Get the free REPORT - Buncombe County - buncombecounty

Show details

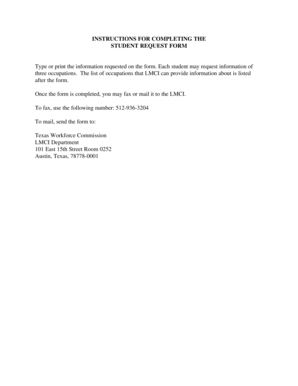

BUNCOMBE COUNTY TAX DEPARTMENT 35 WOOD FIN STREET STE 307 ASHEVILLE, NC 28801-3015 (828) 250-4930 www.buncombecounty.org Return by JANUARY 31, 2012, to avoid a 10% penalty BUSINESS LISTING FORM LOCATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report - buncombe county

Edit your report - buncombe county form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report - buncombe county form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit report - buncombe county online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit report - buncombe county. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report - buncombe county

How to fill out report - Buncombe County:

01

Start by collecting all the necessary information and documents required for the report.

02

Begin by writing a clear and concise introduction that includes the purpose and scope of the report.

03

Organize the report into sections, such as background information, findings, recommendations, and conclusion.

04

Use appropriate headings, subheadings, and bullet points to make the report easy to read and navigate.

05

Present the information in a logical and coherent manner, ensuring that there is a clear flow of ideas.

06

Use proper grammar, punctuation, and spelling to maintain professionalism in the report.

07

Include any relevant data, charts, graphs, or visuals to support your findings and make the report more visually appealing.

08

Conclude the report by summarizing the main points and providing any necessary recommendations or actions to be taken.

09

Proofread the report to check for any errors or inconsistencies before finalizing it for submission.

Who needs report - Buncombe County:

01

The report may be required by government agencies or departments within Buncombe County for administrative or planning purposes.

02

Local businesses or organizations operating within Buncombe County may need the report to make informed decisions or comply with regulations.

03

Researchers or academics studying the area or specific aspects related to Buncombe County may find the report useful for their studies or research projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is report - buncombe county?

The report in Buncombe County refers to the financial statements and other required forms that businesses and individuals must submit to the county government to report their taxable income, expenses, and other financial information.

Who is required to file report - buncombe county?

All businesses and individuals who generate taxable income within Buncombe County are required to file the report.

How to fill out report - buncombe county?

To fill out the report in Buncombe County, you need to gather all relevant financial information, such as income, expenses, deductions, and credits. You can then use this information to complete the designated forms provided by the county government.

What is the purpose of report - buncombe county?

The purpose of the report in Buncombe County is to accurately report financial information, such as income and expenses, to determine tax liabilities and ensure compliance with local tax regulations.

What information must be reported on report - buncombe county?

The report in Buncombe County typically requires the reporting of various financial information, including taxable income, expenses, deductions, credits, and any other relevant financial details as specified by the county government.

Where do I find report - buncombe county?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the report - buncombe county. Open it immediately and start altering it with sophisticated capabilities.

How do I execute report - buncombe county online?

With pdfFiller, you may easily complete and sign report - buncombe county online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out report - buncombe county using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign report - buncombe county and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your report - buncombe county online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report - Buncombe County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.