not been specified yet. The taxpayer should refer to the IRS website or consult with a tax professional for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of irs quicklook service form?

The penalty for the late filing of the IRS QuickLook Service form can vary depending on various factors including the taxpayer's filing history, the amount of tax owed, and the reason for the late filing. It is advisable to consult with a tax professional or refer to the IRS guidelines for specific penalty details.

How do I make changes in irs quicklook service form?

With pdfFiller, it's easy to make changes. Open your irs quicklook service form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the irs quicklook service form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your irs quicklook service form in seconds.

Can I edit irs quicklook service form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign irs quicklook service form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your irs quicklook service form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.