With long-term investment horizons, our strategies are generally designed for short-term investors. Generally, we buy a fixed return investment with an expected value of return greater than the risk of holding it until maturity. For instance, we purchase an investment that we know is a long-term investment and expect it to deliver an annualized risk-adjusted return of 10%. We pay for our investment by selling a security that meets our investment objectives at a maturity date, or we purchase a variable annuity, where we pay for the value of the underlying investment and receive a yearly annuity. Generally, we have a limited maturity date to the underlying investment or unlimited maturity to a variable annuity, if a limited maturity date exists. The total value of our investment will not decrease because of changes in the value of the underlying investment. In many cases, we purchase investments from investment grade issuers that have a history of meeting their financial goals; however, the investment does not mean that such issuers will always meet their financial goals. See the risk summary for a description of how we assess our assumptions and assumptions are modified by certain risks. We select investments based on the performance of the underlying investments when we buy securities from them; for example when we purchase short-term investment grade government securities, we choose those securities with a history of performance that meets our risk criteria. We typically invest in U.S.-based equities. Furthermore, we invest in fixed income securities that are not subject to market-based limitations on returns (such as capital gains tax). When we buy fixed income securities, we typically invest in bonds from the United States government and companies in the S&P 500 Index. We are not actively invested in emerging market, money market, and other types of foreign securities (such as cash and short-term investments). We generally follow a diversified portfolio design when making investment allocations, but we are actively invested in the underlying investments in the investments listed. The investments in the investments listed in this section are generally in U.S. government bonds, corporate junk bonds, and U.S. mortgage-backed and agency securities. The investments listed in this section are generally in international capital markets (including Japanese yen), fixed income securities, commodities, fixed income derivatives, and other equity investments. We maintain a wide range of equity investments, from low yielding to high yielding securities. We buy investments from a variety of industry sectors. In particular, we buy investments from businesses in the financial, automotive, and technology industries, as well as energy and utility companies.

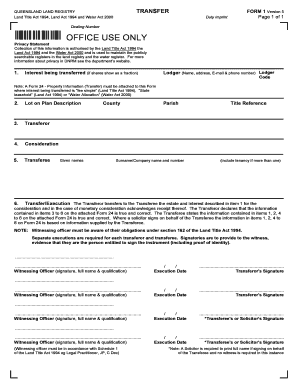

Get the free pam high yield bond form

Show details

Release Date 12-31-2014 PSF High Yield Bond Overall Morningstar Rating Morningstar Return Morningstar Risk QQQ Average Available through Pacific Life Variable Annuity Products Benchmark Credit Suisse HY USD Out of 2017 High Yield Bond VA subaccounts. An investment s overall Morningstar Rating based on its risk-adjusted return is a weighted average of its applicable 3- 5- and 10-year Ratings. See disclosure for details. Investment Strategy from un...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your pam high yield bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pam high yield bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pam high yield bond online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pam high yield bond. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pam high yield bond?

Pam high yield bond is a type of bond that offers higher interest rates, but also comes with higher risk.

Who is required to file pam high yield bond?

Investors who purchase pam high yield bonds are required to file the bond.

How to fill out pam high yield bond?

To fill out pam high yield bond, the investor needs to provide relevant personal and financial information, including the bond's details.

What is the purpose of pam high yield bond?

The purpose of pam high yield bond is to provide investors with an opportunity to earn higher returns on their investment.

What information must be reported on pam high yield bond?

Pam high yield bond requires reporting of personal and financial information, as well as details about the bond itself.

When is the deadline to file pam high yield bond in 2023?

The deadline to file pam high yield bond in 2023 is typically April 15th, unless otherwise specified.

What is the penalty for the late filing of pam high yield bond?

The penalty for the late filing of pam high yield bond may vary, but it can include fines and interest charges on the outstanding amount.

How do I modify my pam high yield bond in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign pam high yield bond and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get pam high yield bond?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific pam high yield bond and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit pam high yield bond on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign pam high yield bond on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your pam high yield bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.